The Long Bond is technically in a Bear Market condition.

My feeling is that if they tank the stock market and we get a pullback in the TBT, it could be a very good buy either for a speculation or a hedge against future borrowing costs.

Posted 12 October 2021 - 09:11 AM

The Long Bond is technically in a Bear Market condition.

My feeling is that if they tank the stock market and we get a pullback in the TBT, it could be a very good buy either for a speculation or a hedge against future borrowing costs.

Mark S Young

Wall Street Sentiment

Get a free trial here:

https://book.stripe....1aut29V5edgrS03

You can now follow me on X

Posted 12 October 2021 - 04:03 PM

Nice.

Safe Haven Demand: Fear

Stocks and bonds have provided similar returns during the last 20 trading days. However, this has been among the weakest periods for stocks relative to bonds in the past two years and indicates investors are fleeing risky stocks for the safety of bonds.

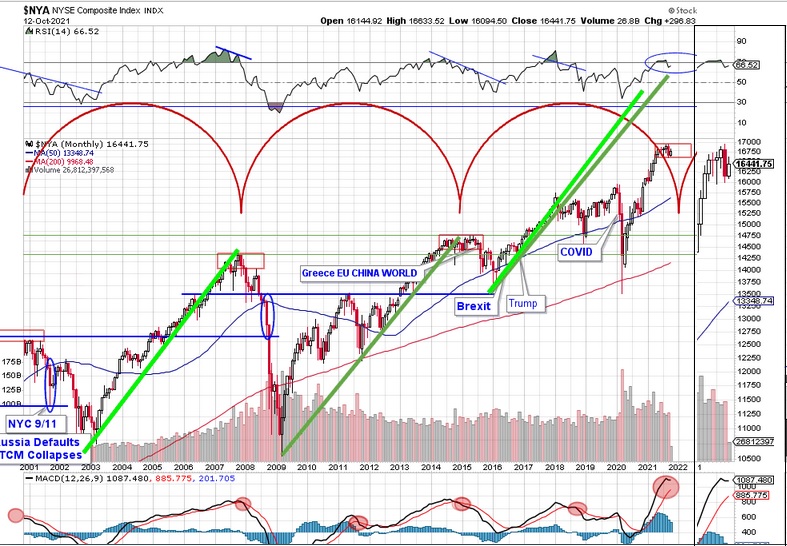

I'm still watching the Monthly $NYSE to see if it can hold on longer. It may just slowly fizzle out.

Edited by Rogerdodger, 12 October 2021 - 04:42 PM.

Posted 12 October 2021 - 04:34 PM

"No new taxes" unless you have a car...if you can find one...

Sharp surge in energy prices threatens economy...

$5 GALLON IN NYC...

Our local Honda dealership expanded 2 years ago, building dozens of covered pods to protect their new cars.

Now they only have 12 Hondas on the entire lot.

No chips, no cars... or phones.

Apple set to cut iPhone 13 production due to chip shortages

Apple will cut its iPhone 13 targets by as many as 10 million devices

One reader: I question all these stories right before EARNINGS

Edited by Rogerdodger, 12 October 2021 - 09:04 PM.

Posted 13 October 2021 - 07:58 AM

Whew good thing I just got my new Iphone lol!!

Posted 13 October 2021 - 10:05 AM

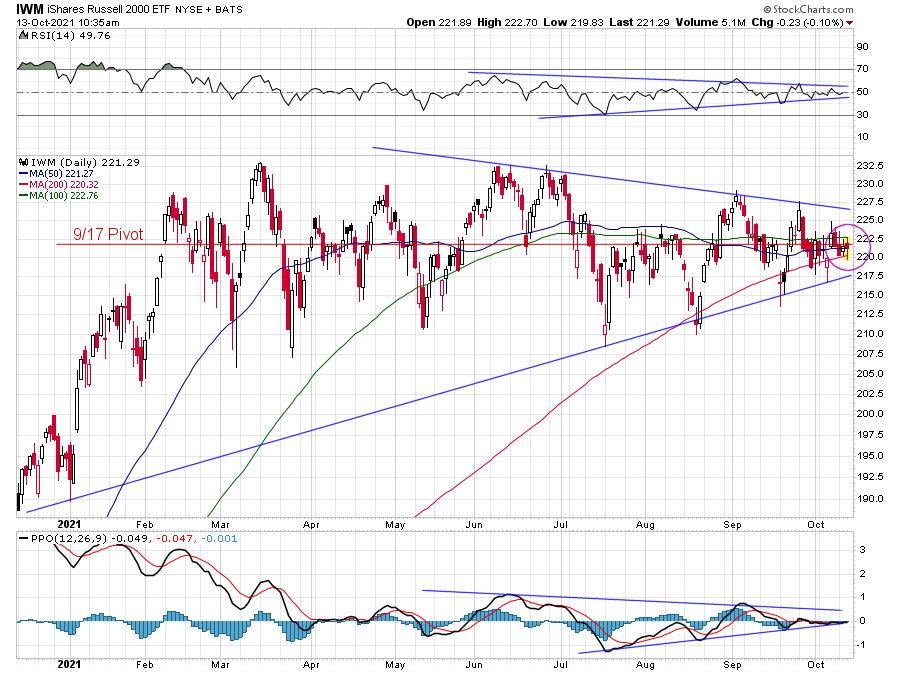

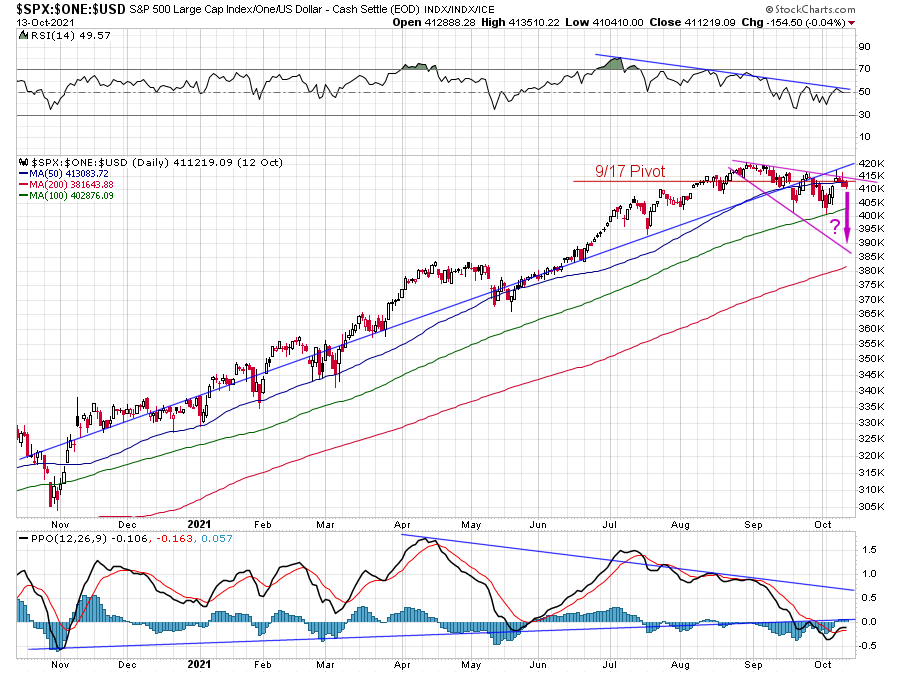

Nice moving average convergence - wouldn't want to be on the wrong side of this when it breaks.

Posted 13 October 2021 - 10:53 AM

Nice moving average convergence - wouldn't want to be on the wrong side of this when it breaks.

Great minds and all that... ![]()

RUT nearing end of Super Wedgie - Fearless Forecasters - Traders-Talk.com

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 13 October 2021 - 11:41 AM

Or - to paraphrase Occam - the simplest explanation...

Posted 13 October 2021 - 02:00 PM

Posted 13 October 2021 - 07:19 PM

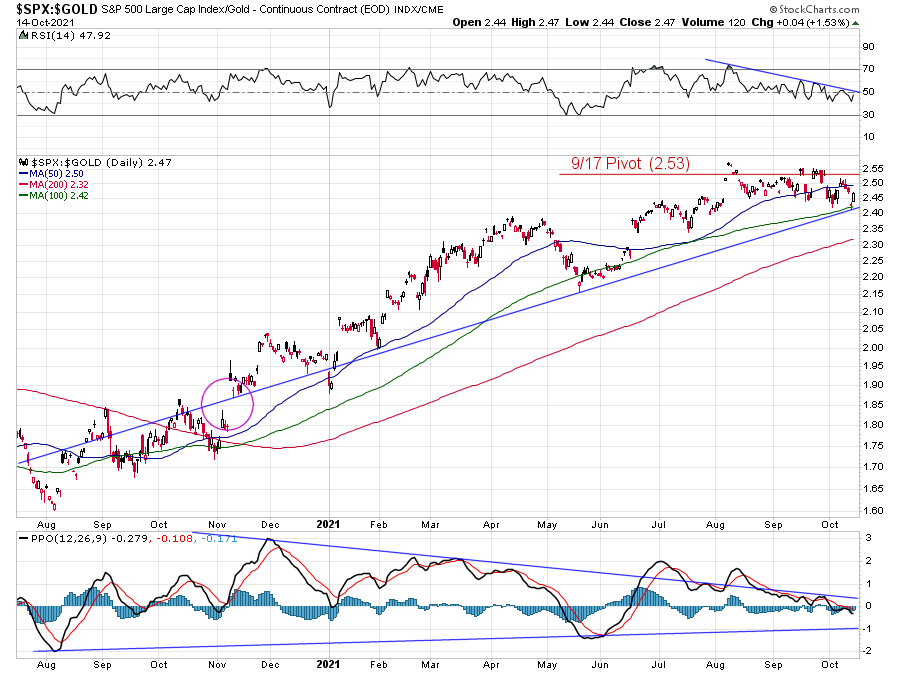

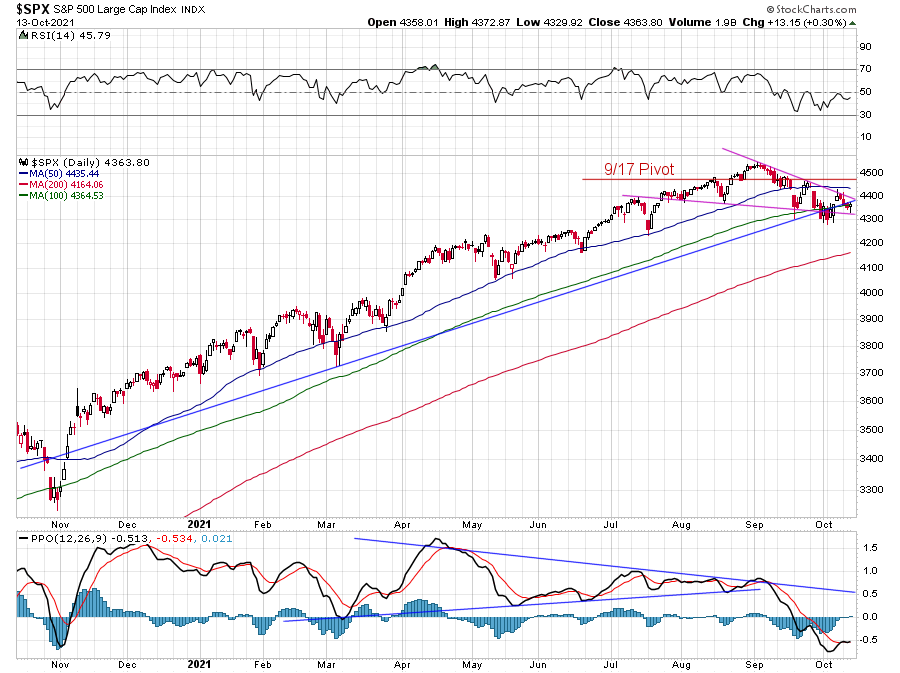

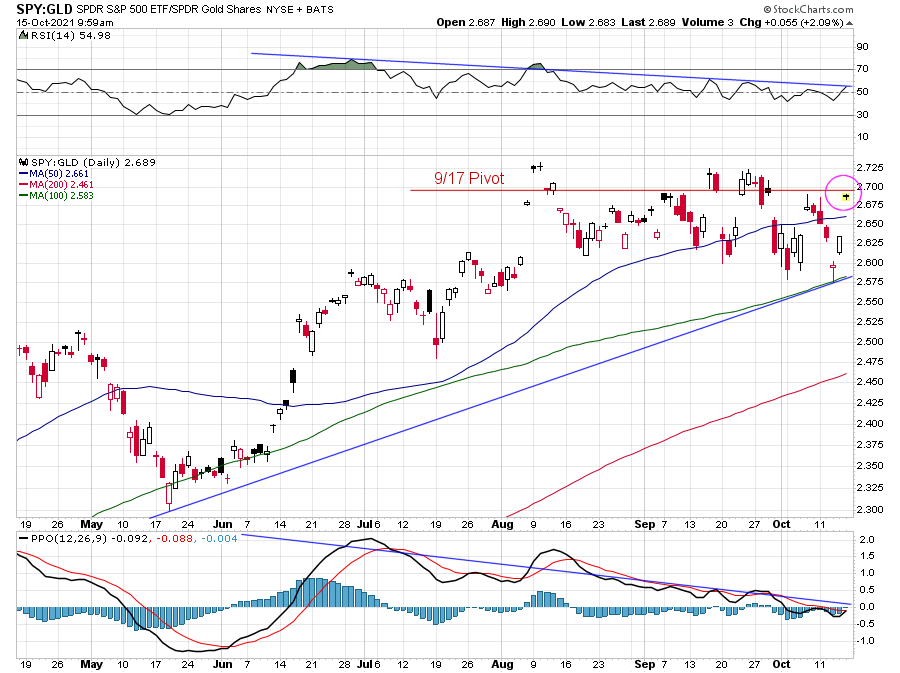

Critical spx/gold support tested today. Will it hold - rally back to the pivot? The best policy to cool off inflation might be to put a damper on the wealth effect for a while. Will the fed do the right thing - or keep pumping fiat to oblivion?

Posted 15 October 2021 - 09:47 AM

Well - that was quick. Almost back to the pivot - nearly +5% - in 2 days

Might have already hit it

So what next? Another leg up for the old bull - or a baby bear scare? The PPO wedge continues to intrigue. The failed breakouts June through August could incline one to view the entire election rally as suspect, so the possibility of a revisit to the November gap sometime in the not-too-distant future cannot be entirely discounted.