ds, please post a plot of what you are seeing vis-a'-vis junk bond relative weakness. The first plot below appears to show recent comparable weakness in both the junk bond (JNK) and equity (SPY) funds at least to the my naked eye. The second plot below appears to show greater recent weakness in the "good" TLT treasury debt than in the "bad" JNK debt which is a bit confusing. What would posses traders to keep the trash and throw out the silverware? I'm confused which unfortunately is my normal condition these days. Anything that you can do to reduce my pixilated state would be greatly appreciated.

Regards,

Douglas

I should point out that my observation on Junk is very early tea leaf reading, but I think Douglas' charts make the point. There are two recent periods where JNK begins to diverge from SPX, early August and possibly NOW. In early August SPX rose while JNK sank or treaded water, this was coincidental to a period in August where TLT spiked twice (indicating easing of rates and possibly weak economic numbers). SPX likes the easing, but JNK gets nervous when the economy seems weak. But now in October commodoties (ie. DBC) are soaring so interest rates move up sharply, but the economy still seems tepid (read Jimmy Carter stagflation). I think Junk bonds are just beginning to get nervous about the economy and maybe ripples from Evergrande, irrespective of the direction of interest rates.

With regard to the silverware analogy, personally I am much more comfortable in general with Junk than TLT because of the magnified interest rate sensitivity of TLT, but that would end if JNK begins to plummet in an economic downturn.

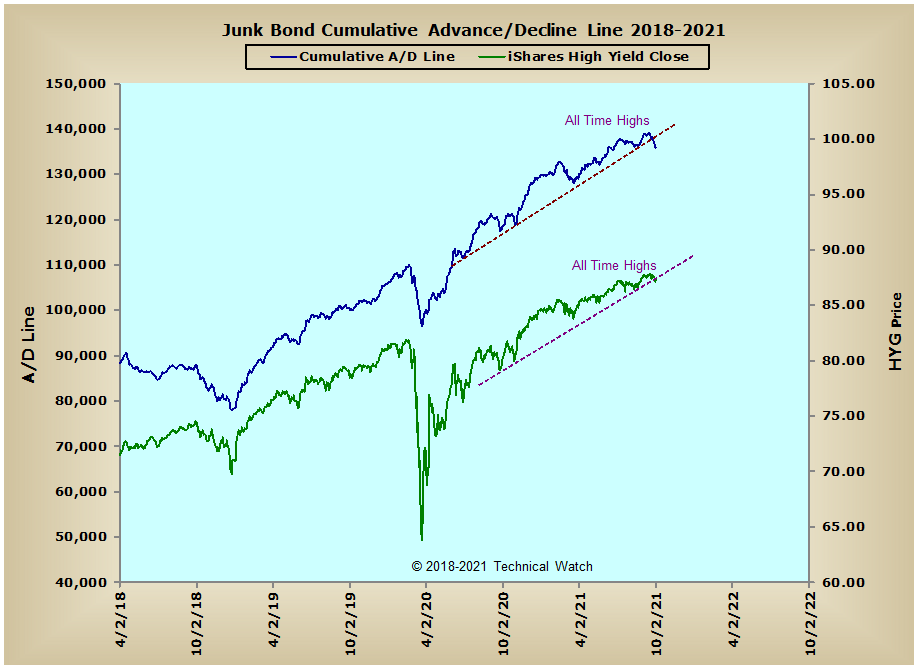

I'm not sure where FIB holds on this, but the way I read his chart, breadth for Junk was weakening and broke a supporting trend line, and if AD leads Price then it implies Price will follow and weaken.

Sorry not up on the technology of uploading charts, last time was over a decade ago. I took a chance and threw in a TA observation so I could post my Wife's video of Dr. McCullough, welcome to the lion's den of accountability. I think we need to keep a close eye on JNK.