Posted 17 January 2013 - 01:20 PM

Posted 17 January 2013 - 01:29 PM

Edited by arbman, 17 January 2013 - 01:33 PM.

Posted 17 January 2013 - 01:29 PM

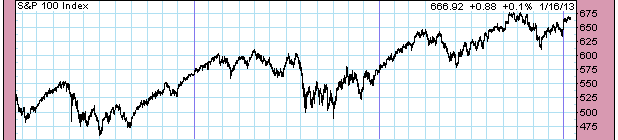

... we had one of the largest economic misses today and the injections absorbed it. ...

Posted 17 January 2013 - 01:40 PM

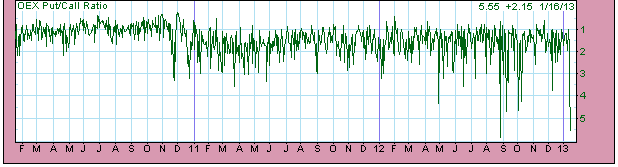

Yes D, OEX guys did go nuts, but market is on steroids for now.

So what did Fed say? Printing until employment improves. That's like saying we will print forever!

New Govt Office To Advise Small Firms On Consumption Tax

January 16 (Nikkei) — The government plans to set up a new office to provide advice to small businesses that wish to transfer consumption tax increases to the prices of their products and services, prior to the introduction of the 8% tax rate in April 2014, The Nikkei has learned.

Subcontractors are becoming concerned that they may be pressured into not passing tax increases over to their product and service prices, as many of them do not have the advantage in price negotiations.

The new office will address such concerns by helping firms to avoid taking on excessive costs. It will accept inquiries and complaints from throughout Japan by telephone and e-mail.

The Japan Fair Trade Commission will work closely with relevant ministries to inspect companies that are suspected of having rejected requests for price increases from their suppliers. The government also plans to come up with new legislation to impose strict controls on such companies.

Edited by salsabob, 17 January 2013 - 01:41 PM.

Posted 17 January 2013 - 01:44 PM

Topping process can take weeks and will fool many...

Edited by pdx5, 17 January 2013 - 01:54 PM.

Posted 17 January 2013 - 01:49 PM

Yes D, OEX guys did go nuts, but market is on steroids for now.

So what did Fed say? Printing until employment improves. That's like saying we will print forever!

Posted 17 January 2013 - 02:09 PM

DamnDamnDamn --Then I'm going to change this up...see you in April.We know this.. when market is going up Fib is bullish. When market is topping Fib is hyperactive , when market declines Fib is nowhere to be seen

Fib

I see the trolls have run Fib off again just as the NYMO appears to be turning up again and broad indexes, like the SPX and RUT, are breaking to new highs as he's been suggesting all along, and even the Naz Comp is trying to come up out of its bull flag (despite the AAPL contagion), and just at the moment I'm wanting a real expert's opinion (trolls, by that I mean Fib's) on whether or not that's a true inverse head-and-shoulders in the SPX measuring to north of 1600 or not.

There is difference between a bearish opinion and a foolish opinion but obviously there are fools here who do not have the slightest idea there is such a the difference.

Posted 17 January 2013 - 02:42 PM

Yes D, OEX guys did go nuts, but market is on steroids for now.

So what did Fed say? Printing until employment improves. That's like saying we will print forever!

If printing was the answer why has Japan's stock market not recovered after decades of trying?

Jobs can improve best when the private business end is stimulated. Printing money (stimulation from top end) won't do it as has been proved in other countries. Enema works best when administered from the correct end.

Posted 17 January 2013 - 03:25 PM

Yes D, OEX guys did go nuts, but market is on steroids for now.

So what did Fed say? Printing until employment improves. That's like saying we will print forever!

If printing was the answer why has Japan's stock market not recovered after decades of trying?

Jobs can improve best when the private business end is stimulated. Printing money (stimulation from top end) won't do it as has been proved in other countries. Enema works best when administered from the correct end.

Yes, tell this to Bernanke.

Posted 17 January 2013 - 04:48 PM

Then I'm going to change this up...see you in April.We know this.. when market is going up Fib is bullish. When market is topping Fib is hyperactive , when market declines Fib is nowhere to be seen

Fib

Edited by ogm, 17 January 2013 - 04:49 PM.