An LBO that was announced in April failed today.

The scock crashed 10% in less than 10 minutes.

ABX indices, even the AAA ones, are crashing.

Credit is dying out fast.

Although the headline indices went up today, the one shorted heavily by this bear ($DJR) went down.

Simon, its largest component, broke below previous low.

Any more reason not to be bearish, Denleo?

You guys are not paying attention

Started by

greenie

, Jul 11 2007 04:30 PM

7 replies to this topic

#1

Posted 11 July 2007 - 04:30 PM

It is not the doing that is difficult, but the knowing

It's the illiquidity, stupid !

It's the illiquidity, stupid !

#2

Posted 11 July 2007 - 05:11 PM

Greenie, I posted yesterday that bears have the best opportunity here. I still think so. My bearish conclusions don't come from credit market analysis. They come mostly from technical indicators.

One example: NYSE composite index is only 100 points from 52 week high and 2,200 from 52-week low (basically trading at the high). Today 100 stocks made new 52-week highs and 80 stocks made 52-week low.

NASDAQ, which is also basically at the 52-week high: 96 new highs and 119 new lows.

Just a couple of examples. There are many others. Not everything is bearish, but too many to give bears a fighting chance for the next few weeks.

Having said that, I only expect an intermediate-term correction; long-term I don't see any evidence that the bull market is over.

Denleo

#3

Posted 11 July 2007 - 05:15 PM

Denleo,

What you are citing here are essentially breadth problems and a lot of us have been harping on that issue for what seems like an eternity. The market is shrugging off bad internals and plugging ahead.

What else do you see that prompted you to change your position so drastically?

Do you actually have a short position?

rkd

“be right and sit tight”

#4

Posted 11 July 2007 - 05:16 PM

Denleo, what do you think about the extreme NDX vs SPX divergence? Which way do you think it will snap now? I think SPX will first snap with the NDX, some 20 more points. Is it the all time high then? Perhaps a decline thereafter. I think it is getting there, but perhaps not quite there...

- kisa

#5

Posted 11 July 2007 - 05:32 PM

Actually this is the first time in a long while I see internal problems. I used to disagree with those who pointed to them before (I didn't see them untill recently). Also a couple of prop indicators are on sell.

Kisa, I like NASDAQ better than S&P. In fact I posted a couple of weeks ago that long NASDAQ short S&P is a good trade (neutral). I still have it in my portfolio. Of course, if market corrects, NASDAQ will follow to the downside. This has been a good relative value trade. I still beleive NASDAQ will do better regardless of overall direction.

Denleo

I forgot to mention: Yes I am short. I was scaling in today and continue to do it tomorrow. No stops. These are options strategies (some are August, some are Novembers, mostly bearish ratio diagonal combos). Trying to combine delta and theta at the same time.

Denleo

#6

Posted 11 July 2007 - 06:55 PM

IMHO 2003-07 bull market is over for most indices. I see signs of deflation everywhere. Credit cycle is turning. Stocks are responding. Credit sensitive sectors are already in bear markets. The rest of the market will follow. Psychology is changing among the market participants (S&P responding to market pressure and cutting RMBS ratings is just one example). Hedge funds are in the bad news. There is no going back any more. Blackstone knew it and so it moved its IPO ahead of schedule.

NDX can remain strongest index for a while. Epicenter of the bubble is credit and construction this time, not dotcom technology.

(I am using the word deflation in its real sense - destruction of credit, not fall in price).

It is not the doing that is difficult, but the knowing

It's the illiquidity, stupid !

It's the illiquidity, stupid !

#7

Posted 11 July 2007 - 08:35 PM

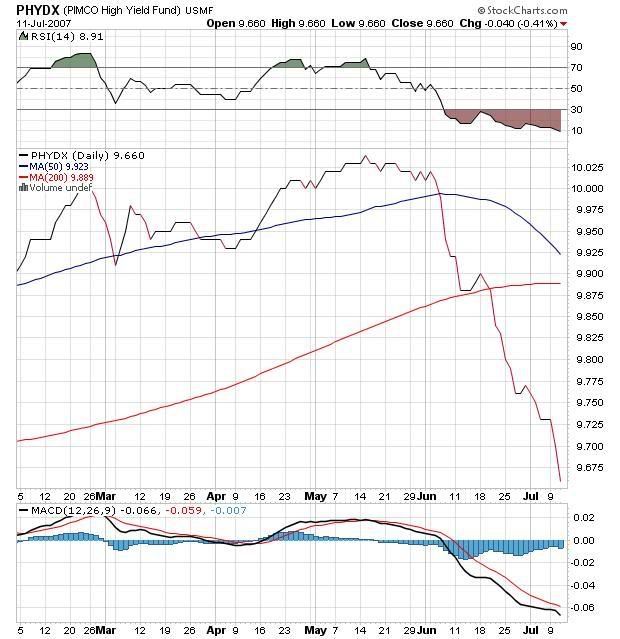

What Greenie said. In pictures.

Now lets all buy more brokerage stocks, because the demand for CDO's is huge, and they will make a lot of money...... Or not.

Apparently Cerberus is having issues with raising debt to finance Crysler buyout, though they denied it for now.... but.... as I sad.. there are about 200 bil worth of buyouts that have already been announced, that are yet to find creditors. The credit crunch is real.

Now lets all buy more brokerage stocks, because the demand for CDO's is huge, and they will make a lot of money...... Or not.

Apparently Cerberus is having issues with raising debt to finance Crysler buyout, though they denied it for now.... but.... as I sad.. there are about 200 bil worth of buyouts that have already been announced, that are yet to find creditors. The credit crunch is real.

#8

Posted 11 July 2007 - 09:05 PM

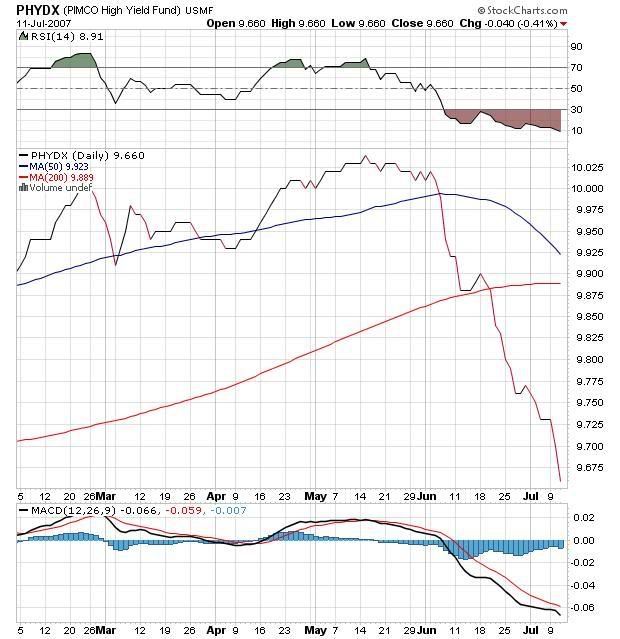

Credit isn't everything -- credit is the only thing. Here's PIMCO's high yield fund (one of the largest).

Anyone want to catch this knife?

Anyone want to catch this knife?

Edited by jawndissedi, 11 July 2007 - 09:10 PM.

Da nile is more than a river in Egypt.