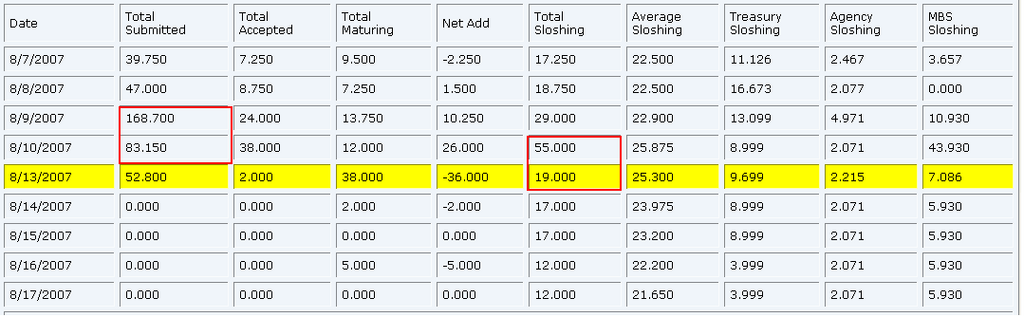

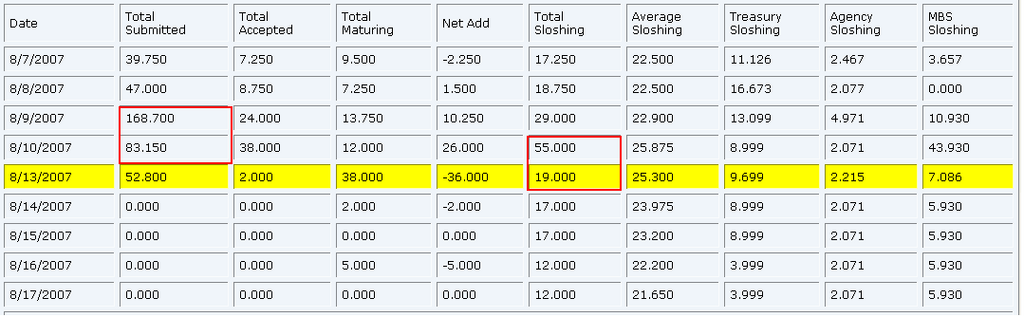

Take a look at that Total Submitted tho..

Posted 13 August 2007 - 09:49 PM

Posted 13 August 2007 - 10:08 PM

Despite all the news hoopla, looks like the amount sloshing.. is kinda low.

Take a look at that Total Submitted tho..

Edited by LarryT, 13 August 2007 - 10:10 PM.

Posted 13 August 2007 - 10:56 PM

Despite all the news hoopla, looks like the amount sloshing.. is kinda low.

Take a look at that Total Submitted tho..

Notice the 10 day average is also above Mondays sloshing value. No way the FED is going to cut.

My FED model shows they are in ease mode. It has 9 inputs and is weighted for each input. Above 65% a cut is possible, as of Friday it was at 78%. That tells me they are in easy money mode just not ready to cut.

Today on CNBC....BREAKING NEWS..FED INJECTS 2 BILLION LIQUIDITY. Did they tell you the 38 billion injected Friday was removed? Nooooo

All day today, FED contiues to inject liquidity.... Bunch of liars

Edited by nimblebear, 13 August 2007 - 10:57 PM.

Posted 13 August 2007 - 11:47 PM

Posted 14 August 2007 - 02:32 AM

Despite all the news hoopla, looks like the amount sloshing.. is kinda low.

Take a look at that Total Submitted tho..

Notice the 10 day average is also above Mondays sloshing value. No way the FED is going to cut.

My FED model shows they are in ease mode. It has 9 inputs and is weighted for each input. Above 65% a cut is possible, as of Friday it was at 78%. That tells me they are in easy money mode just not ready to cut.

Today on CNBC....BREAKING NEWS..FED INJECTS 2 BILLION LIQUIDITY. Did they tell you the 38 billion injected Friday was removed? Nooooo

All day today, FED contiues to inject liquidity.... Bunch of liars