var Bar, Count, Big, CountBig: integer;

InstallTimeBasedExit(1);

for Bar := 20 to BarCount - 1 do

begin

ApplyAutoStops(bar);

if (

((PriceClose(bar-2)-PriceClose(bar-1))/PriceClose(bar-2) > 0.015) and

((PriceClose(bar-2)-PriceOpen(bar-1))/PriceClose(bar-2) > 0.01) and

(PriceClose(bar-1) < SMA(bar-1, #Close, 50))

) then

begin

if(

(PriceOpen(bar) > PriceClose(Bar-1)) and

(PriceHigh(bar-1) < PriceClose(bar-2)) and

(PriceOpen(bar-1) > PriceClose(bar-1))

) then

ShortAtMarket(Bar, '');

end

end;

So what does this say? Well it says...

1) Look for a day when Qs gap down 1%

2) And closed down 1.5% from previous close

3) And it closed down below 50MA

4) And today was a gap up

5) And yesterday's highs did not fill the gap

6) And last part is that it was a down day.. I shouldn't have put that in, it was redundant..

Then cover at the open the following day...

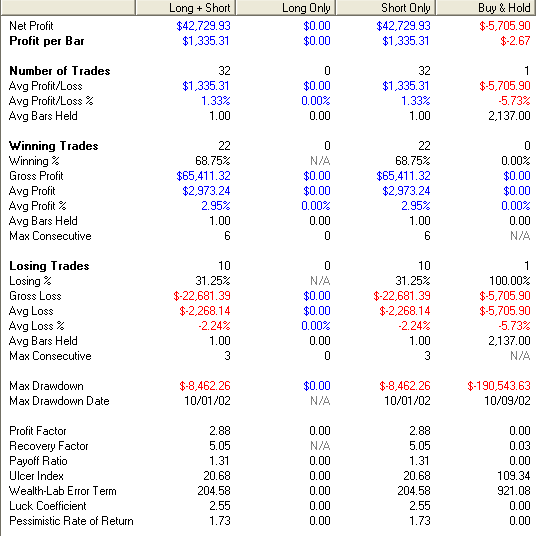

As the back test shows, out of 32 occurances, 22 of them were winners. Though the average loss % vs average gain % didn't make this trade attractive. But I kept a tight leash on stops and rode it down til it broke the lows and came back up and stopped me out for a profit.

Now here's the interesting part.. if I change the rules so that I cover 2 days later instead of 1 day later, the winning % is still about the same. Hence if prices got up to say the gap up opening of today (Qs 47.70ish), and one sold short, there's still 69% chance that the market will go down from there and be profitable.

That I found interesting. Tomorrow is 9/11 and therefore I'm not expecting much weakness, but I'm not expecting much strength either.