Edited by dcengr, 02 November 2007 - 11:07 PM.

Posted 02 November 2007 - 11:02 PM

Edited by dcengr, 02 November 2007 - 11:07 PM.

Posted 02 November 2007 - 11:13 PM

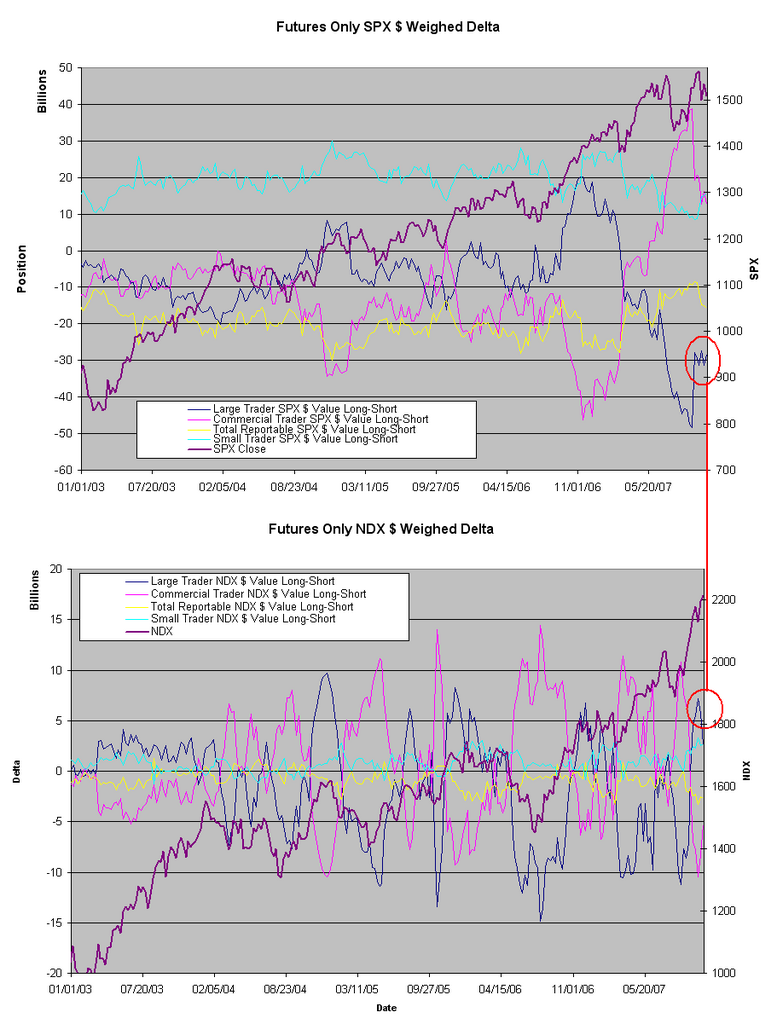

Money has to come from somewhere and go someplace...

Edited by Trend-Signals, 02 November 2007 - 11:13 PM.

Posted 02 November 2007 - 11:26 PM

Posted 02 November 2007 - 11:49 PM

Posted 02 November 2007 - 11:59 PM

Edited by Trend-Signals, 03 November 2007 - 12:01 AM.

Posted 03 November 2007 - 12:09 AM

Posted 03 November 2007 - 12:22 AM

Posted 03 November 2007 - 12:24 AM

Posted 03 November 2007 - 12:26 AM

Posted 03 November 2007 - 01:52 AM