Bearish capitulation

#21

Posted 11 January 2010 - 02:40 PM

#22

Posted 11 January 2010 - 02:42 PM

If the MCSUM does turn down, it may mean something - or - it may give us another resting period from an overextended situation.IF NYSI turns down from here at the resistance zone

As I've shared with the board in the past, when the MCSUM is as high as it is, even if it does turn lower, prices can still move to higher highs in spite of these breadth plurality contraction periods. The market breaths in...the market breaths out. It is a living organism just as anything else that is "stimulated" by an outside source (volume is the heart of the animal). Because of this, we will likely see another trading range of sorts develop when the MCSUM does finally go to work in trying to bring back some parity between buyers and sellers (the zero line demarcation point). I just wouldn't get too excited in the prospects of something more dramatic happening once this turn does occur. Just like in the September/October period, it's not likely to occur the way many think it will.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#23

Posted 11 January 2010 - 02:48 PM

#24

Posted 11 January 2010 - 02:57 PM

If the MCSUM does turn down, it may mean something - or - it may give us another resting period from an overextended situation.IF NYSI turns down from here at the resistance zone

As I've shared with the board in the past, when the MCSUM is as high as it is, even if it does turn lower, prices can still move to higher highs in spite of these breadth plurality contraction periods.

Fib there is NYSI divergence if we turn down from here, this is a major signal right where the volume came the last time around October, do not ignore...

The prices WILL turn sharply lower, and they better do that for a bull market correction... If we first drift a bit higher, then drip, drip lower with this kind of bullish speculation, the end of such a move will not come before a water fall...

Edit: BTW, this 20 points rally above Dec highs was the drift higher in my opinion, although we may see higher highs too, it will get only more fragile if this NYMO configuration persists...

Edited by arbman, 11 January 2010 - 02:59 PM.

#25

Posted 11 January 2010 - 03:01 PM

Yes, there was a divergent structure in place.Fib, just for the record, where was the A/D line at the SPX 1576 high? Had it gone divergent?

Additionally, there hasn't been a time since 1926 when there's been an important top in prices without a divergent NYSE A/D line.

Two charts below from the 1/8/2008 updates...first the raw numbers, and then the common stocks only.

Fib

Edited by fib_1618, 11 January 2010 - 03:02 PM.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#26

Posted 11 January 2010 - 03:13 PM

When the MCSUM moves above the +500 level, and especially above the +750 level, a sharp price correction with follow through is not likely to happen. What you will likely see is a lot of choppiness in prices take place, which can cover a wide spread, but there's no way for a trend in the opposite direction to occur until the MCSUM get closer to, and preferably through, its zero line.Fib there is NYSI divergence if we turn down from here, this is a major signal right where the volume came the last time around October, do not ignore...

The prices WILL turn sharply lower, and they better do that for a bull market correction... If we first drift a bit higher, then drip, drip lower with this kind of bullish speculation, the end of such a move will not come before a water fall...

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#28

Posted 11 January 2010 - 03:43 PM

Very astute statement.A lot of traders are committing to a position, lets say short, THEN, they are hunting for evidence, any evidence technical or fundamental, this is desperation, then comes moving stops, increasing exposure, adding to a loosing position.

I have several signatures that compliment this observation. In this case, I'll choose this one:

"What we see depends mainly on what we look for"

Right now, the trend of least resistance remains higher. Because of this, we should only be looking for evidence of an impending turn from this same direction. Until the predominance of the evidence is high enough to force you to look for this change, everything else is just a distraction, or as aptly put in the statement, an act of desperation to compliment a predetermined bias.

No finger pointing implied or suggested....just being philosophical.

Fib

I agree that traders are getting restless, and are assuming it has to come down. Very tricky ongoing trend for some, yet maybe easy for others. The summation is rolling, so big down not as likely for now.

#29

Posted 11 January 2010 - 03:47 PM

#30

Posted 11 January 2010 - 04:05 PM

Huh?The cumulative A/D was not divergent, as it is now, but its momentum is, as it is now...

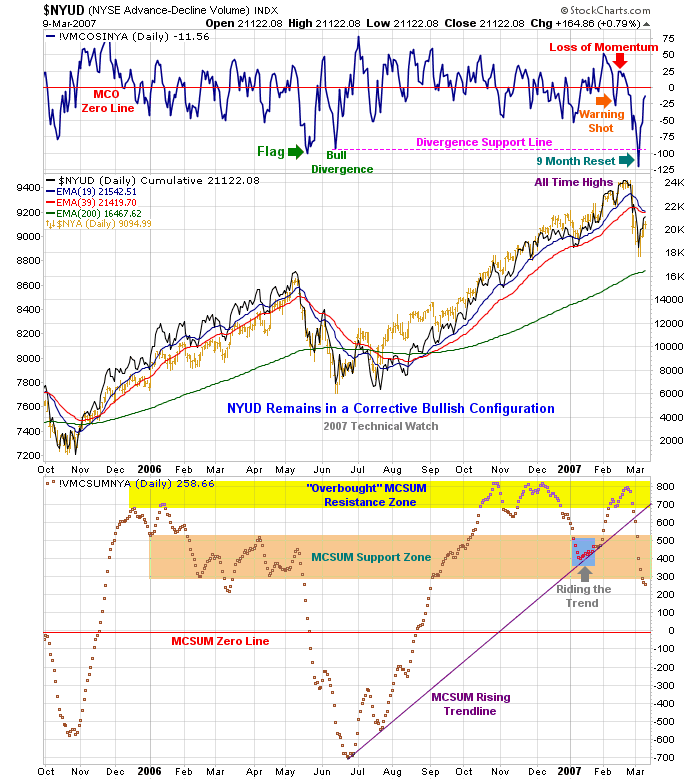

NYSI was above 900 when Feb 2007 decline happened...

Structurally, the similarities are slight between now and February 2007 period. The only thing that will "go out of bounds" of what the MCSUM currently forecasts is for something similar to the one day 9% decline that the Shanghai Index took that rippled through the world markets back in 2/07. Could be the Greece situation, but Greece is certainly not China as far as a force to be reckon with, so you'll have to hope for something more concerning.

Fib

Chart from 3/9/07.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions