I'm going to suggest that the psychology has changed quite a bit. Folks are holding off buying because they see and hear a lot of bad news about real estate right now. They also see a lot of folks who can't sell their homes.

They see rising rates as a sign that there will be better bargains later, instead of a signal to "get a move on".

I predict that the low in real estate will be a stealth affair. We'll suddently look up and realize that improving markets are no longer the exception but rather the rule.

Now, what will that take? I have no idea. I'm guessing that the need to buy will just marginally begin to exceed the excess supply. Around here, the data is very interesting. Our city saw 19% more sales at a 17% lower price, on average. Our city is undergoing a redevelopment surge. Our neighoring town on the river already had theirs and they saw about 5% lower prices and sales last year. The next town over on the river saw a big increase in sales and an 89% increase in the average price paid. They had just completed some major development. Note that these three towns span perhaps 5 miles of river front. It looks to me like investors are buying values, but at the fully priced zone, things are dead as a door nail.

I'm thinking it'll be a very spotty, complex low, very location sensitive. Nothing like a stock market low. We'll probably see a pick up in the market right around here as more development finishes, as we're becoming a pretty sexy community for not much money. Other areas will probably require a new employer moving in, or something similar. Others will just bottom out because folks want to live there and finally found a buyer for their house. And other still will just have gotten so cheap that folks can afford to live there.

Mark

But it's also important to keep in mind that we have yet to see the "sense of urgency" to buy housing that has accompanied price tops in the past, so this is something we should start to see once the 5.25% level is violated to the upside.

I believe da cheif has also expressed the view that, as rates rise, potential buyers who have been sitting on the sidelines will rush into the market before it's "too late." At the risk of contradicting two seasoned observers who have watching this market longer than I have, I am inclined to believe this phenomenon will be offset during this cycle by two more significant factors:

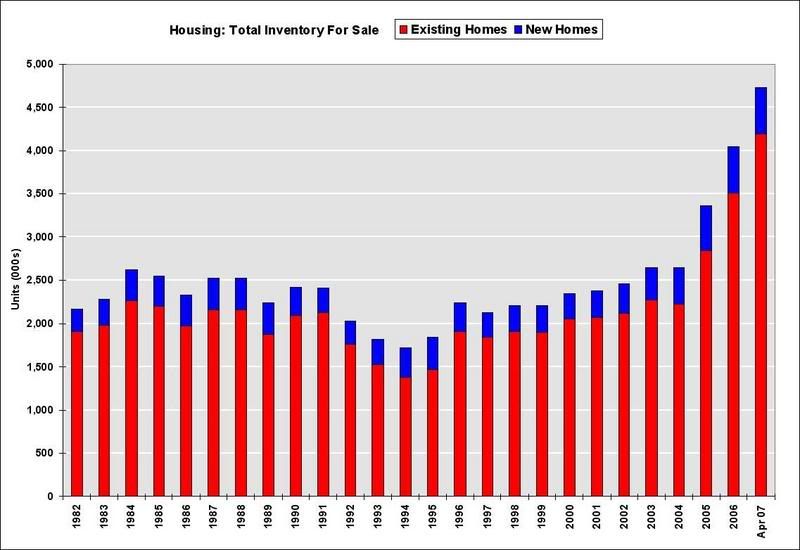

1) Speculative enthusiasm for real estate has pushed home ownership about 500 basis points above its historical average: ~69% today vs. ~64% over the last 5 or 6 decades. The liquidation of speculative investors may counter any boost from hold-out buyers.

2) Home buying during this cycle has been facilitated by unprecedented creative financing strategies. As the availability of stated-income and other controversial mortgage products shrink, would-be last-minute buyers may lack the means to execute the "sense of urgency" purchases you are anticipating.