is the spx going to pull the rut out of its rut!!

#1

Posted 18 May 2007 - 08:55 AM

#2

Posted 18 May 2007 - 09:27 AM

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#3

Posted 18 May 2007 - 09:44 AM

Oh, and while we're on the subject of fixation...with the Bank of China raising rates on Saturday, let's not be surprised that we might finally see a 5% or 10% correction in the Shanghai Index come Sunday night since they announced this move after their markets had already closed. And judging by the reaction of the US markets this morning, it won't be the catalyst for anything dire for the rest of the globe either.

Fib

The US markets follow the China markets.

If the China market takes a dive, the US markets will take a dive.

I wouldn't read too much into today's OPEX action, considering China is closed. After reading your post I realized that its time to short the DOW for a quick trade. that rising wedge on 30 min charts and " we couldn't care less about anything" attitude in the market, seems like a good setup.

As for the longer term, you may very well be right, and the big decliune isn't in the cards just yet. But the rotation from small caps into large caps is a good sign. That the times may be finaly changing, and some parabolas like RUT oir XBD already starting to look suspect.

Edited by ogm, 18 May 2007 - 09:46 AM.

#4

Posted 18 May 2007 - 09:46 AM

I'm fascinated on why everyone is all of sudden so worried about the RUT of late.

Fib

Maybe its because they see what is happening there,... if they are not swept up in all the DOW & S&P hype,...

they could be seeing the fact that the RUT has traded thru and below the FEB 27th low,....for the last 4 days in a row.

Now if the DOW or S&P were doing that the ..... CNBC heads would be all over it.

But just as the SOX,.... they hype it when they try and push the markets higher,... and when it dropped or went

absolutely NO where for about a year ,....they stopped talking about it.

So,....... since we can still trade the RUT why not focus on it!

Edited by Mr Dev, 18 May 2007 - 09:48 AM.

.. .. ..

Mr Dev

......trading is basically a simple operation, but you have to be a genius to understand the simplicity.

.....timing,..... is ....everything !

... remember no guessing visit MrDev!

#5

Posted 18 May 2007 - 10:00 AM

#6

Posted 18 May 2007 - 12:39 PM

Edited by Mr Dev, 18 May 2007 - 12:40 PM.

.. .. ..

Mr Dev

......trading is basically a simple operation, but you have to be a genius to understand the simplicity.

.....timing,..... is ....everything !

... remember no guessing visit MrDev!

#7

Posted 18 May 2007 - 12:56 PM

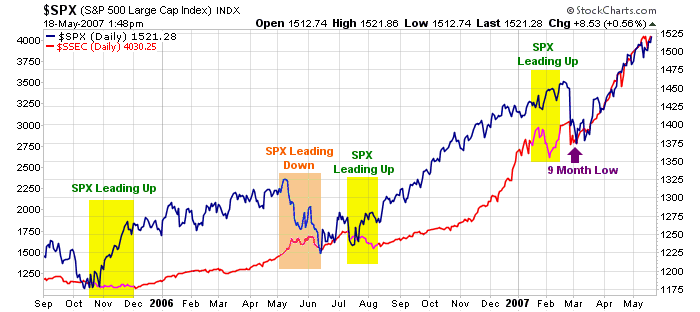

Funny, but if you overlay the Shanghai and the SPX you will find that, with the exception of the end of February period, the SSEC tends to trail the SPX by about 2 months in direction.The US markets follow the China markets.

If the China market takes a dive, the US markets will take a dive.

Or maybe it's another attempt to find a new flaw in the machinery by using this new and exciting "non confirmation" after the lack of leadership idea with the NASDAQ has failed to produce the desired results?Maybe its because they see what is happening there,... if they are not swept up in all the DOW & S&P hype...

Nope, everything does matter, but only if one decides that it does.Yeah, nothing matters

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions