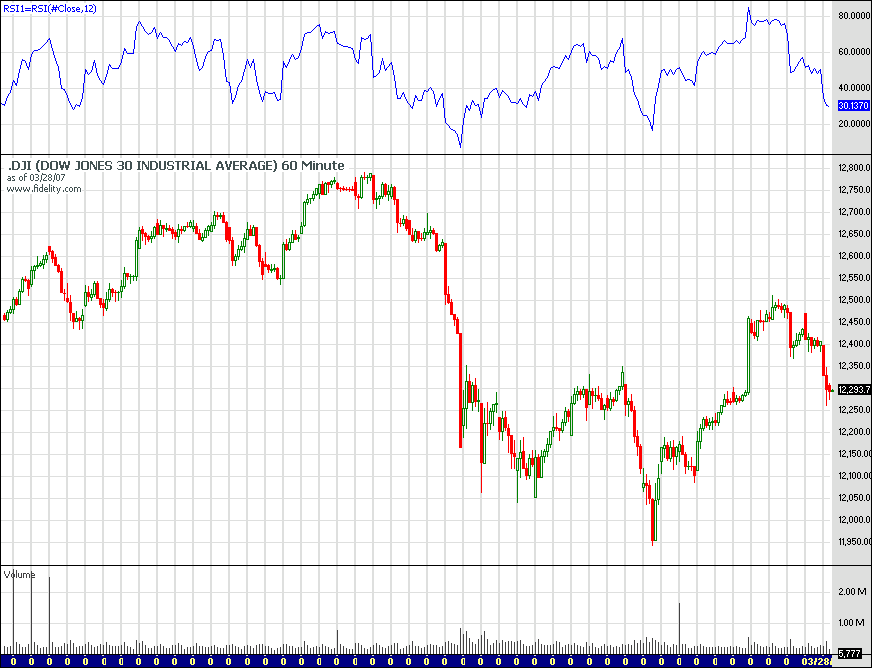

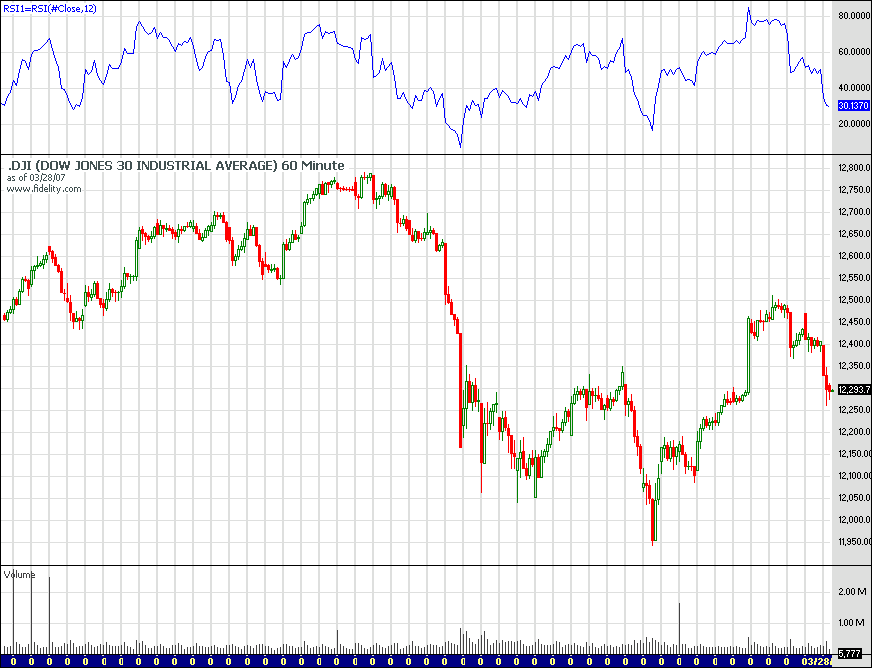

Futures position is too much in the gutter. So while I still maintain a wave B/C outlook, my "guess" is that bears need some caution here.

Especially the dow 12-hour RSI. Its in bounce zone and near support.

Posted 28 March 2007 - 11:06 AM

Posted 28 March 2007 - 11:39 AM

Posted 28 March 2007 - 11:43 AM

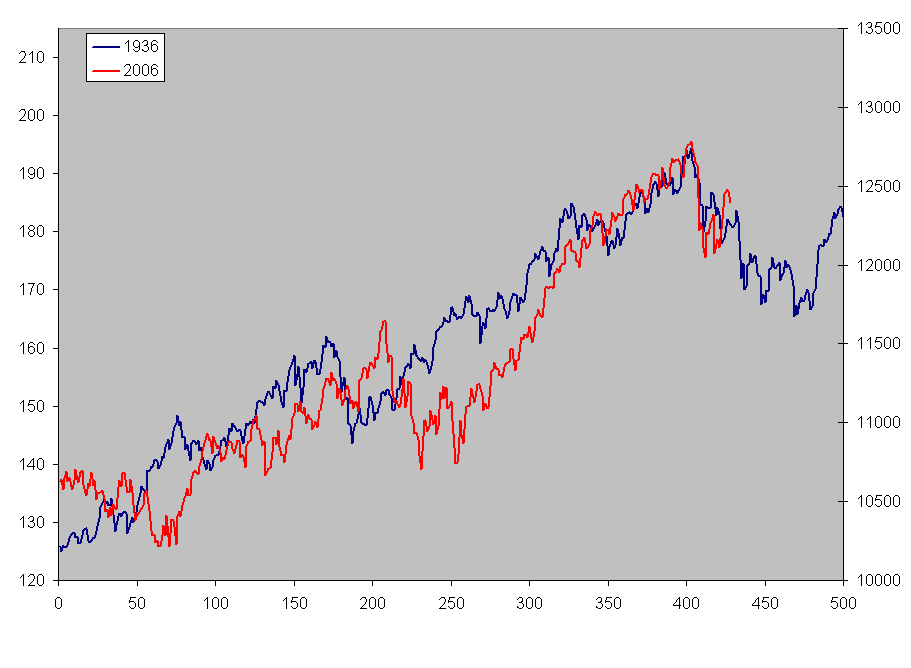

Note the Dow has gone below the two retracement highs at 12,350, after a runup to close the gap, market is going lower than previous low....11,650 minimum.

Posted 28 March 2007 - 12:14 PM

Posted 28 March 2007 - 12:17 PM

Posted 28 March 2007 - 12:34 PM

My guess is that earnings reports must assist in the drive down, and that'll get into swing a few weeks from now.

And combine that with economic data... to be released 3rd week of april.

Posted 28 March 2007 - 01:46 PM

Posted 29 March 2007 - 04:25 AM