Looks like i'm all out on a limb buy myself as usual, went short the close. Bear raids could work nicely on a low volume holiday week. Of course the market could also wake up from this trade war drama, and realize this so called deal leaves a lot to be desired. What should be sinking in is this, we have to be ready to go toe to toe with China for many years to come. (JMHO)

hardly a money making strategy for the last 10 years

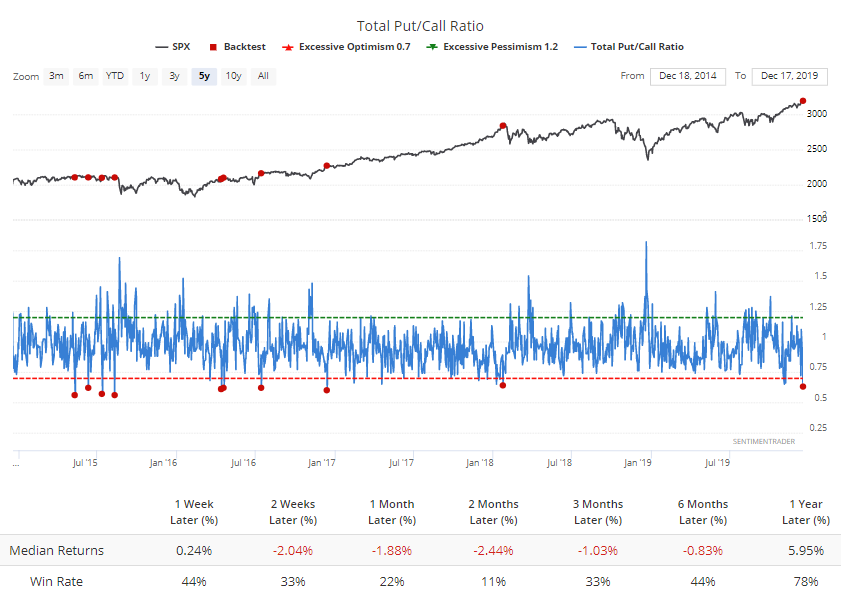

>Looks like i'm all out on a limb buy myself as usual, went short the close<