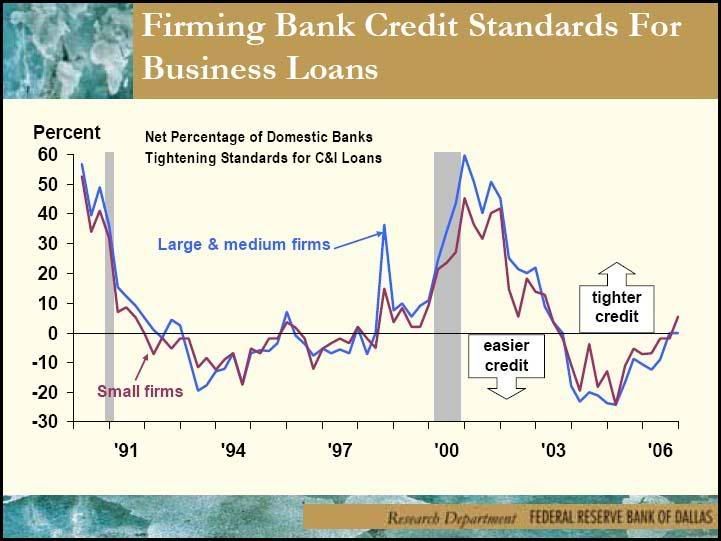

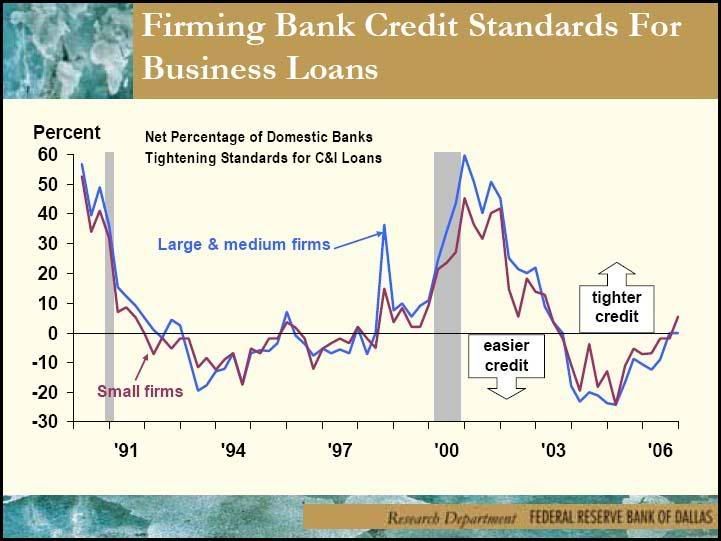

What happens if the debt bubbles can not be sustained or even secured by the real estate for the next 8-9 months? Does anyone have an idea? Let's say the banks ask some outrageous risk premiums or imposes stiff lending rules and the borrowing slows down further. By any means, the commercial credit growth was slowing down with a crashing speed the last time I checked...

I am really amazed how the right arm and left leg of the market got shot down over the last 9 months and the market only rallied higher. Many core tech stocks have been in a bear market since the middle of 2005, the oil and gas issues got shot down last summer, now the REITs got hit...

I don't know how important was the weight of the tech stocks since the indices clearly stayed buoyant despite the lack of growth and deteriorating productivity. I believe the bear market in the tech stocks is partially responsible of the slower improvement in the productivity, it is just less tech spending.

The central banks easily inflated while the real growth slowed down and we had this material mania top last summer. When they shot the materials down last summer by the BoJ's first rate hike and huge drain, the oil seemed to recover first, but the gold has been having trouble ever since. The Fed replaced the drain by pumping up and the USD never budged higher and finally declined in winter one more time.

Finally, the BoJ did it again a few weeks ago and the pain of the ongoing problems in the credit markets by the high rates actually doubled, the sub-prime lenders imploded. The era of free money sure seems to be over now when it seems to be most needed...

So where from here? The investors had to go back and buy the tech, not that they really wanted to, it seems. But really for those funds who have to be 100% invested, there seems to be no other choice since last November. The sector cycle lined up and the NDX rallied well thereafter.

But here we are with less growth, less money or low inflation and less financing options. I am sounding too perma bearish in these days, but this condition can not allow the indices to sky rocket, imho. Why? The USD is also saying the Fed can not ease quickly without a significant devaluation.

My best guess is several months of consolidation at best, but when these financing problems surfaces, you usually expect several months of lag as well for the activity to stabilize and we don't see any turn around in the housing yet, this actually puts away any real estate secured financing option for several months out and hence any new economic activity with any new liquidity probably twice as far out...

I don't see how the market can actually improve for at least 7-8 months or so and this is probably the best case scenario. For now, the liquidity that's sloshing around will continue to push the indices higher or keep them here, but clearly there is one more significant decline coming latest by the summer, even if everything starts to improve magically from here...

- kisa

REITs

Started by

arbman

, Mar 06 2007 08:07 PM

6 replies to this topic

#2

Posted 06 March 2007 - 08:50 PM

The answer to your questions about REITs is readily available, you just have to do your homework. Here's your first assignment:

McCulley at PIMCO

And here's today's extra credit opportunity:

Reuters

McCulley at PIMCO

And here's today's extra credit opportunity:

Reuters

Da nile is more than a river in Egypt.

#3

Posted 06 March 2007 - 09:34 PM

See there is a difference here, REITs vs what's going on the in the subprime lenders market. One of them is related to a business model and the other one is related to the problems in the residential housing sales via the unworthy borrowers. Now, the implosion of the sub-primes is directly related to the cooling in the housing.

The REITs are a different beast. The REITs will actually invest in a commercial property by covering all of the costs and making a profit. So, they are much smarter investors than the dumb or poor home buyers. Now, we have seen a broad sell off in the REITs, this is significant, it means the investors are not really seeing an increased demand in the commercial RE space or there is no further growth opportunity because of the insanely high prices or rates or both or all of the above.

What goes on in the sub-primes may or may not affect the overall economy, but what's happening with the REITs is directly related to the health of the economy since not only it indicates the demand for the commercial space, but also any borrowing by a corporation on their own RE assets will be immediately compared to the REITs activity and valuations. Even if a corporation issues bonds, they still have to show some assets and book value anyway. The bottom line is they simply can not borrow as easily or favorably unless there is a healthy REIT trend, imho.

This was my main point, why the REITs are getting hit is also another important issue.

- kisa

The REITs are a different beast. The REITs will actually invest in a commercial property by covering all of the costs and making a profit. So, they are much smarter investors than the dumb or poor home buyers. Now, we have seen a broad sell off in the REITs, this is significant, it means the investors are not really seeing an increased demand in the commercial RE space or there is no further growth opportunity because of the insanely high prices or rates or both or all of the above.

What goes on in the sub-primes may or may not affect the overall economy, but what's happening with the REITs is directly related to the health of the economy since not only it indicates the demand for the commercial space, but also any borrowing by a corporation on their own RE assets will be immediately compared to the REITs activity and valuations. Even if a corporation issues bonds, they still have to show some assets and book value anyway. The bottom line is they simply can not borrow as easily or favorably unless there is a healthy REIT trend, imho.

This was my main point, why the REITs are getting hit is also another important issue.

- kisa

#4

Posted 06 March 2007 - 10:40 PM

Must subprime lenders are REITs. You really, really need to do your homework.

Da nile is more than a river in Egypt.

#5

Posted 06 March 2007 - 11:02 PM

Of course they are, forgive my ignorance in completely separating them out of the group, I meant to say they are not really like the most prime commercial REITs out there who may or may not be in the lending as their core business. What is the market cap of the subprimes to the primes, or what is the ratio of the subprime lending within the lenders? Probably quite tiny (and even smaller for the overall REITs portfolio)...

Correct me if I am wrong, but I did read the article and although I like the plankton theory, it might take a very (very) long time before the subprime problem alone to reach all the way to the top for a REIT correction this visible, imho. If the home prices stabilize and start going higher, probably the ponzi scheme will let the subprime problems to be also subdued, but this is clearly not the case. I think there seems a bit more than that at the moment, or perhaps the REITs already passed the stage where the problem was only specific and contained to the subprimes, I am not sure, meaning the planktons are totally depleted in the ocean...

- kisa

Edited by kisacik, 06 March 2007 - 11:10 PM.

#6

Posted 06 March 2007 - 11:28 PM

Doesn't look like it's taking very long to me:

Da nile is more than a river in Egypt.

#7

Posted 06 March 2007 - 11:43 PM

Thanks, this should effect everything from the lending to the corporate bonds eventually, in fact soon. This seems to be a derivative of the higher interest rates and eventually inverted yield curve. As the rates go higher, qualifying the borrowers for the higher rates gets also more difficult, so you have a compounded slow down, never thought of it this way actually. You always think that people would simply not look for a loan or consider themselves out of the market, I guess it doesn't work that way, you really have to tell them a hard 'no!'...

BTW, if that '98 spike is in the remaking at the moment, the fuse is pretty short for the equities too. This wasn't the main reason why I was thinking a substantial correction to come into the summer, but this chart certainly makes me think that my suspicion above about a further tightening in the credit worthyness is an added risk for the liquidity creation in the months ahead. We have a visible cooling in the liquidity and now a visible restraint for the borrowing is coming, this is only getting worse probably...

Edited by kisacik, 06 March 2007 - 11:46 PM.