Posted 17 October 2007 - 11:08 AM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

Posted 17 October 2007 - 11:18 AM

Edited by NAV, 17 October 2007 - 11:21 AM.

Posted 17 October 2007 - 11:22 AM

Posted 17 October 2007 - 11:23 AM

Posted 17 October 2007 - 01:28 PM

Mark,

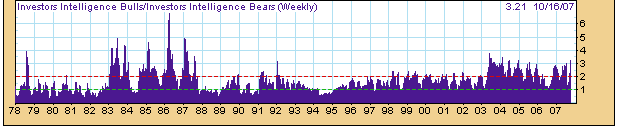

What am i missing here ? The bullishness between 83 and 86 was way higher than what it is today and yet it was a great bull market. Someone who had shorted then based on this survey would have lost their shirt. Today's numbers pales in comparison with that era.

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter