WSJ: Volatility in the bond market has taken the spotlight in recent days, with rising bond yields both in the U.S. and abroad weighing on equity markets. Stock futures are lower as investors continue to question the timeline for interest-rate cuts.

On Wednesday, U.S. stock indexes dropped after bond yields climbed to their highest level in a month.

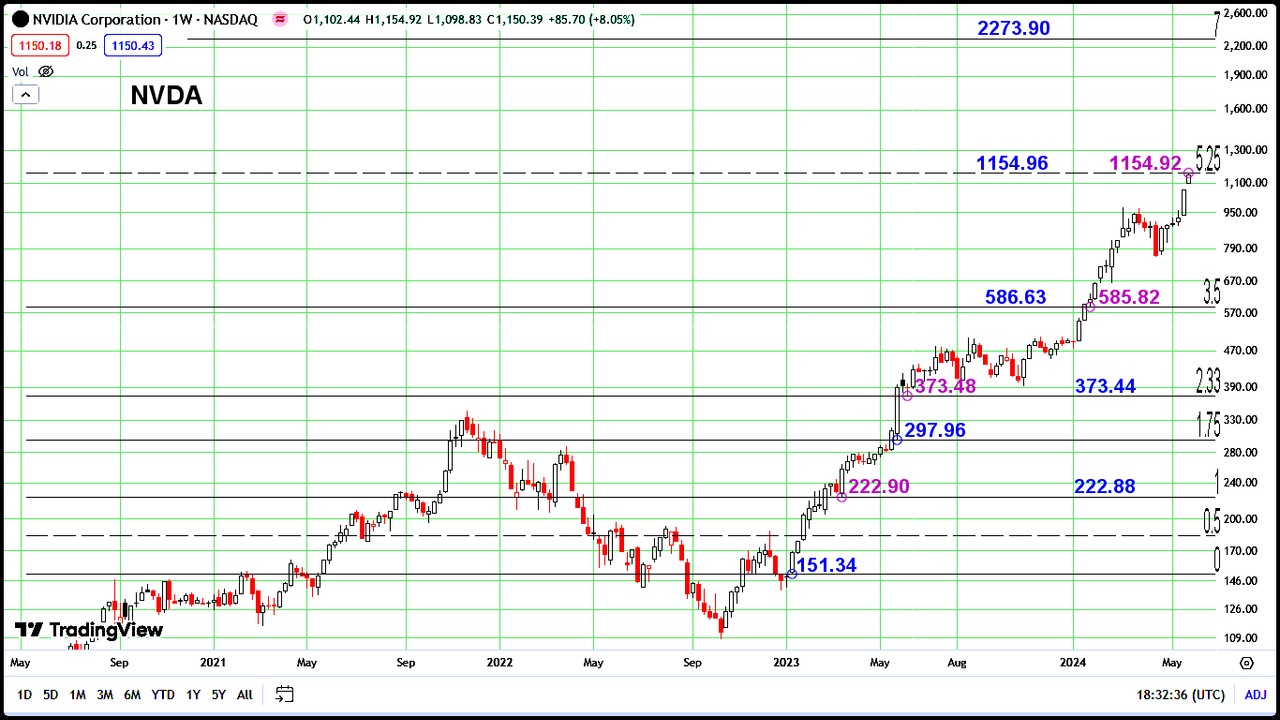

Nvidia, Microsoft, Apple and Alphabet between them have added over $1.4 trillion this month, more than the other 296 stocks that rose put together. Half of the gain was just one company, chip maker Nvidia.

Behind the rises in the biggest stocks this month and this year are two trends, which have already run a long way: artificial intelligence and higher-for-longer interest rates. Any trend can always go further, but there are challenges to both.

"...Unfortunately there are more negative catalysts around. Bond yields are proving to be a thorn in the side for stocks as rate-cut expectations slip toward November. Jamie Dimon reiterated his warning that valuations are too high to justify share buybacks in a speech Wednesday.

"There is one last hope for the market rally, thoughfalling inflation. Much of the recent pressure on stocks has come amid fears that inflation will remain stubborn, concerns that have been shared by several Fed officials.