this is my thinking exactly, i dont see a bottom , this bounce looks like an a bc i am out of the way and waiting for bottoming action. which i believe will take place soon. its time to be patient. let the bottom play out and see what we have. and i agree w/the large specs heavily on one side of the boat, they will panic short cover. i believe the banksters will be quite long. and yes there has been capitulation. panic selling especially in the miners. which relative to gold are way overdone. and this to me is a mark of bankster buying for the longer term. they spent years naked shorting miners. regulators ha. it seems that there will be a big shift dollarRuss - I have been suggesting caution since June - now that we have seen a capitulation sequence (what I had been waiting for), it's time to hone-in on looking for a bottoming pattern - none to be found yet by-the-way - since the capitulation was most-likely Wave 3 down action of some degree - our small (so-far) counter-trend bounce is most likely a Wave 4 - no confirmation on how many 4-5's are ahead - one or more - and I am cautioning on the Wave 5 itself, when it occurs, could itself be an extended 5 sub- Waves down. So yes I am suggesting more downside - a little more 5% or less - some more 5-15% - or much more 15% plus I would not speculate yet.Are you suggesting more downside?Beware of extended 5th Wave here - would be appropriate for this decline to end that way!not much to say, no one has posted on any thread on this board

waiting for this C wave to complete, another decline to come.

it will happen in bankster time. the large bait are positioned for

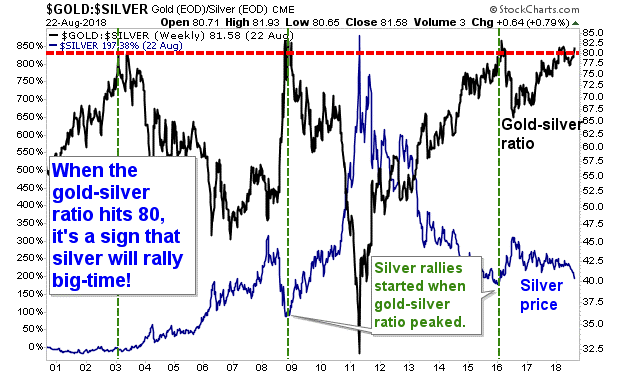

the trap. when its sprung is anyones guess. alot like 16 except the

commercials are net long

dharma

But make no mistake, when this bottom occurs - (probably in the midst of a future broad market decline) - the recovery sequence for the PM space will be breathtaking

topping, stocks topping, crude oil topping. pms and commodities bottoming. sept/oct will be interesting. i sold tsla on the blab from musk about taking it private. now i am waiting to be a buyer

dharma