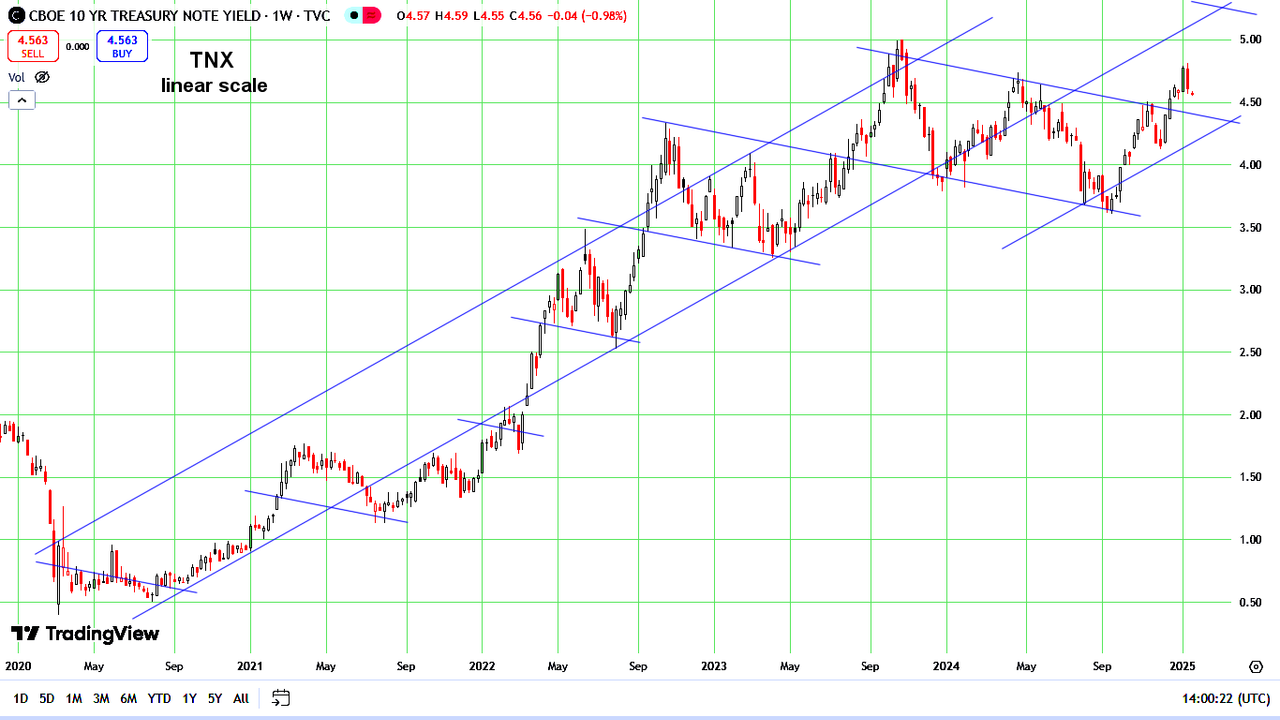

"Global Bond Tantrum" CNN rating on junk bond demand = "GREED"

Just days into 2025, yields on US government debt are surging as the risks to supposedly super-safe assets mount.

The rate on 10-year notes alone has soared more than a percentage point in four months and now is within sight of the 5% barrier last breached briefly in 2023 and otherwise not seen since before the global financial crisis nearly two decades ago. Yields edged higher on Monday as traders’ expectations for Fed easing dwindled further and oil prices rose.

Friday’s blowout employment report provided the latest evidence — while the Federal Reserve is rethinking the timing of further interest-rate cuts

Chart link @ https://i.postimg.cc/FR1PjTqk/R.jpg

NOTE the SPX McClellan sum index was trying to turn up last week but is now accelerating to the downside.

It needs to slow down before it can think about reversing to the upside. YIKES!

Edited by Rogerdodger, 13 January 2025 - 12:28 PM.