Time for another glance....

#1

Posted 18 June 2007 - 12:45 PM

http://stockcharts.com/c-sc/sc?s=$SPX&p=D&yr=8&mn=0&dy=0&i=p50387844942&a=99807757&r=3357.png

#2

Posted 18 June 2007 - 12:47 PM

#3

Posted 18 June 2007 - 12:54 PM

at the my big count....if we need one more high...target is 1549/50

http://stockcharts.com/c-sc/sc?s=$SPX&p=D&yr=8&mn=0&dy=0&i=p50387844942&a=99807757&r=3357.png

This is some bullish pattern: 1700-1950 top of wave 5?

#4

Posted 18 June 2007 - 01:05 PM

Edited by Teaparty, 18 June 2007 - 12:59 PM.

#5

Posted 18 June 2007 - 01:15 PM

#6

Posted 18 June 2007 - 01:18 PM

#7

Posted 18 June 2007 - 01:32 PM

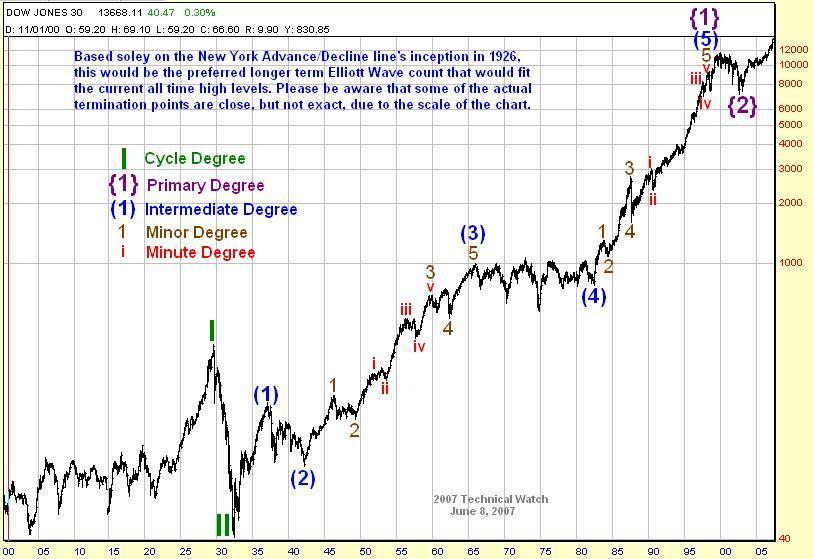

2) The key in knowing if a 4th wave of the same degree is tracing out is that momentum tools, such as the MACD, will generate lower lows than that of the second wave bottom within this same pattern sequence. So until this happens, you're probably looking at further sub division of the current pattern.

Aside from that, and the running correction consideration you have in 2005 (which I'm not a big fan of), the count "looks" plausible, especially if the A/D line tops out in here. However, your triple three decline in the 2000-2003 period is questionable based on the fact that the March 2003 lows were able to generate higher anxiety ratings than that of the actual 2002 lows...which would mean that it's more than likely a second wave bottom.

We're you able to check out the multi decade Dow count proposal I put up last week?

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#8

Posted 18 June 2007 - 01:34 PM

32.50 was mentioned in shorter timeframe than the subject of big count in the current thread..sorry to confuse

http://www.traders-t...showtopic=71384

Edited by hiker, 18 June 2007 - 01:39 PM.

#9

Posted 18 June 2007 - 01:48 PM