Copper and all metals are in a rally mode, I guess Fed will need to raise interest rates because economy is booming? FCX is up 3.83%?

wave 3

#182

Posted 11 December 2019 - 12:13 PM

the fed will not raise rates, but whatever powell says or does will gold get kicked down the stairs????? he is already doing qe though he says he is not . the repo market is saying there is a lack of liquidity so he is debasing the currency no matter what he calls it. i have been accumulating 2 miners if there is interest i will talk about it. they are optionality plays ie they need higher gold prices to launch . i am a long term bull so i plan to wait , until 1550 is taken out they will be dead money

this chart from thompson says it all https://gracelandupd...0hiroshima1.png

quite the base.

fed has to keep things propped up . its a game of con-fidence once that is gone dollar will seek intrinsic value.watching db no clues but they cant be in good shape! so we wait till the wizard behind the curtain speaks. my account keeps creeping towards its sept highs.just a stones throw as of yesterday. so miners are being bought./accumulated

dharma

i keep this handy to remind me https://pbs.twimg.co...=png&name=small

volcker in 2006 “A great mantra of central bankers these days is ‘inflation targeting.’ I don’t understand that nomenclature. I didn’t think central bankers were in the business of targeting inflation. I thought we were supposed to be targeting stability. We all say we are in favor of stability. You hear these speeches, Bernanke saying, ‘We are in favor of stability. That is why we target inflation.’ There is a certain semantic problem for me in that connection.”

#183

Posted 11 December 2019 - 12:14 PM

I'm certainly interested in any input on mining plays and all your comments. Thanks!

#184

Posted 11 December 2019 - 12:22 PM

the fed will not raise rates, but whatever powell says or does will gold get kicked down the stairs????? he is already doing qe though he says he is not . the repo market is saying there is a lack of liquidity so he is debasing the currency no matter what he calls it. i have been accumulating 2 miners if there is interest i will talk about it. they are optionality plays ie they need higher gold prices to launch . i am a long term bull so i plan to wait , until 1550 is taken out they will be dead money

this chart from thompson says it all https://gracelandupd...0hiroshima1.png

quite the base.

fed has to keep things propped up . its a game of con-fidence once that is gone dollar will seek intrinsic value.watching db no clues but they cant be in good shape! so we wait till the wizard behind the curtain speaks. my account keeps creeping towards its sept highs.just a stones throw as of yesterday. so miners are being bought./accumulated

dharma

i keep this handy to remind me https://pbs.twimg.co...=png&name=small

volcker in 2006 “A great mantra of central bankers these days is ‘inflation targeting.’ I don’t understand that nomenclature. I didn’t think central bankers were in the business of targeting inflation. I thought we were supposed to be targeting stability. We all say we are in favor of stability. You hear these speeches, Bernanke saying, ‘We are in favor of stability. That is why we target inflation.’ There is a certain semantic problem for me in that connection.”

I was being sarcastic, the economy is not going to boom in 2020. Please feel free to discuss any miners that you wish, I think there are many that would be interested.

#185

Posted 11 December 2019 - 12:34 PM

Waiting for 32 on gdx patiently, ![]()

https://c.stockchart...702119487&r=433

https://www.thetechn.../12/gold3-1.jpg

gold seems have broken out of the base

https://www.thetechn.../12/Gold1-1.jpg

gold DSI doesn't get as high as 97 in a bear market, and doesn't fall below 10 in a bull market.

It didn't fall below 10 in the recent weakness, so I assume it's in a LT bull mkt.

https://pbs.twimg.co..._s2WkAEQJ-G.png

https://lh6.googleus...yS4ITyUrceb8lG5

#186

Posted 11 December 2019 - 12:52 PM

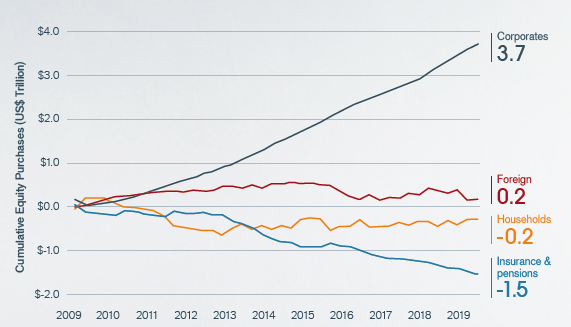

Sobering analysis on the Fed's recent actions and the implications

That is really disturbing. Nobody (no foreign entities and the people) wants to buy USB, so Fed prints money to buy 90% of it. Wow! This means we may be sitting on a time bomb. Trump's making major economies the enemies, they do not want to fund the our deficits any more and they want to destroy our currency by not using it in any way they can.

An equally absurd situation in stock bull market -- is by the stock buyback operation of their own shares. This again can be at dangerous situation with consumer price inflation (exacerbated by Trump's trade war) as rising price, rising fed rate, falling profit, falling buyback, and the mkt can sink like a rock.

Stock purchases since 2009:

"Corporations : +$3.7t

Foreigners: +$0.2t

Households: -$0.2t

Institutions: -$1.5t

Total : +2.2t"

https://twitter.com/...583153819504640

#187

Posted 11 December 2019 - 02:22 PM

Waiting for 32 on gdx patiently,

https://c.stockchart...702119487&r=433

https://www.thetechn.../12/gold3-1.jpg

gold seems have broken out of the base

https://www.thetechn.../12/Gold1-1.jpg

gold DSI doesn't get as high as 97 in a bear market, and doesn't fall below 10 in a bull market.

It didn't fall below 10 in the recent weakness, so I assume it's in a LT bull mkt.

think only members can see those charts, at least I cant see them

#188

Posted 11 December 2019 - 02:36 PM

Waiting for 32 on gdx patiently,

https://c.stockchart...702119487&r=433

https://www.thetechn.../12/gold3-1.jpg

gold seems have broken out of the base

https://www.thetechn.../12/Gold1-1.jpg

gold DSI doesn't get as high as 97 in a bear market, and doesn't fall below 10 in a bull market.

It didn't fall below 10 in the recent weakness, so I assume it's in a LT bull mkt.

think only members can see those charts, at least I cant see them

stockchart => click "reload"

Other images appear from the links.

#189

Posted 11 December 2019 - 02:41 PM

never short a dull market hold true here?

#190

Posted 11 December 2019 - 02:52 PM

5 up in GDX 15 min chart.

lets se what a correction here does