andr, you are an intelligent man, and know very well that ALL rockets fall back to earth when fuel is burned up.

nasdaq

#11

Posted 04 March 2025 - 11:59 AM

#12

Posted 04 March 2025 - 12:42 PM

The biggest problem is that maybe right for being bullish but now you've gotta make up the -10% drawdown instead of getting out and then back in again. Main point is that I'm sticking with my forecast from November, lots of volatility and maybe slight new highs!!

#13

Posted 04 March 2025 - 01:29 PM

The biggest problem is that maybe right for being bullish but now you've gotta make up the -10% drawdown instead of getting out and then back in again. Main point is that I'm sticking with my forecast from November, lots of volatility and maybe slight new highs!!

while you are thinking to the market, I'm thinking how improving my forehand speed, that lately has lost a bit of its old power. I'm not in my best phisical shape, BUT I WILL GET IT BACK, I PROMISE, LOL.

I'm enjoying today's reversal and when I enjoy the market's behavior, I tend to become less serious, it's a trait of my personality that I cannot contain, LOL.

forever and only a V-E-N-E-T-K-E-N - langbard

#14

Posted 04 March 2025 - 01:54 PM

andr, you are an intelligent man, and know very well that ALL rockets fall back to earth when fuel is burned up.

thank you for your appreciation, you too are clearly an intelligent man. That said, if you ask me if the stock market is stretched in its bullish rise, I can only say YES. Whoever you asked, would give the same answer, I think.

But, there's a big big problem. If it can get or not even more stretched and for how long it can remain in such a condition. Looking at charts, to me the market is not done in the long term. May I be wrong ? Obviuously yes, but

I'm not ready yet to become bearish. The time for it, will come, later on this year. Now it's soon. My honest thought.

forever and only a V-E-N-E-T-K-E-N - langbard

#15

Posted 06 March 2025 - 04:06 PM

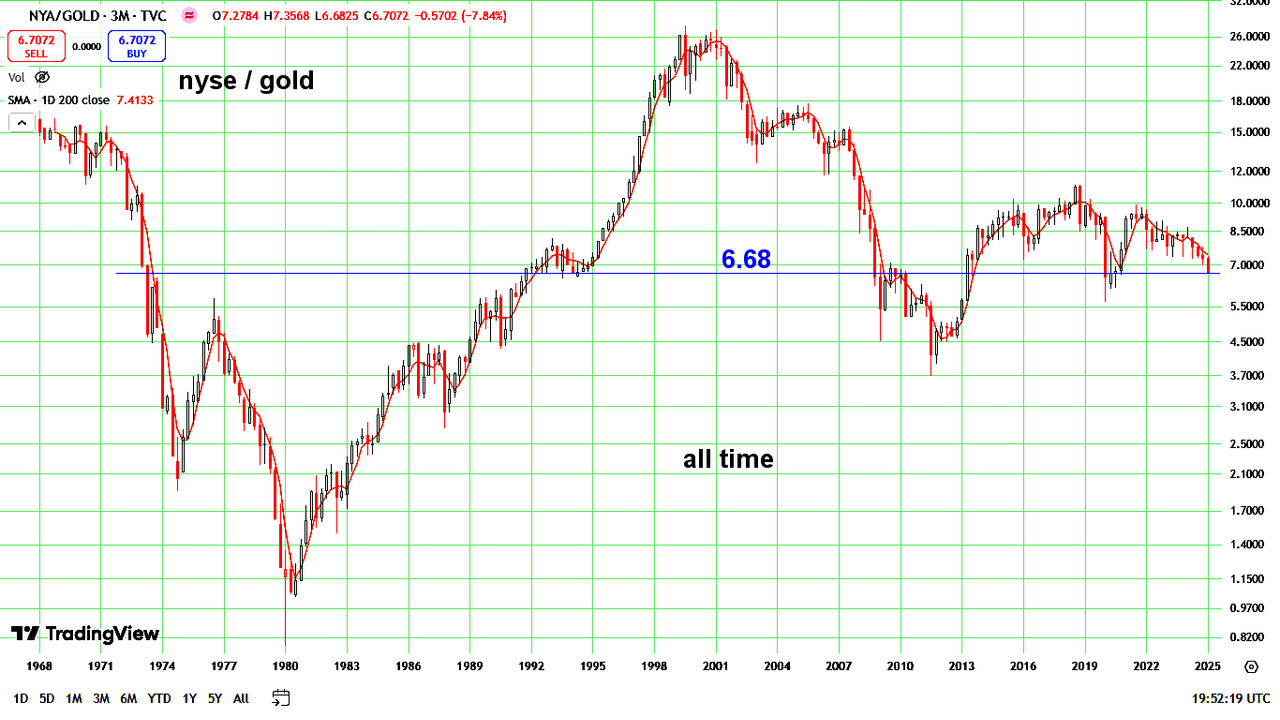

Decision point? Today's market value through history...