This is a bit of a detailed update to one of my specialty charts that filters bull market conditions from bear market conditions...

In my SPX forecast made on 4.9.16 (more about this below), I called for the SPX to remain in a bull market through 2021, so was a bit surprised with the heavier weakness in US equities in November and December of 2018...

Of all the economies in the world, the US economy is one of the strongest and most resilient, so rather than denying what was happening for all the world to see, I had to dig deeper for understanding...

- I absolutely was expecting Europe to move into economic recession, and the same was true for Asia (and still is for both economies)...

- The +25-year bear market in the US dollar had ended years ago, and a new bear market in bonds was just beginning (both still true)...

- The bear market in gold had not yet completed and while oil was in a corrective state, its long-term bull market still had an appointment with new ATHs (both still true)... so the relative weakness in US equities was not making any sense until the incredible market breadth and rally in the early weeks of 2019 helped present the new narrative for US equities...

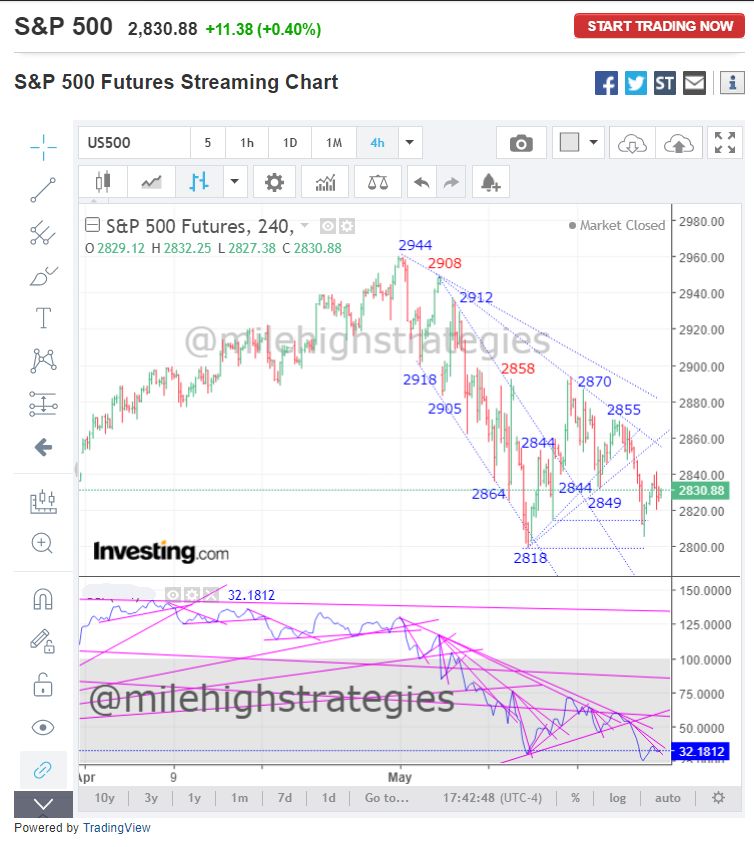

All those other factors remained true, AND the momentum indicator line on the SPX quickly moved back within the gray bubble zone - so the bull market in US equities was still in tact, though a reset in momentum was needed to EXTEND the time frame for this great bull market in the US equity markets beyond 2021...

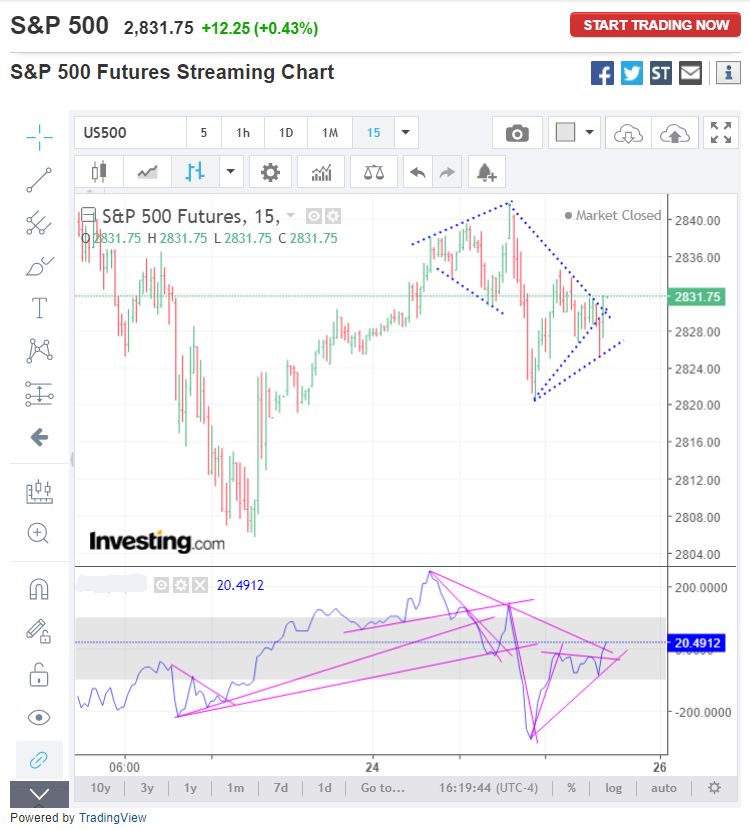

Long introduction, I know, but context is needed from time to time... this week the momentum indicator line has extended its push upward past the confluence of the TLs (chart above), and its next higher target remains the long-term DTL... watching.

CONTEXT - I mentioned a few things in my earlier post today (combining two posts here) that probably should also be put into context...

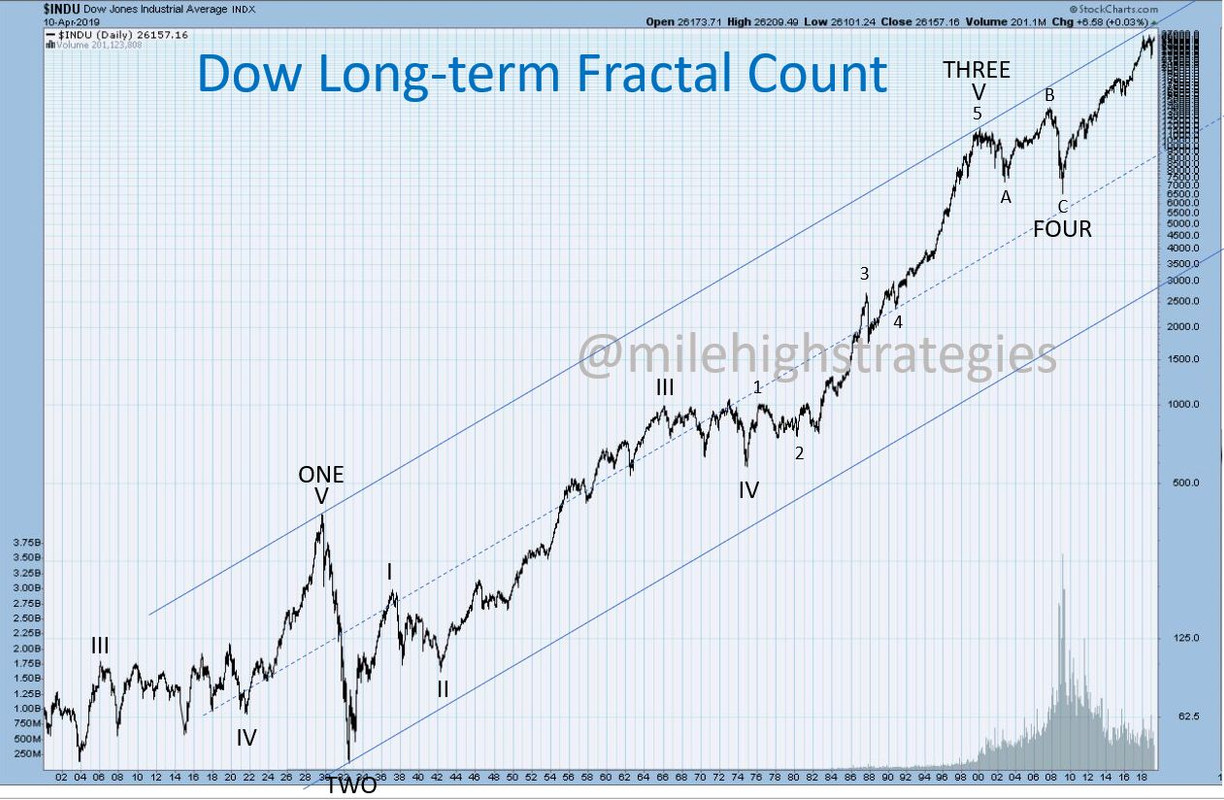

First, my forecast from 4.9.16 - the first chart is the very exact chart from nearly three years ago wherein I forecast that the SPX would move upward from the ~2000 range (2047.60) to the ~3600 range in this final installment of the US equity markets' bull market cycle...

I absolutely nailed the wave-(iii) high of January 2018, to within 3.5-points of the actual high!!! I next called for a wave-(iv) completion at ~2696...

What actually happened, I covered in my earlier post (above) - rather than the SPX stopping at my target of ~2700, it proceeded down to the 14.6 Fibonacci level at the ~2350 range in Wave-(w):(iv), in what has morphed into a double zig-zag corrective fractal...

The second chart (below) provides the adjustment I've made to the forecast in light of the US equity markets electing to to extend beyond the 2021 time frame...

Despite the helluva rally we've seen in the US equity markets since the December 2018 lows, the fractal is NOT impulsive, but corrective (three wave fractals), with wave-(x):(iv) still in work, with a target up at the 78.6 Fibonacci level - ~3290 range...

Once complete, then wave-(y):(iv) will come back to my original ~2696 wave-(iv) completion target to complete a nearly 3-year larger corrective fractal structure, and then the SPX will rally upward nearly 100% into the 2028-2032 time frame to the ~5100 range...

There's a lot happening between now and then, but at least this provides some measure of context to my longer-term forecasting... watching.

Edited by tsharp, 06 April 2019 - 01:45 PM.