SPY Short Interest=Massive

#1

Posted 28 August 2007 - 09:23 PM

#2

Posted 28 August 2007 - 09:36 PM

#3

Posted 28 August 2007 - 09:42 PM

#4

Posted 28 August 2007 - 09:46 PM

You don't even have to go back a year to see where the vlume on SPY was dwarfed by the volume on the QQQ. That has changed in a big way. It is beginning to look to me as if SPY has surpassed QQQQ as the ETF of "trading choice". Anyway I know that some "prognosticators" have, in the past, made a big point of the short interest in the q's when predicting market direction (Schaeffer comes to mind among others). Anyway, here's the deal. On August 15 the SPX closed at 1406.7. Many of the shorts should have been covering by then I would think. Or at the very least the short interest should have dropped substantially after a fall of 150 points on the underlying. Well did it? Nope. In fact, it went up. SPY has 397,312,000 shares outstanding and, as of the August 15 close had 242,747,172 sold short. That is over 61% of the shares sold short. Do you think that short interest has decreased or increased since then. THAT was the low close....August 15th. This might not be a great time to crawl in bed with a short position and get real comfortable. With the backdrop of the 87 crash being spun as a high probability in many circles there just may be too many on that side of the trade. I regard this drop as a short term trap.....we shall see.

Yes indeed. Good to see someone doing their homework.

D

#5

Posted 28 August 2007 - 10:00 PM

Edited by selecto, 28 August 2007 - 10:01 PM.

#6

Posted 28 August 2007 - 10:06 PM

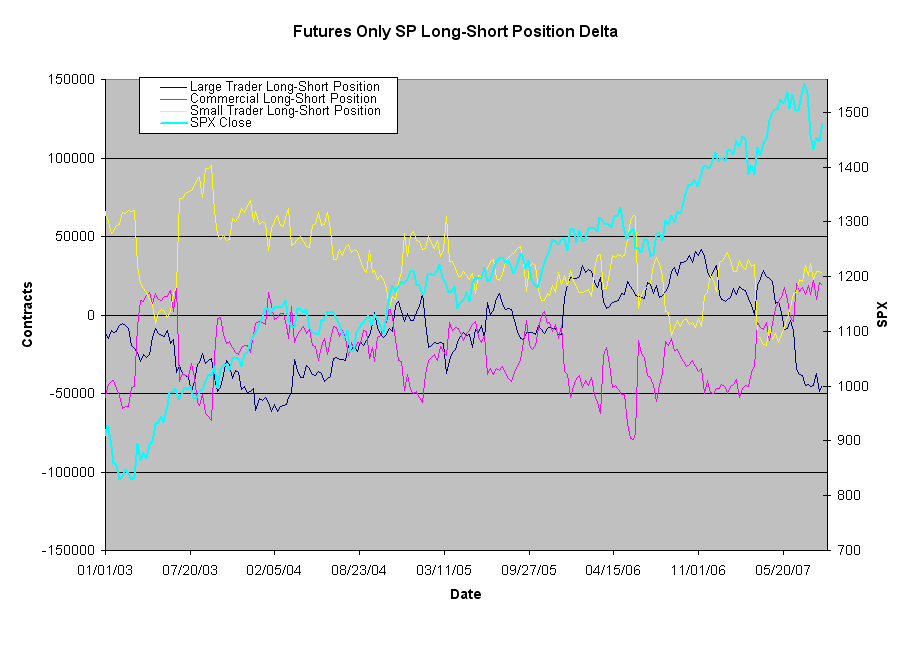

Strange how these guys who are usually very wrong are still holding longs during the bounce up.. my belief is that da bottom's not hit til they flip short, and no indication they've flipped short as of yet.

#7

Posted 29 August 2007 - 07:15 AM

It may go up for a few days, but I'm trying to look at the bigger picture.. that is, SP small traders are STILL LONG and haven't capitulated.

Strange how these guys who are usually very wrong are still holding longs during the bounce up.. my belief is that da bottom's not hit til they flip short, and no indication they've flipped short as of yet.

Note though the last time the Commercials had a sustained net long position was in the 2nd 1/4 of 03. Subsequently the market worked it's way higher.

#8

Posted 29 August 2007 - 08:24 AM