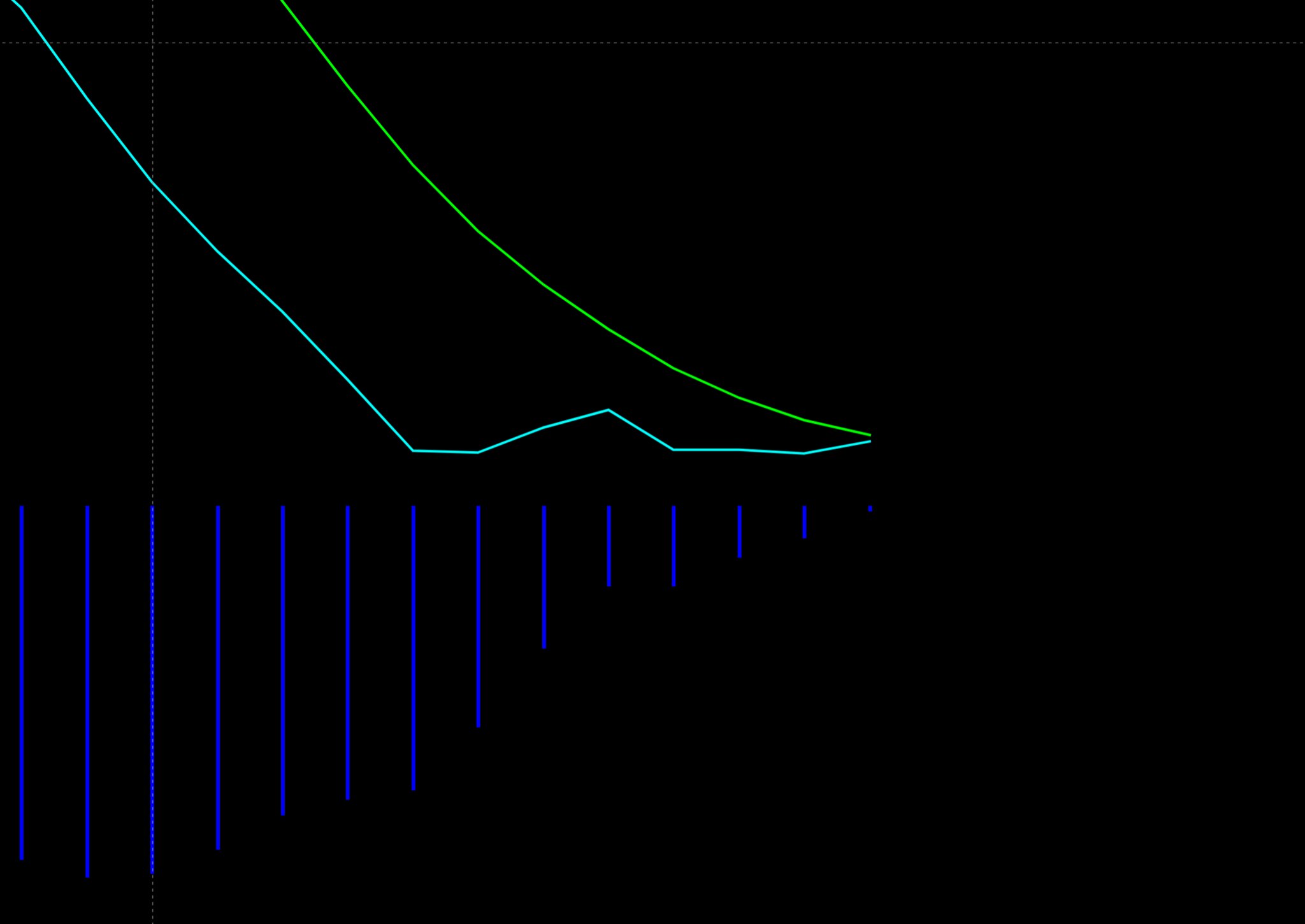

Twiggy on Friday: A weak Dollar is bullish for Gold. Spot gold is consolidating below resistance at $1300/ounce. Rising Twiggs Trend Index signals buying pressure. Upward breakout above $1300 is likely and would signal another primary advance, with a target of $1400*. Reversal below $1250 is unlikely but would warn of another test of primary support at $1200.

what now?

#351

Posted 26 August 2017 - 09:32 AM

#352

Posted 26 August 2017 - 12:06 PM

The gold COT is interesting this week.

1) the small specs are not bullish, which is bullish

2) hedge fund buying has gotten carried away and the commercials are happily selling to them, and have sold too much too fast. Each time the comms have sold heavily into a gold rally gold has buckled under the selling and headed south. We are at that level again. If gold can break the upside (and the 8 hr squeezed BB tell us any move will be dramatic) then a serious upleg is under way. If we get a sharp drop it's business as usual and the commercials are in control.

3) there is a precedent for the commies getting it wrong. In Aug 28th of 2009 (exactly 8 years ago) gold was in a comparable coiling pattern and they shorted it. Gold broke to the upside and they continued selling into it for the next 4 weeks. Gold kept rising and they then panicked and bought back their positions, the buying driving gold even higher. That was the run to $1,923 in Sept 2011.

At the risk of stating the obvious, $1300 is the make-or-break.

#353

Posted 26 August 2017 - 05:09 PM

The gold COT is interesting this week.

1) the small specs are not bullish, which is bullish

2) hedge fund buying has gotten carried away and the commercials are happily selling to them, and have sold too much too fast. Each time the comms have sold heavily into a gold rally gold has buckled under the selling and headed south. We are at that level again. If gold can break the upside (and the 8 hr squeezed BB tell us any move will be dramatic) then a serious upleg is under way. If we get a sharp drop it's business as usual and the commercials are in control.

3) there is a precedent for the commies getting it wrong. In Aug 28th of 2009 (exactly 8 years ago) gold was in a comparable coiling pattern and they shorted it. Gold broke to the upside and they continued selling into it for the next 4 weeks. Gold kept rising and they then panicked and bought back their positions, the buying driving gold even higher. That was the run to $1,923 in Sept 2011.

At the risk of stating the obvious, $1300 is the make-or-break.

maybe, would not be surprised to see a couple week decline but of 2-3% in gold but who knows

Senor

#354

Posted 27 August 2017 - 10:01 AM

At the close on Friday the last time the spot gold 8 hour Bollie Bands were this pinched was the low last December at 1123.

Which way gonna break? Stand back!

the same thing occurred in dec 15 which kicked off the big gold rally.

when bb pinch, like they are now, it indicates a big move is going to occur. of course it doesnt indicate direction.

what is interesting to me is the commercials have put on an outsized short position. this is happening as diwali buying is going to take place. now maybe the indian govt is going to introduce some plan to curtail diwali buying and the commercials will have little opposition. the govt, in india, like all other govts , is corrupt. its why there is a 10% import tax on gold., they have a spread so the mafia can get theirs. its interesting to me. lets see how it plays out. the commercials are not always right and when they are wrong it is at critical times. of course in 80 when they were wrong , the exchange members were also caught wrong footed, so they just changed the rules , no silver buying allowed

dharma

#355

Posted 27 August 2017 - 12:45 PM

so guys let me get this straight.

we are only 4 days away from the beginning of the next QUARTER

the quarterly macd on gold price is inches from crossing north

the monthly macd on XAU is inches from crossing north after a bullish triple P

and then we are 3 weeks away from the seasonally most bullish time frame for gold price

and then we are 1 month away from the usa possible default on its debt

and having said all of the above you are telling me that the commercials decided to be SHORT at this time ?????? what the helll ???!!!!!

#358

Posted 27 August 2017 - 01:30 PM

nothing should surprise us the the gold market . probably the most rigged corrupt market ever imo

#359

Posted 27 August 2017 - 01:44 PM

so guys let me get this straight.

we are only 4 days away from the beginning of the next QUARTER

the quarterly macd on gold price is inches from crossing north

the monthly macd on XAU is inches from crossing north after a bullish triple P

and then we are 3 weeks away from the seasonally most bullish time frame for gold price

and then we are 1 month away from the usa possible default on its debt

and having said all of the above you are telling me that the commercials decided to be SHORT at this time ?????? what the helll ???!!!!!

We are 1 month from the next quarter....oops

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#360

Posted 27 August 2017 - 03:10 PM

dammit, you are right about that, why am I thinking september is the 4th quarter