JNUG has a pretty good hourly gap to fill from 4.50 and 5. Oct 30 to Oct 31st.

Can she make it?

Fun in The Cheap Seats!

#21

Posted 14 November 2014 - 03:46 PM

#22

Posted 14 November 2014 - 03:57 PM

this may turn into a retirement trade.

it only takes one ya know.

JNUG has a pretty good hourly gap to fill from 4.50 and 5. Oct 30 to Oct 31st.

Can she make it?

Edited by Mr Dev, 14 November 2014 - 03:59 PM.

.. .. ..

Mr Dev

......trading is basically a simple operation, but you have to be a genius to understand the simplicity.

.....timing,..... is ....everything !

... remember no guessing visit MrDev!

#23

Posted 14 November 2014 - 04:10 PM

thank u mr dev u reaffirm my trades , thxs im holding jnug @3.89 nbunch of share s wanna hold till the 10 areaim looking well ABOVE that one. . Xau did Kiss 71 today for a HOD.

this may turn into a retirement trade.

it only takes one ya know.

JNUG has a pretty good hourly gap to fill from 4.50 and 5. Oct 30 to Oct 31st.

Can she make it?

#24

Posted 14 November 2014 - 04:39 PM

Edited by fib_1618, 14 November 2014 - 04:42 PM.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#25

Posted 14 November 2014 - 04:40 PM

The bears missed that one too. They were all in the burn unit.

Trade what's there.

Edited by Rogerdodger, 14 November 2014 - 04:43 PM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#26

Posted 14 November 2014 - 05:56 PM

now there's another laughable opinion ...which is very far from any scientific or technical analysis .

we did nothing here but talk our way into more gains on the day. !

non the less we can get rich on bear market rallies. . just as easy and maybe faster than ..buy and hold.

this reminds me of the Kid who pranks by yelling fire at the BACK DOOR of a the theater ... and then RUNS.

im starting to wonder if you're just short and maybe in denial ?

i wish you could make a call and start a thread of your own some day..instead of lurking around the fringes.

GET IN THE CAGE MATCH if you can !

For those still here in the cheap seats:

This is one of those excitable threads that is part and parcel towards the end of a bear market rally when the commodity itself is only snapping back to what was previous support.

Mission accomplished on both fronts it would seem...minimal downside target for gold is still at $1100...maximum at around $985.

Fib

Edited by Mr Dev, 14 November 2014 - 06:02 PM.

.. .. ..

Mr Dev

......trading is basically a simple operation, but you have to be a genius to understand the simplicity.

.....timing,..... is ....everything !

... remember no guessing visit MrDev!

#27

Posted 14 November 2014 - 06:12 PM

Hmmm...I also guess I'm off Mr. Dev probation now.

Hopefully you took your profits for, as you should know, any kind of double digit gains in these 3X funds, usually sees an equal and opposite effect the next trading day.

If not...good luck...maybe this time it will be different.

Fib

********************

now there's another laughable opinion ...which is very far from any scientific or technical analysis .

we did nothing here but talk our way into more gains on the day. !

non the less we can get rich on bear market rallies. . just as easy and maybe faster than ..buy and hold.

this reminds me of the Kid who pranks by yelling fire at the BACK DOOR of a the theater ... and then RUNS.

im starting to wonder if you're just short and maybe in denial ?

i wish you could make a call and start a thread of your own some day..instead of lurking around the fringes.

GET IN THE CAGE MATCH if you can !

For those still here in the cheap seats:

This is one of those excitable threads that is part and parcel towards the end of a bear market rally when the commodity itself is only snapping back to what was previous support.

Mission accomplished on both fronts it would seem...minimal downside target for gold is still at $1100...maximum at around $985.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#28

Posted 14 November 2014 - 07:34 PM

Big gap downs above previous lows are often bought, especially with these trading vehicles.what was your buy signal based on there RD?

I watched the first two 5 minute candles and bought when price broke above their tops, with their lows as a stop.

This guy has a pretty good s/t setup using RENKO and MAs, although RENKOS can be confusing if you are used to candles.

Tom's Charts

http://stockcharts.c...047917&r=36.png

#29

Posted 15 November 2014 - 09:10 AM

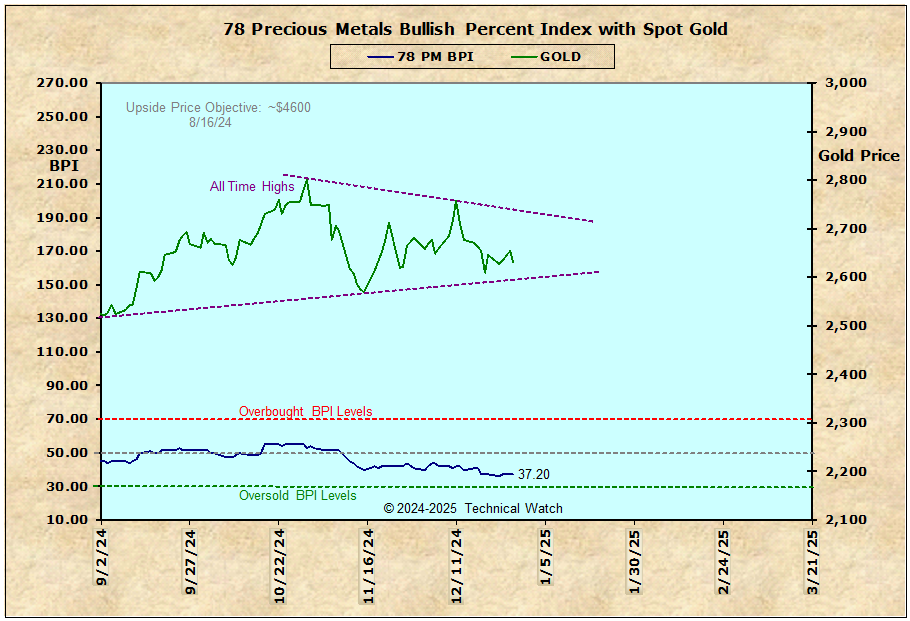

Through Friday's close with the Bullish Percent Index as a compliment.This is one of those excitable threads that is part and parcel towards the end of a bear market rally when the commodity itself is only snapping back to what was previous support.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#30

Posted 15 November 2014 - 10:29 AM

Survey Participants Look For Softer Gold Prices Next Week

"Market participants include bullion dealers, investment banks, futures traders and technical chart analysts."

Of course if they are wrong, they will be scrambling.

Dollar needs to drop for US priced gold to do much. osistm

It may be trying to drop with MACD curling and RSI divergence.

http://stockcharts.com/c-sc/sc?s=$USD&p=D&b=5&g=0&i=p35939551729&r=1416065732063.png

Import and Export Prices

I saw regular unleaded gas nearing $2.60 last night.Minus signs sweep October's import & export price report including a very steep 1.3 percent monthly decline for import prices. This is the fourth straight monthly decline for import prices and the steepest in nearly 2-1/2 years. Oil is the central factor with petroleum import prices down 6.9 percent in the month. But even when excluding petroleum, import prices are down with October, September and August all at minus 0.1 percent. Year-on-year, total import prices are down a very sizable 1.8 percent.

The negative pressure is beginning to move into prices of finished goods which, after having been flat all year, are now inching into the negative column.

If "They" control the markets they may want both oil and gold to drop even more, since that's Russia's biggest store of wealth.

Russian central bank buys up domestic gold output as sanctions bite

Russia has stepped up its gold buying significantly this year, data from the World Gold Council showed, adding nearly 115 tonnes of gold to its reserves in the year to date, against 77.5 tonnes in the whole of 2013 and 75 tonnes in 2012.

The Russian central bank has been the most active official sector gold buyer over the last decade. Its holdings have nearly tripled since the end of 2004 to 1,149.8 tonnes, making it the world's sixth largest gold holder among central banks.

Edited by Rogerdodger, 15 November 2014 - 10:53 AM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.