Technical Setup on Thursday compared to March 31

#31

Posted 12 April 2008 - 07:13 PM

~Benjamin Franklin~

#32

Posted 12 April 2008 - 07:24 PM

Accepted. I have no problem with you and I discussing intelligently and with respect, differences of opinion. I enjoy it. It's enlightening and valid as no one, of course, knows the future for sure. It's all about probabilities. As you probably know, I'm not against doing it with fun and wit too. As long as it's not demeaning.My apologies then for offending you.

U.F.O.

Cheers U.F.O.

Edited by milbank, 12 April 2008 - 07:27 PM.

"The power of accurate observation is commonly called cynicism by those who have not got it."

--George Bernard Shaw

"None are so hopelessly enslaved as those who falsely believe they are free."

--Johann Wolfgang von Goethe

#33

Posted 12 April 2008 - 07:24 PM

As I posted on Denleo's thread Thursday-trin and internals did not show a favorable situation going into Friday. My technical work told me to go short , as apparantly Denleo's told him-and I went short qqqq Thursday(via puts). Covered Fridays close.

thats is such BS the trin and internals on the mclellan were the same as the march 20th trading day and the march 31st trading day

show me how they were different!!!

The internals on the QQQQ's was vastly different Thursday, than on March 20th or 30th. both summation, and otherwise-the BS, I feel-was your interpretation of it.

#34

Posted 12 April 2008 - 07:49 PM

~Benjamin Franklin~

#35

Posted 12 April 2008 - 09:20 PM

As I posted on Denleo's thread Thursday-trin and internals did not show a favorable situation going into Friday. My technical work told me to go short , as apparantly Denleo's told him-and I went short qqqq Thursday(via puts). Covered Fridays close.

thats is such BS the trin and internals on the mclellan were the same as the march 20th trading day and the march 31st trading day

show me how they were different!!!

The internals on the QQQQ's was vastly different Thursday, than on March 20th or 30th. both summation, and otherwise-the BS, I feel-was your interpretation of it.

the internals on the nyse, comp spx were as good on april 10th as on march 20 and march 31st

the internals as indicated by the mclellan...the only index showing a divergence was the ndx which is the most narrow of the four indexes

what are you talking about???

your justifying staying in the hand with a 7- 3 offsuite..you won the hand against pocket aces

one card in the deck to save you and you caught it

#36

Posted 12 April 2008 - 11:50 PM

#37

Posted 12 April 2008 - 11:57 PM

Did you see even a single post calling for a big gap-down on Friday ? I didn't. The only trade with conviction i saw was from Denleo. If Denleo says he saw it coming, i will agree with him .The rest is all post-mortem analysis. I don't expect anyone on this board to post their real-time trades. But it helps if they show their technical setups before the event occurs, so that we all can benefit.

Nope, not a single post on a big gap down..

Gap down?

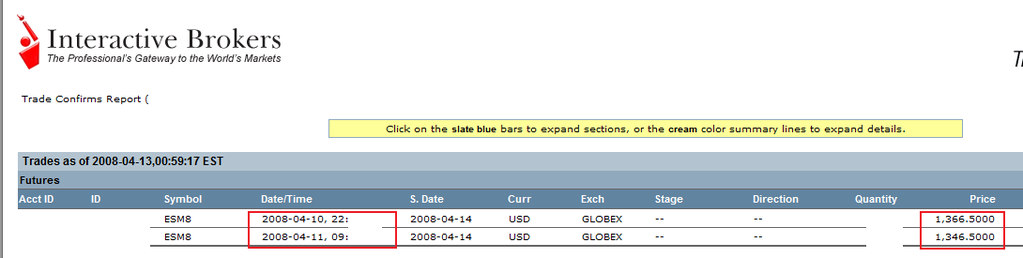

Guess obligatory evidence of my "paper" trade..

Edited by dcengr, 13 April 2008 - 12:03 AM.

#38

Posted 13 April 2008 - 12:41 AM

http://www.traders-t...showtopic=87037

http://www.traders-t...showtopic=87134

Now, I was not necessarily expecting a gap down. What I was expecting was a decline. We broke the hourly trendline, rallied back to resistance and a backkiss to the broken line. That's a different technical situation than March 31.

That said, I made a post a couple of weeks ago regarding the upcoming earnings period. In that post I said that earning were bound to disappoint. That the commentary in conference calls should disappoint. So while I didn't specifically mention GE, I don't think it should be much of a surprise in general to expect a dissapointing earnings period.

GE's action was telling. From some of the bull posts what I hear is that the market has anticipated the coming recession. If that was the case, then why did GE gap down like it did? It's because it has not anticipated. The coming fundamental news is not reflected in stocks. You had the proof Friday.

Likewise, I'm not sure why anyone thinks the trend is up. What we have is a potential double bottom, with a market that broke out, then failed back under the breakout point. That my friends, is not an up market.

Again, the hourly charts told you all you needed to know Wednesday.

Finally, I would go on to say that despite the fact that we mostly post about technicals here, doesn't imply that fundamentals aren't important, perhaps more important. If you feel that your technicals let you down on Friday, perhaps you should look closer at the possible fundamentals in connection with the technicals. In a bull market the market would have taken the GE news, gapped lower, then rallied.

IT

Edited by IndexTrader, 13 April 2008 - 12:43 AM.

#39

Posted 13 April 2008 - 06:39 AM

..

sure i agree fundamentals affect the market

but imo they have a secondary effect on the market, with technicals being the key

technicals reflect the bets folks are placing on fundamentals (i.e. their estimates/predicitons of fundamentals..ahead of the news)

so the technicals are ahead in that sense imo..but technicals can not AFFECT the market..they reflect the bets and the setup..

a stock does not fall because its stochastics are overbought..it is just a range indicator and if programs and folks follow (which they do), the stock could turn from that 'overbought' status (nothing to do with actually being overbought..just a way of calling/naming it so)

no fundamental Newtons laws here..all created stuff

Edited by n83, 13 April 2008 - 06:42 AM.

#40

Posted 13 April 2008 - 04:36 PM

Edited by thespookyone, 13 April 2008 - 04:42 PM.