Euphoria, euphoric rally - China plays the stall card to extract more

#11

Posted 18 November 2019 - 08:52 AM

#12

Posted 18 November 2019 - 08:53 AM

Patience, lack of, is one of my major weakness in trading

Sentiment (updated). Long-term data still in deep pessimism – but short-term DSI for $QQQ $NDX now moving into the >90% range. This year had two pullbacks from slightly higher optimism, which then *took time* to roll over. Getting close but as always, need patience.

#13

Posted 18 November 2019 - 08:54 AM

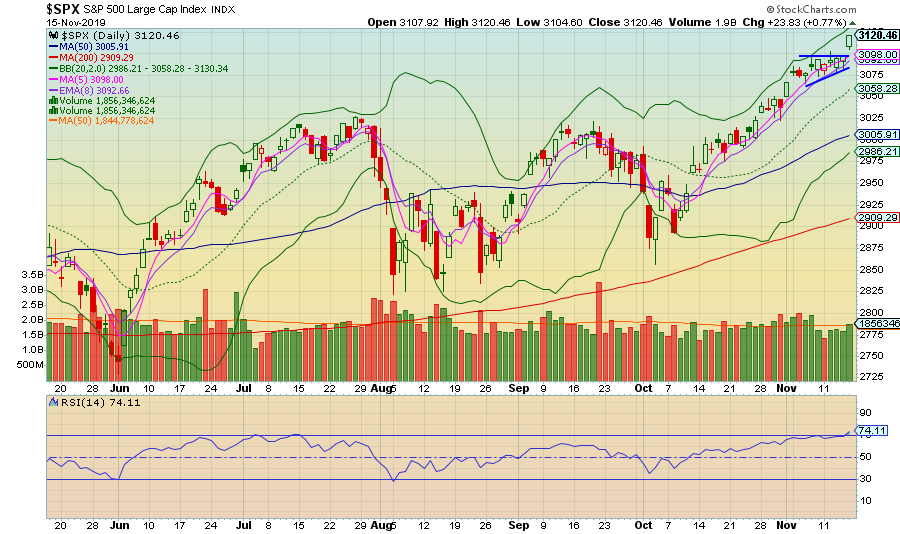

My Core Equity Model is approaching *tactical* overbought – the last time was at the July top. Ideally the market can pull back, perhaps retest the breakout and set up the core rally into next year (but not required). We'll see. $ES_F $SPX $SPY

#14

Posted 18 November 2019 - 08:54 AM

Love it when all the ever lasting bears are now bullish along with everyone else. A small pullback is the most someone can expect ![]() market will never go down anymore in 2020

market will never go down anymore in 2020 ![]()

#15

Posted 18 November 2019 - 08:55 AM

This is a valuation gut check but means nothing for stock market performance for now and thus is more just a perspective on things. The price to sales ratio in the S&P 500 is exactly at the same level as seen in early 2000.

#16

Posted 18 November 2019 - 08:57 AM

ES 3125 - Sell time.

#17

Posted 18 November 2019 - 08:58 AM

$SPX bullish sentiment is at 90% bulls. Recent 90% extreme readings saw a pullback to the 20 day moving average or lower shortly after this reading. 20 day moving average 3057 vs 3118. For more sentiment charts please take a free trial at http://hedgefundtelemetry.com

#18

Posted 18 November 2019 - 08:59 AM

Whether you believe the Fed's actions are "QE," "QE-Lite," or "Not QE at all" is largely irrelevant.

What is relevant is that each time the Fed has engaged in monetary programs, the markets have risen.

Currently, our portfolios are long-biased meaning we have more equity-risk in our allocation than fixed income and cash.

https://seekingalpha...orrection?ifp=0

#19

Posted 18 November 2019 - 09:00 AM

YM 27,950 looks to be the key pivot zone now for the swing move....

Break that, and short term action should turn back down for a bit....

Edited by K Wave, 18 November 2019 - 09:00 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#20

Posted 18 November 2019 - 09:02 AM

Another TOP picker:

The Sirens' Call

The article is longer than most, should not fit in the TL;DR bucket for most investors. I'm not going to reconstruct the article here, but just give some brief points that fit the frame of the article. Here I go:

- Value investors have been sidelined. Growth is winning handily.

- Valuation-sensitive investors are raising cash. Buffett sitting on $130 billion is quite statement. He's not alone. More on that below.

- Momentum is working.

- There has been a decline in IPO quality.

- Lots of money is getting attracted to private equity.

- Corporate leverage is high, and covenants are weak.

- Non-GAAP accounting gets more attention than it deserves.

- Defined benefit plans are net sellers of stock, but not for the reasons I posit in my article - they are doing it to move to private equity and alternatives, and bonds as a part of liability-driven investing.

Cutting against my thesis:

- More companies are committing to paying dividends, and growing them. I'm impressed with the degree that corporations are thinking through their use of free cash flow, even as they lever up.

- Actual volatility isn't that high.

- The Fed is supportive.

On net, these conditions give some confirmation to what my quantitative model is saying… the market is near a top. Could it go higher still? You bet, with an emphasis on the word "bet." The S&P 500 at 4,500 would be where valuations were during the dot-com bubble.

Asset-Liability Management and Market TopsI want to emphasize one point, and then I am done. I wrote another article called Look to the Liabilities to Understand the Assets. There are a few more like it at this blog.

The main idea as applied to the present is this: when you have "strong hands" (those with long time horizons and strong balance sheets) raising cash levels and those with "weak hands" (those with shorter time horizons and weaker balance sheets) staying highly invested in risk assets, it is a situation that is unstable. Those that have capability to "buy and hold" are sitting on their hands, whereas those who have to get returns or they will suffer (typically municipal defined benefit plans and older retail investor who didn't save enough) are risking a great deal, and have little additional buying power.

This is unstable. This situation typically exists at market tops. Remember, it is what investors DO that is the consensus, not what they SAY.

With that, consider your risk positions, and if you think you should act, do so. If you are uncertain, you could ask an intelligent friend or do half.

https://seekingalpha...rens-call?ifp=0