Edited by dcengr, 13 October 2007 - 01:39 PM.

What is the significance of this number?

#1

Posted 13 October 2007 - 01:39 PM

#2

Posted 14 October 2007 - 12:24 AM

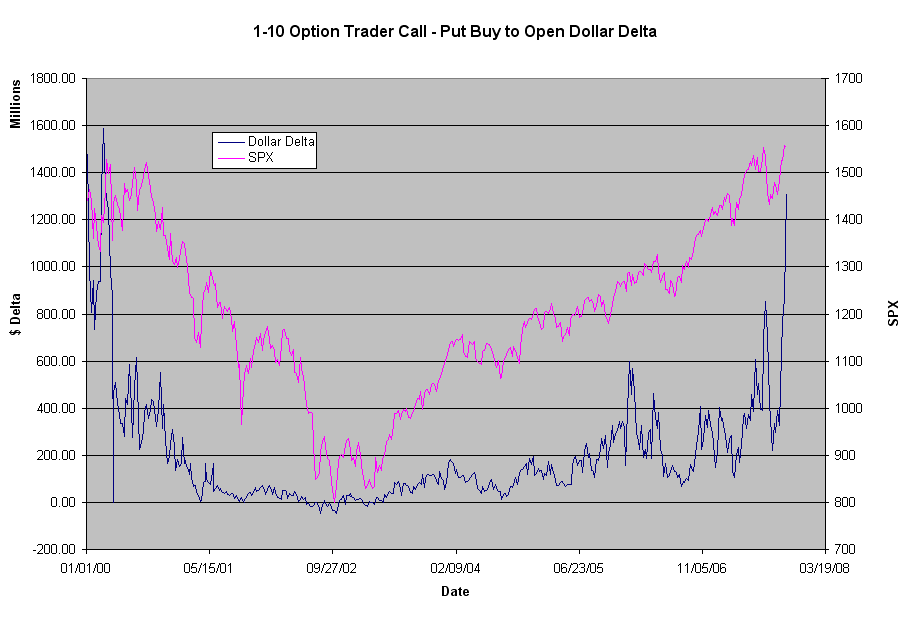

That is the dollar delta between calls and puts premiums for this week... for 1-10 equity options traders...

This value was last visited.. oh you know when.

As a matter of fact I do not know when.

And I'm guessing many here don't know either. Would you be kind enough to tell us when or is it a secret?

#3

Posted 14 October 2007 - 01:45 AM

#4

Posted 14 October 2007 - 06:47 AM

That is the dollar delta between calls and puts premiums for this week... for 1-10 equity options traders...

This value was last visited.. oh you know when.

Hi dcengr, IMHO, the last time that value was visited was in July 2007 approximately between July 16-20, just before the sharp decline began that culminated in the August 16, 2007 bottom; is that correct? TIA Also, IMHO, the delta between calls and puts premiums for this week is bearish. IMVHO, the MMs will want to sell calls short to get the fat premiums on the calls and hedge that with long puts. I would appreciate it if you could provide a link where I could find and keep track of the dollar delta between call and put premiums-TIA.

Cheers,

Bob-C

#5

Posted 14 October 2007 - 07:08 AM

Hi pdx5, see my reply to dcengr above. See this well-written options FAQ from http://www.optionsce...technical.jsp#7 The FAQ explains the meaning of Delta and its significance and provides an options' calculator page that gives the "Greeks" for securites such as the QQQQs or indices like DJX. The FAQ from www.optionscentral.com explains Delta as follows:Dce...please explain what you mean in layman's language.

TY.

Cheers,Where can I find option delta values on the internet? A: Delta is one of the options greeks that is derived from an option pricing module. Delta, normally expressed as a percentage, seeks to measure the rate of change in an options' theoretical value for a one-unit (i.e. $1) change in the price of the underlying security or index. There are a couple of ways to obtain the "delta" of an option.

- From the 888options homepage, you can click on the menu link titled "Quotes". Enter a symbol and under "Apply to:", select "Detailed Options Chains." The option's Greeks (including the delta), will be listed in the table below.

- You can also solve for the option delta using our options calculator. There is an options pricing calculator under the "Tool and Literature" link on our website. This calculator is available in Basic, Advanced, or Cycles format. First time users are encouraged to review the Basic calculator as there are discussions on the various inputs necessary to calculate an options' theoretical pricing.

Bob-C

#6

Posted 14 October 2007 - 10:55 AM

If it helps, this is what the chart looks like...

The data is available from OCC. Whether the data from OCC is correct or not, I do not know. I do know I checked my spreadsheet calculation of it, and that appears correct.

#7

Posted 14 October 2007 - 11:23 AM

Hi dcengr, thanks very much for your time and effort and for the information.All you need to do to get that number is subtract the $ amount of the premium paid for option calls from puts. Its just a way to gauge sentiment..

If it helps, this is what the chart looks like...

The data is available from OCC. Whether the data from OCC is correct or not, I do not know. I do know I checked my spreadsheet calculation of it, and that appears correct.

Good luck on your trades.

Regards,

Bob-C

#8

Posted 14 October 2007 - 07:29 PM

klh

#9

Posted 14 October 2007 - 08:02 PM

#10

Posted 14 October 2007 - 08:14 PM