China Has Taken Over Gold Price Control from the West

BY GAINESVILLE COINS

THURSDAY, MAR 28, 2024 - 15:14

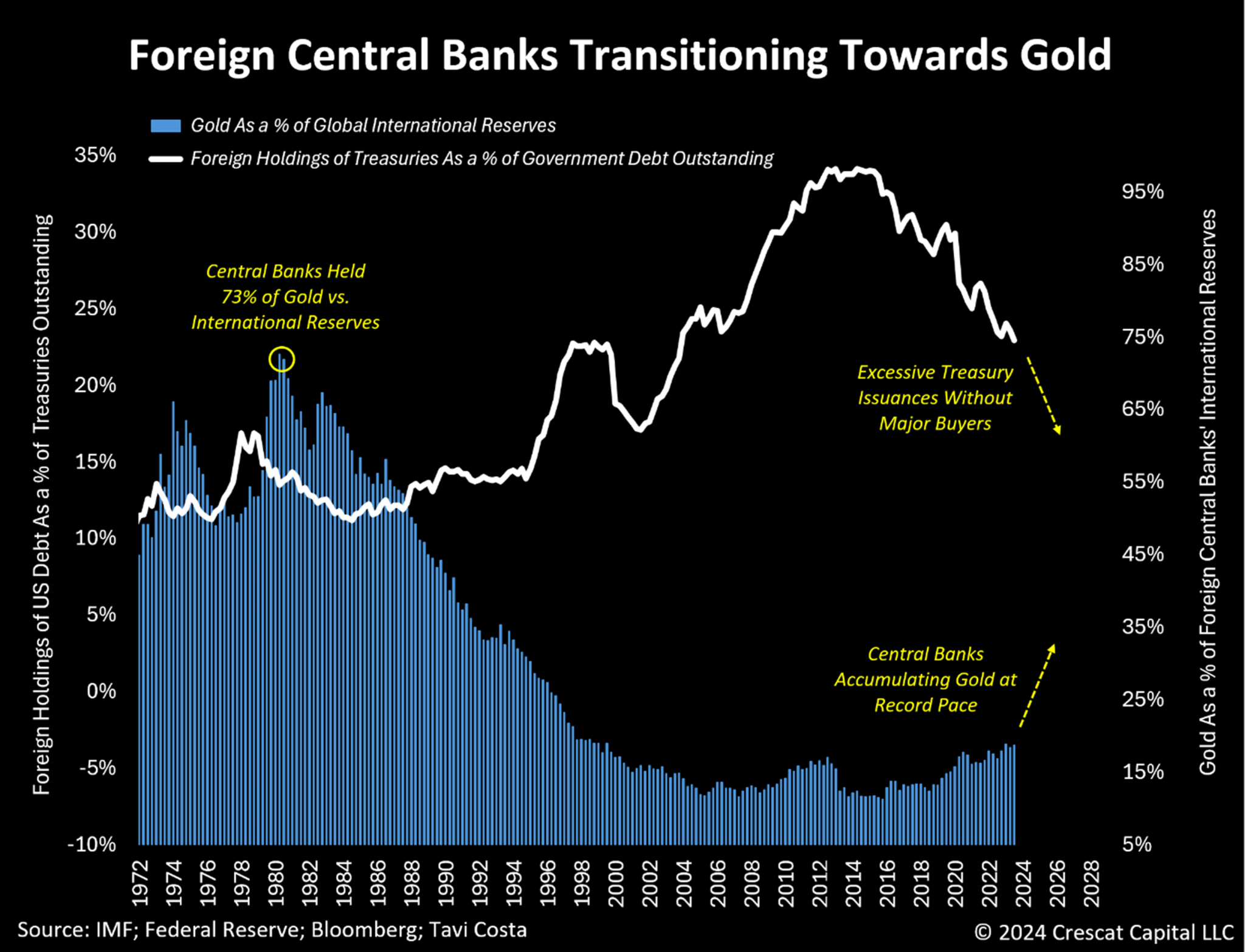

The PBoC on an Unprecedented Gold Buying Spree

Covert PBoC gold purchases can be computed by comparing the WGC’s data with what is officially reported by central banks.

The difference between WGC’s estimated buying and reported buying, arising from the fact that the WGC’s numbers are based on field research, is “largely” created by the PBoC, two industry insiders shared with me.

My estimate is that the PBoC now holds 5,358 tonnes, which is 3,108 tonnes north of what’s officially disclosed at 2,250 tonnes

Estimated annual PBoC gold buying and total holdings. The Chinese central bank is buying gold like never before:

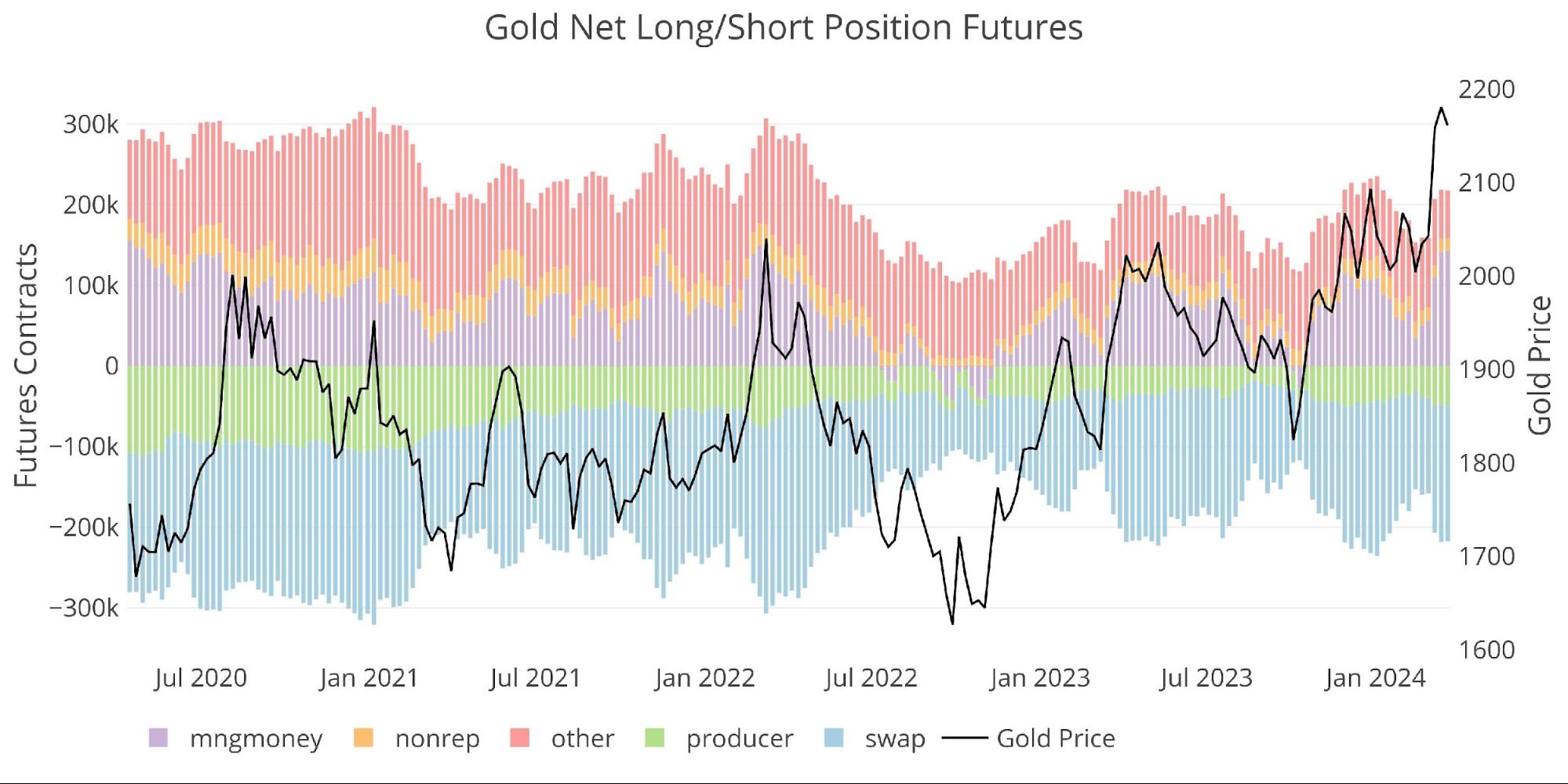

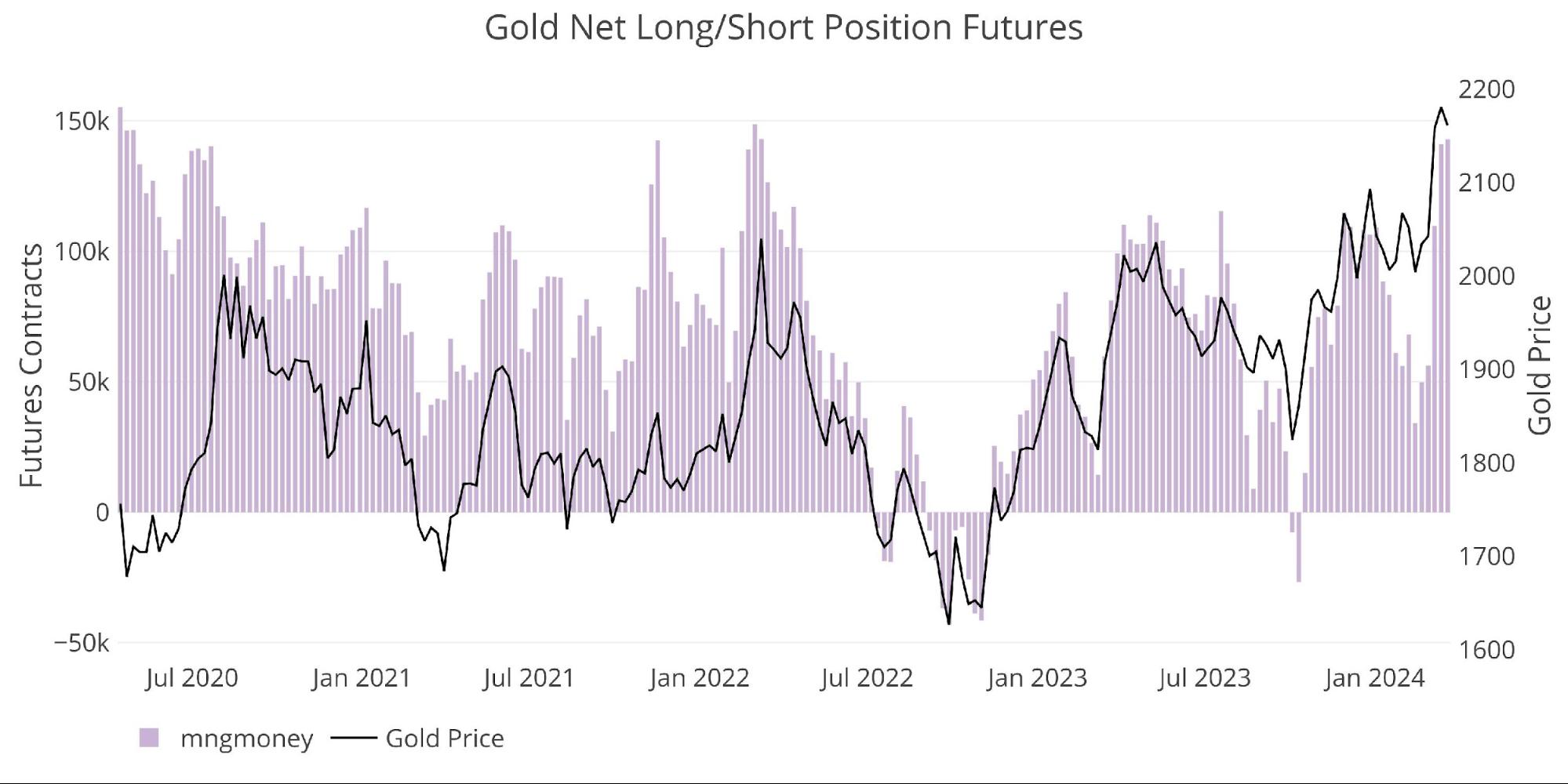

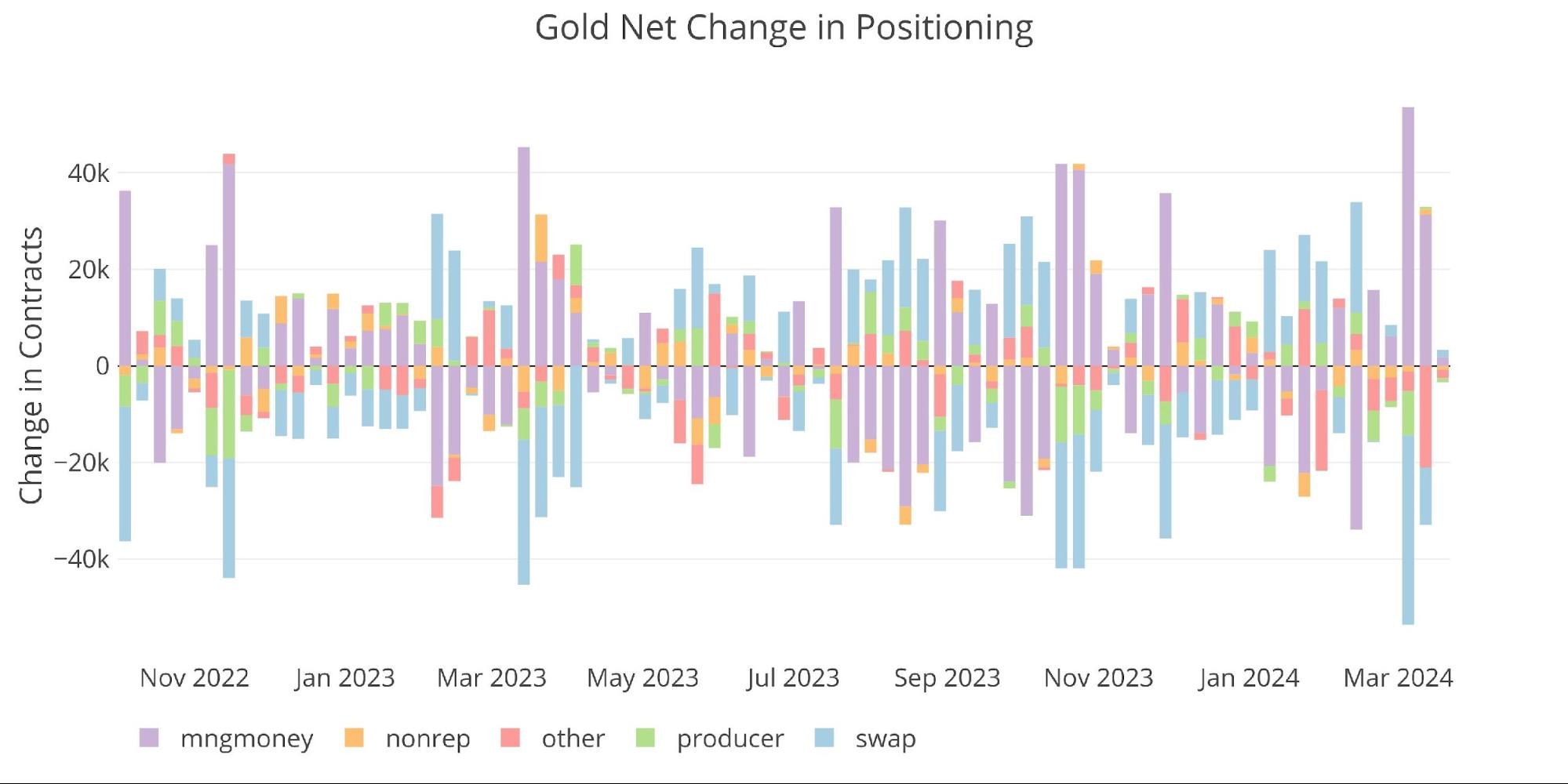

An Explosive Gold Market

Chinese massive gold buying over the past two years have fundamentally changed the gold market. Whereas before 2022 Western institutional supply and demand was driving the price of gold and the price was more or less stuck to the "real yield" (10-year US TIPS interest rate), ever since the war gold has been less sensitive to real yields and follows its own path. This divergence, according to my analysis, has been created by China that has become one of the main driving forces of the gold price.

Turning to the mainland

As the real estate sector in China began crumbling late 2021, Chinese people started changing their gold buying behavior and lost their long-standing sensitivity for the price. One explanation could be that because of capital controls Chinese investors have few places to go other than the local stock market, real estate, and gold. And when the former two are in the doldrums, which is currently the case, the latter attracts more attention.

Shanghai gold premiums

Before 2022, these premiums fell when the price rose and vice versa. Now premiums stay positive during gold rallies. For our analysis we use the uncensored premium on the Shanghai International Gold Exchange, not the manipulated premium on the Shanghai Gold Exchange

Read more