Edited by da_cheif, 10 June 2007 - 09:42 PM.

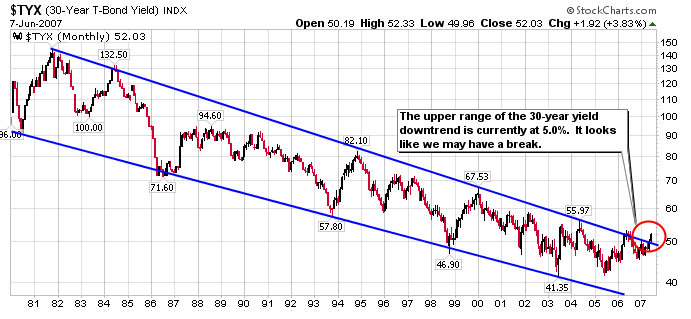

t bonds ready to go......

#2

Posted 10 June 2007 - 09:52 PM

Edited by Russ, 10 June 2007 - 09:52 PM.

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#3

Posted 10 June 2007 - 09:54 PM

Edited by da_cheif, 10 June 2007 - 09:58 PM.

#4

Posted 10 June 2007 - 09:56 PM

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#5

Posted 10 June 2007 - 10:02 PM

http://www.gold-eagl...yson012805.html

but eventually an 80-81 type recession is going to wipe out lots of them, this time could be much worse as saving are very low and government and private debts large.

being in debt up to ur eyeballs is the place to be during an inflationary economic boom of unparalleled proportions.......

#6

Posted 10 June 2007 - 10:06 PM

being in debt up to ur eyeballs is the place to be during an inflationary economic boom of unparalleled proportions.......

When will the multi trillion dollar debt and even bigger unfunded liabilities get squared away? How is an eventual default going to be stopped?

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#7

Posted 10 June 2007 - 10:25 PM

being in debt up to ur eyeballs is the place to be during an inflationary economic boom of unparalleled proportions.......

When will the multi trillion dollar debt and even bigger unfunded liabilities get squared away? How is an eventual default going to be stopped?

that worry is as old as the ded c scrolls.....

#8

Posted 10 June 2007 - 10:34 PM

Did the stock market look like this in the 80s when the bonds sold and the market rallied ?

I don't think so.

I understand the theory that the bond yield rally because of the economic growth. However, isn't it a valid argument that the economic growth was enabled by lower bond yields as a precondition in the first place?

US consumer. cashing out home equity translates into China growth.... and so on. Chicken and egg argument IMO.

Also seems like the declining trend in bond yields for the past 20+ years was correlating with the rising stock market. And if the trend in bonds is changing now, why wouldn't the correlation persist the other way ?

As for refinancing into fixed rates... most of the people who took out arms will not be able to get a fixed rate mortgage to save their lives as the lending standards tighten and rates rise. Most of those people shouldn't have been given any mortgage in the first place.

Edited by ogm, 10 June 2007 - 10:35 PM.

#9

Posted 10 June 2007 - 10:38 PM

that worry is as old as the ded c scrolls..... .......

Well I know that you have the opinion that Martin Armstrong is a crook and a fraud but I studied his work for many years and his 32,000 variable super-computer model (which the CIA and Chinese government tried to aquire in late 1998 according to Armstrong's staff) forcast that there would eventually be a world-wide debt crisis with interest rates sky rocketing and gold going to several thousand dollars per ounce. Eventually he said that governments would have to create new currencies, perhaps 3, one for the America's, Europe and Asia.

As radio host Michael (Glen

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#10

Posted 10 June 2007 - 10:53 PM