FWIW....90% Down Vol Days

#1

Posted 14 March 2007 - 10:47 AM

#2

Posted 14 March 2007 - 11:13 AM

I said this many times here and I repeat, the fastest corrections occur when the currency starts to slip lower quickly. I have seen many crashes in different countries due to the currency devaluations, they are almost instantaneous, the current structure with no warning from the breath indicators etc very much follows the pattern. I watch the USD more than anything now...

#3

Posted 14 March 2007 - 11:31 AM

I just read a piece on Market Tells by Rainsord Yang. He points out that the only other time in history we've seen three 90+% volume down days concentrated in a 3 week span was October of 1987.

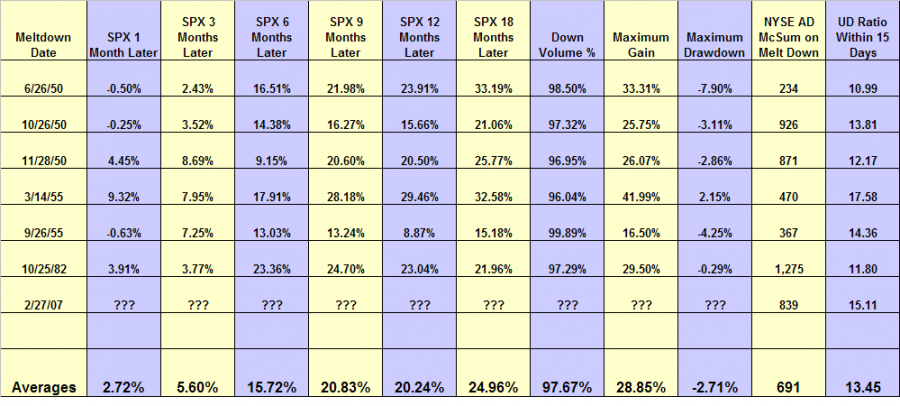

There has been a lot of excitement in the market the past two weeks with respect to extreme up and down volume days. This study was promised to a few people to settle a disagreement for the consequences of extreme down volume days going forward. The intent was to post this study a few days ago, but family emergency issues delayed the report until now... not as timely as it could have been.

The study looks at longer term price returns following a lopsided down volume day as witnessed on February 27, 2007. The following filters are used to best replicate the market conditions leading up to the +95% down volume day on 2-27-07:

1) The 95% or more down volume day occurred within four weeks of a new six month high as measured by the S&P 500

2) The price changes were measured from the day the 95% down volume event transpired. Therefore in some cases, additional price degradation occurred prior to the event.

The following table lists all qualifying events since 1950 and includes the SPX change over arbitrary longer term, the maximum draw downs, and maximum gains in between the arbitrary time frames. For reference, the NYSE AD McSum value on the day of the melt down is included.

95% down volume days under these conditions similar to the recent market climate are rare, resulting in a small sample space... reducing its statistical significance, but the results are what they are, and provide doubt to notion such events are initiation moves to price collapses.

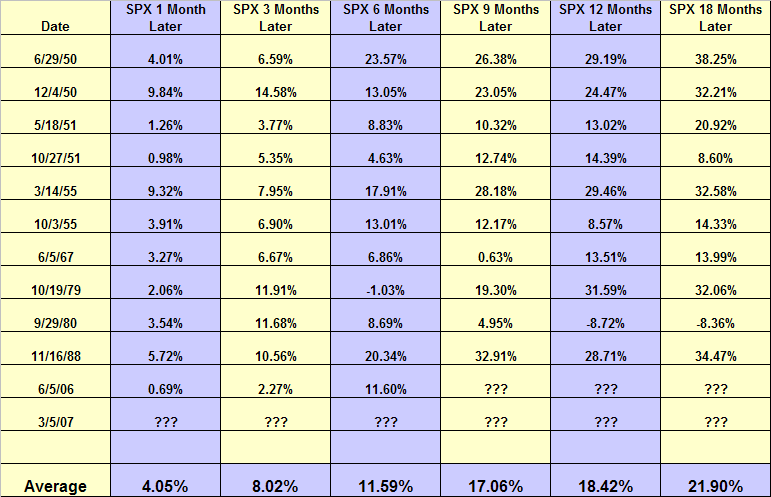

Since the first study's research was completed, a 90% down volume day unfolded on Monday March 5th (2007), thus another iteration of price return determinations were conducted with these filtering criteria:

1) Two 90% or more down volume days within a 10 day period.

2) The first down volume day occurs within four weeks of a new 6-month price high as measured by the SPX.

3) In this study, the price returns going forward were determined from the day the second 90% or more down volume day occurred.

The relaxed down volume percentage requirement from the first study provided a few more qualified sample points.

Of course, this time could be different, but past historical down volume extremes similar to the current market conditions, suggest the probability is high significant price appreciation will be the norm going forward in the longer term.

FWIW

Randy

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#4

Posted 14 March 2007 - 11:44 AM

#5

Posted 14 March 2007 - 11:45 AM

Which exchange? nyse, naz, amex etc. . .First let me state that I'm NOT predicting a crash. I just wanted to throw this out there because it is an anamoly.

I just read a piece on Market Tells by Rainsord Yang. He points out that the only other time in history we've seen three 90+% volume down days concentrated in a 3 week span was October of 1987.

#6

Posted 14 March 2007 - 11:47 AM

#7

Posted 14 March 2007 - 12:27 PM

#8

Posted 14 March 2007 - 12:33 PM

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#9

Posted 14 March 2007 - 12:35 PM

#10

Posted 14 March 2007 - 12:37 PM

First let me state that I'm NOT predicting a crash. I just wanted to throw this out there because it is an anamoly.

I just read a piece on Market Tells by Rainsord Yang. He points out that the only other time in history we've seen three 90+% volume down days concentrated in a 3 week span was October of 1987.

there were similar episodes in 62, 66, 70 and a lot of other times.