The most meaningful inflation data - Core CPI month over month down from 0.6% to 0.5%;

Initial unemployment claims up from 216K to 227K.

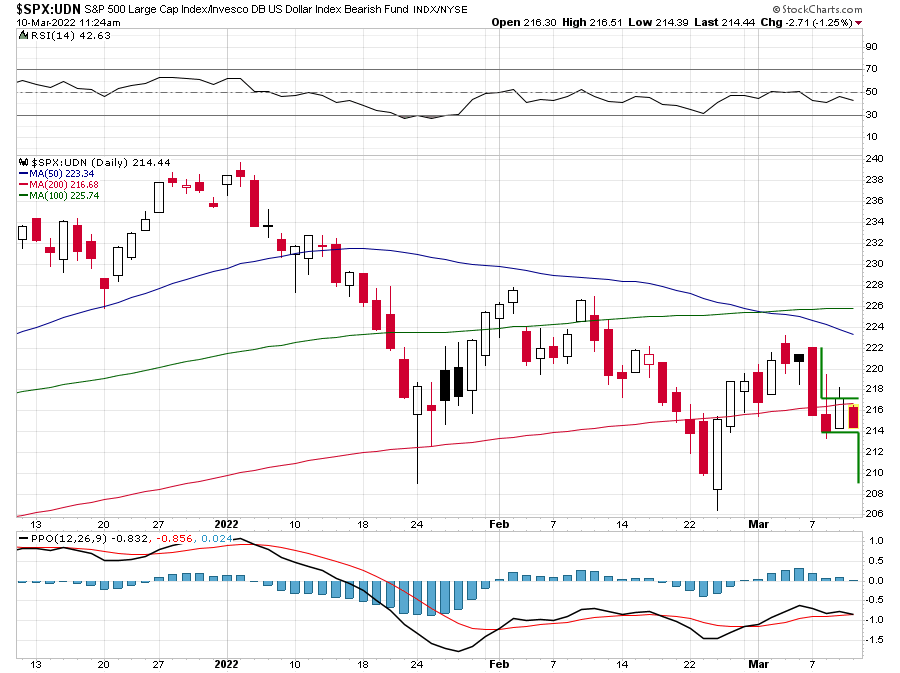

The new development in inflation trend should make the Fed think twice when doing rate hiking.................

Edited by redfoliage2, 10 March 2022 - 09:50 AM.