This is from MA's private blog on or about May10:

"We should see a new high next week which could be as soon Monday with a decline thereafter into the week of the 18th(TP) which should be a panic cycle to the downside. a lot of these moves will be determined by the reversal system, so as long as the Dow does not elect its next bullish reversal at 24765, the market should decline into the the week of the 18th.

The 2nd quarter is a turning point so we either have to make new lows or close below the 1st quarterly close. The intraday low may occur in May, with June being the lowest monthly closing."

The Dow did not exceed 24765 (the April high) not even intra-day so the bullish reversal was not elected.

Above is per a poster at: https://bitcointalk....ic=1082909.7680

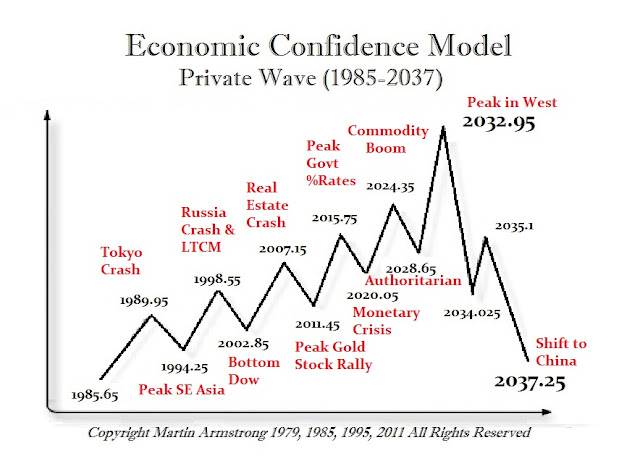

So you are accusing Financial Sense of lying about MA predicting that stock market would bottom in March and rally into June? I have seen him make many great predictions for decades, he was bullish after the crash of 87 which his pi cycle called to the day and he remained bullish into the end of the century. He also predicted to me at his seminar in the late 1990's that oil would hit 10 dollars and then go to minimum 65 which he later increased to 100 once the really was underway. The NYSE peaked to within 1 day of the Jan 18th major pi cycle date. Who else has a model that did anything like that and has done it many times over the past 4 decades.