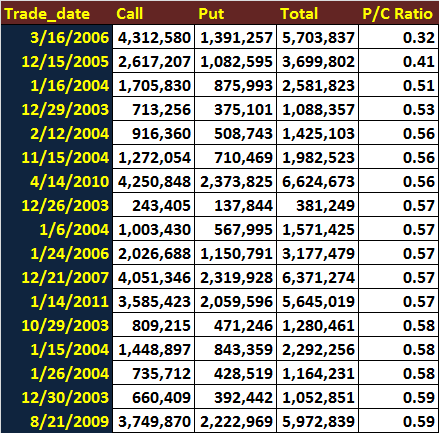

Have not been buying any VXX calls since last week but will do so today if rally persists.

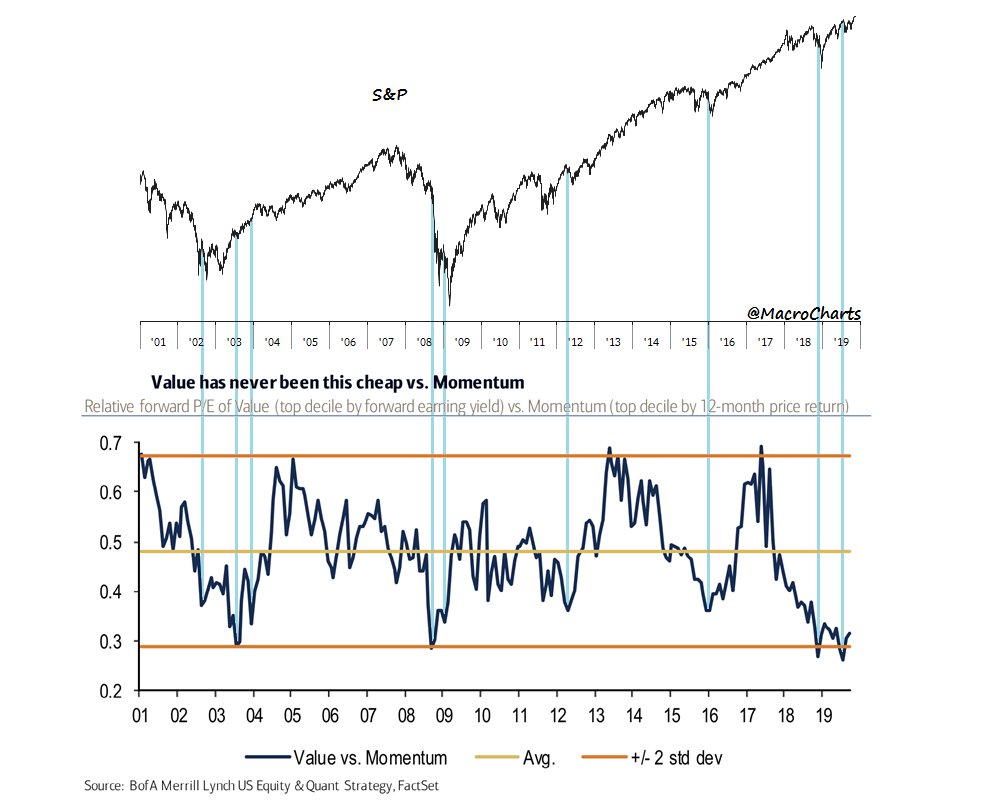

Investors Seek Protection From A Possible SPX Fall - 2020 - VIX futures are higher for Feb 2020 than in July 2019, investors expecting a possible jump in the VIX, and fall in the SPX possibly 1st Qtr in 2020. @LanceRoberts @michaellebowitz @DiMartinoBooth @SoberLook