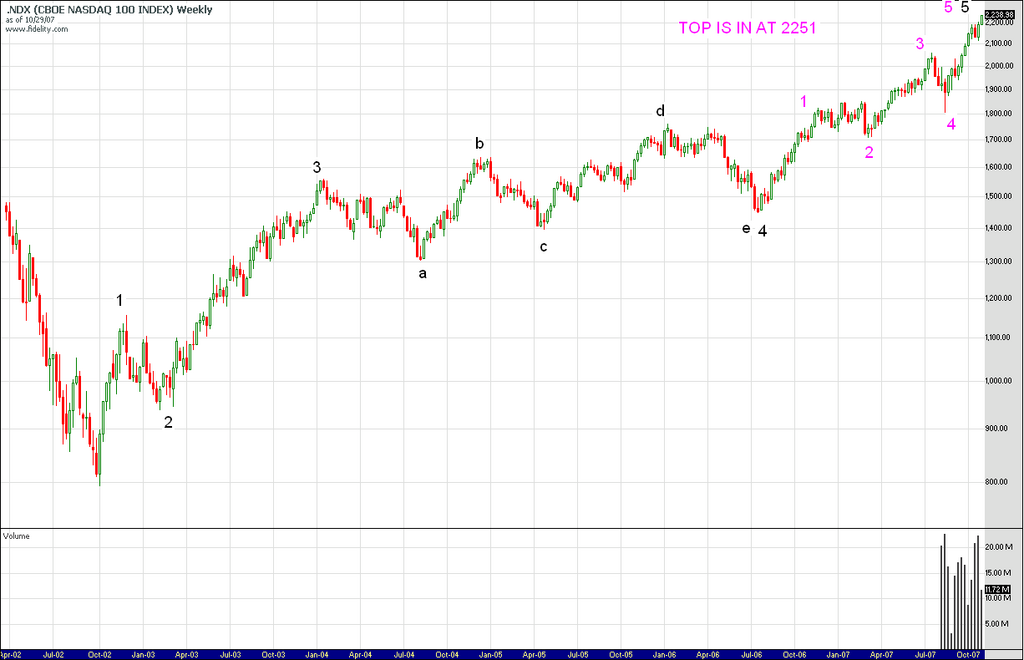

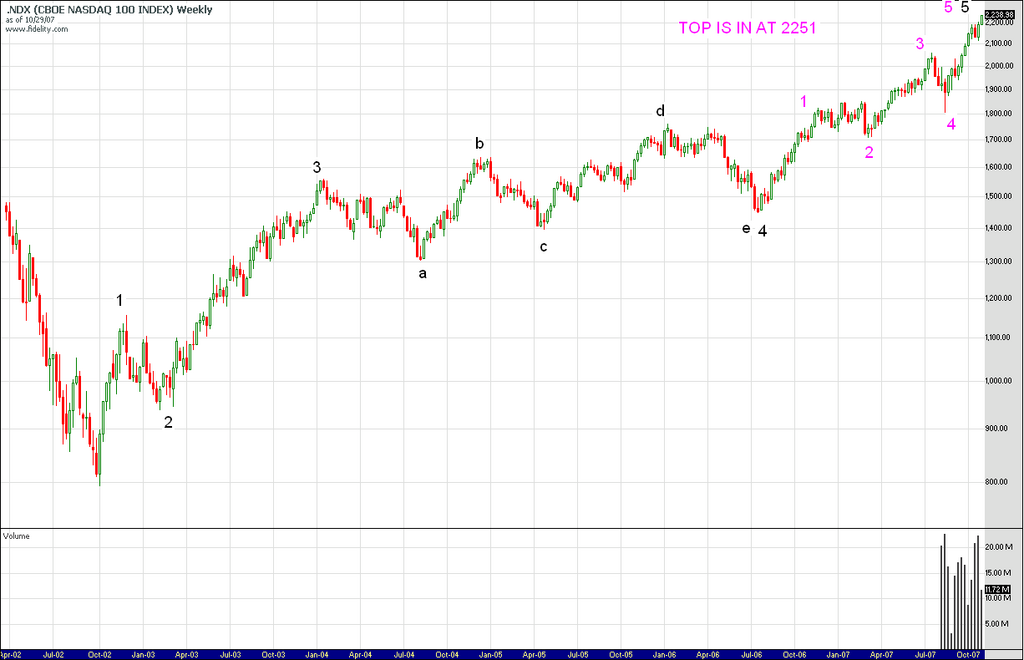

I can't make a useless top call without showing some EW crap... so..

If you count this way, EW will truly become crap. Look at the wave 3 in pink.

Repeat after me. Wave 3 cannot be the shortest. Wave 3 cannot be the shortest.

And that's not the only problem with the count...

The pink wave 4 bottom overlaps the pink wave 1 top which cannot happen unless you have and ending diagonal , but in ending diagonals the subwaves unfold in 3 wave moves not five wave moves. So strike 2...

Strike three is your running wave 4 triangle from 2004 to 2006. The subwaves in a triangle must all be corrective 3 wave moves, no impulses allowed, and the rally from late Auguts 2004 to January 2005 is clearly impulsive. So strike 3...

Why is it that so many practice e-wave without knowing what any of the rules are?