IS THE FED BEHIND THE CURVE?

#1

Posted 15 September 2024 - 10:14 PM

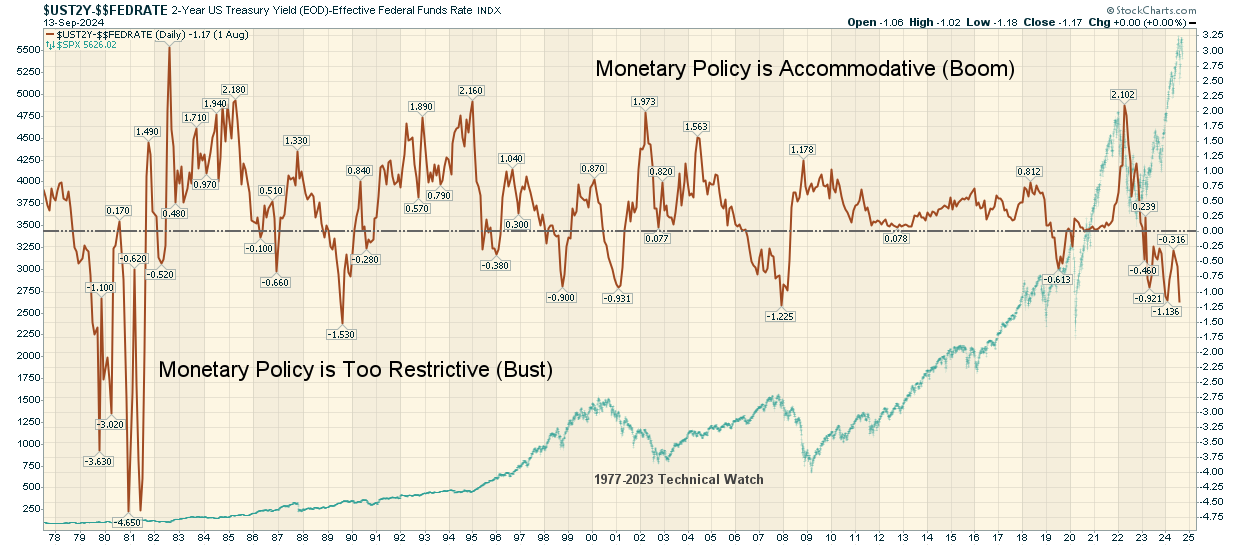

The difference between the 2-year Treasury yield and the Fed interest rates dropped to -1.69%, the most in at least 35 years.

This gap is now even larger than in 2008 and in 1989, a few months before the recession began.

The 2-year Treasury yield is considered a leading indicator for the next Feds interest rate moves.

In other words, the bond market expects that the Fed will be cutting rates at a rapid pace in the coming months.

This has been driven by increasing evidence of the deteriorating labor market and many indicators suggesting this trend will continue.

Is the Fed behind the curve?

--'

This is absolutely incredible:

The S&P 500 has seen FOUR market cap swings of $2 trillion or more since August 1st.

In fact, since August 1st, these 4 swings have moved a total of $12.7 TRILLION in market cap.

Last week, the index added $1.8 trillion, more than the total https://t.co/n4DIUfLkVl

(https://x.com/Kobeis...8662504620?s=03)

#2

Posted 15 September 2024 - 10:15 PM

Key Events This Week:

1. August Retail Sales data - Tuesday

2. August Building Permits data - Wednesday

3. Fed Interest Rate Decision - Wednesday

4. Fed Press Conference - Wednesday

5. Philly Fed Manufacturing Index - Thursday

6. August Existing Home Sales data - Thursday

(https://x.com/Kobeis...7014616516?s=03)

#3

Posted 15 September 2024 - 10:25 PM

.

#NASDAQ100 Topped July 10, 2024

At the bursting of the tech bubble $NDX topped & dropped over 40% in 2 months. It got a bear market rally, then continued to drop. Just over 1 year later it was down 72.40%. Then 2 years 7 months later it bottomed after dropping 83.65%

$QQQ https://t.co/Y85pce6FRj

#4

Posted 15 September 2024 - 10:26 PM

.

SPX Top

By the 1st rate cut in 2001, S&P 500 already topped. $SPX got a bounce w/ the 1st cut for 19 days. Then selling resumed. In 2007, $SPY topped 17 days after the cut (link). In both cases, the #FOMC cut only produced a bounce followed by a CRASH

https://t.co/HhJND8n3qQ https://t.co/rEAiamqpv5

King of the Charts (@ChartingProdigy) posted at 7:20 AM on Sun, Sep 15, 2024:

.

#NASDAQ100 Topped July 10, 2024

At the bursting of the tech bubble $NDX topped & dropped over 40% in 2 months. It got a bear market rally, then continued to drop. Just over 1 year later it was down 72.40%. Then 2 years 7 months later it bottomed after dropping 83.65%

$QQQ https://t.co/Y85pce6FRj

#5

Posted 16 September 2024 - 02:40 AM

Net short 1 es, 2 nq

Completed rollover into December ES & NQ contracts.

#6

Posted 16 September 2024 - 03:38 AM

The difference between the 2-year Treasury yield and the Fed interest rates dropped to -1.69%, the most in at least 35 years.

To provide context...data is only through August 1st:

http://technicalwatc...mbust091624.png

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

#7

Posted 16 September 2024 - 05:33 AM

Es long 5687.5

Net short 1 es, 2 nq

Completed rollover into December ES & NQ contracts.

#8

Posted 16 September 2024 - 06:45 AM

Nq long 15707

Es long 5687.5

Net short 1 es, 2 nq

Completed rollover into December ES & NQ contracts.

#9

Posted 16 September 2024 - 08:35 AM

Es long 5587.75

Nq long 15707

Es long 5687.5

Net short 1 es, 2 nq

Completed rollover into December ES & NQ contracts.

#10

Posted 16 September 2024 - 08:35 AM

Nq long 19582.5

Es long 5587.75

Nq long 15707

Es long 5687.5

Net short 1 es, 2 nq

Completed rollover into December ES & NQ contracts.