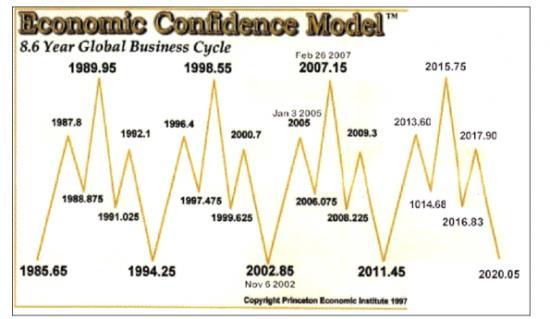

Thanks Russ. Yes, I found the ignore button..LOL! And because I got quite a few emails to post I decided to consider the source...and realize the majority here enjoy intellligent discussions and know how to approach people in a civil way. Thanks for your input and Happy New Year.Hi Irene, Remember your friends and ignore the guy that seems to be detested here, his argument that Gold's chart is parabolic may come true eventually but not yet, remember to equal 1980's high adjusted for inflation gold has to be well over $2000. I do have some longer term projections for a big low in the gold stocks in 2014 though, but the final high for gold should be in 2016 from my work and Armstrong changed his mind from his 2017 date to my date now too.

I thought you would be interested that the Amanita timing service is long gold as of Dec. 21 for a variety of escoteric (New World Order codes), cycles and astrological reasons, the author Manfred Zimmel is looking to stay long until late March. Gold is closing well above Martin Armstrong's bearish reversal number of 1570 for year end.

Russ

Irene