After a firm session to start the week on Monday, the major market indices continued to battle their confluence of 20, 50 and 200 day EMA resistance levels to finish on Friday with an average loss of -2.30%. The S&P 600 Small Cap Index was hit the hardest as it gave back -4.39%, while the Dow Industrials finished nearly unchanged at -.28%.

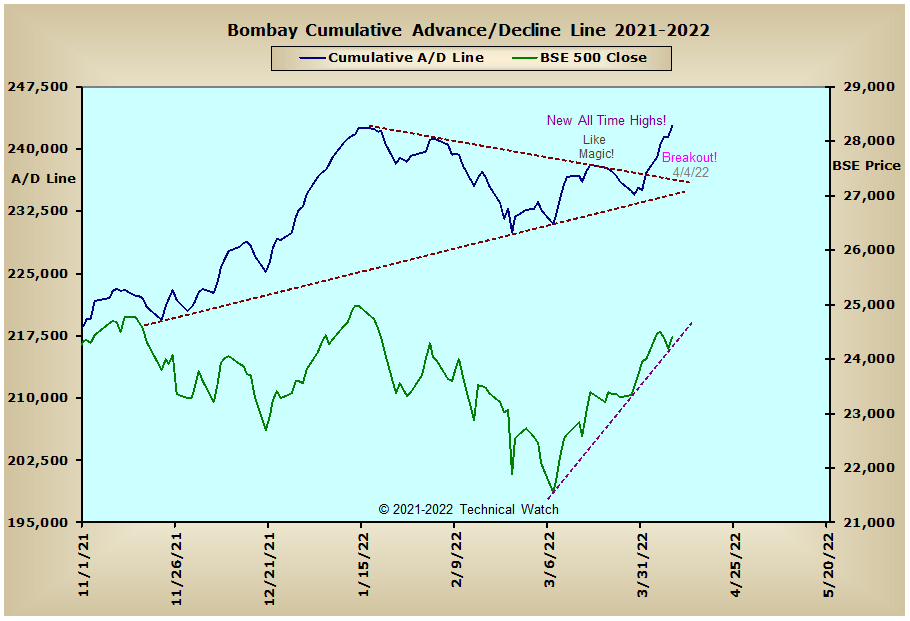

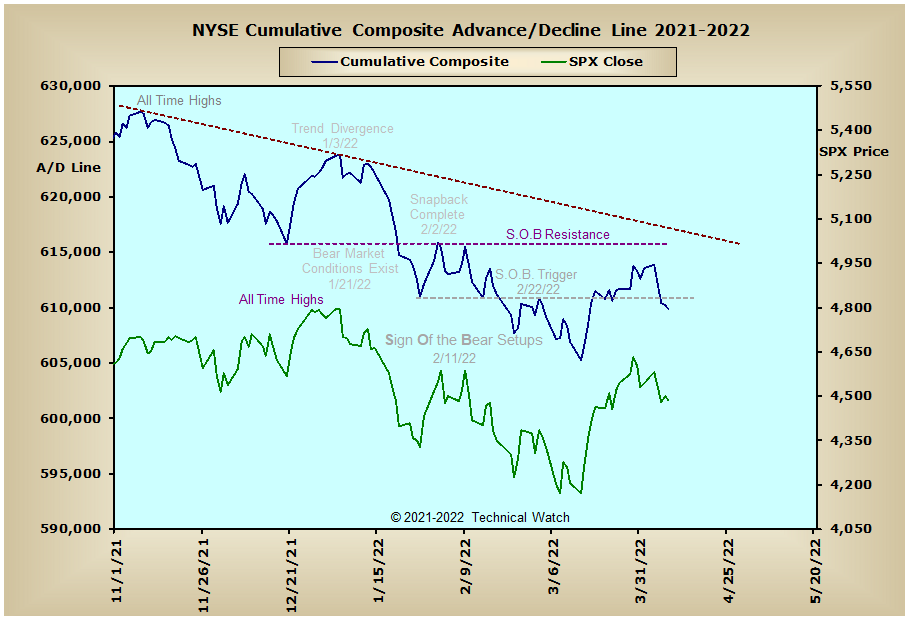

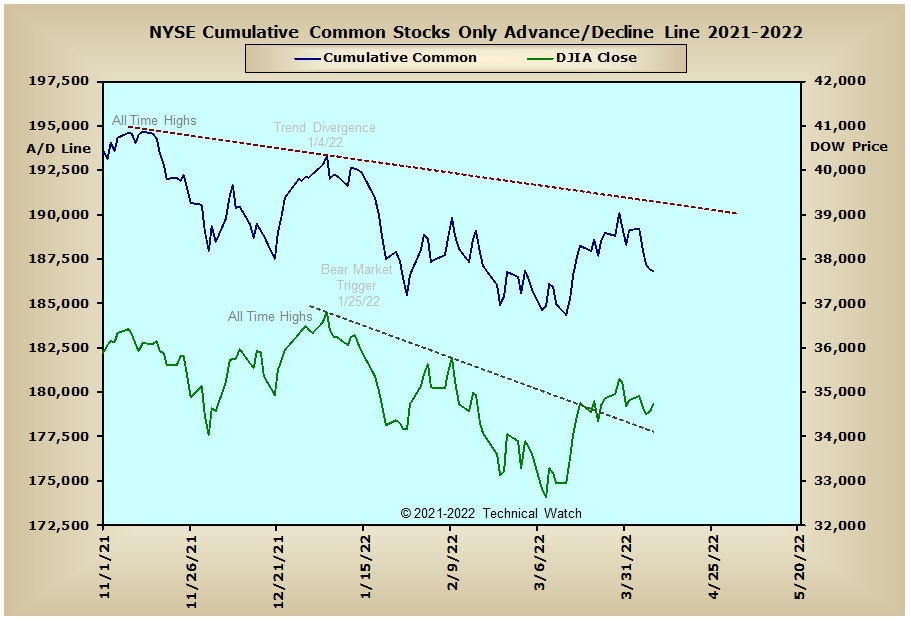

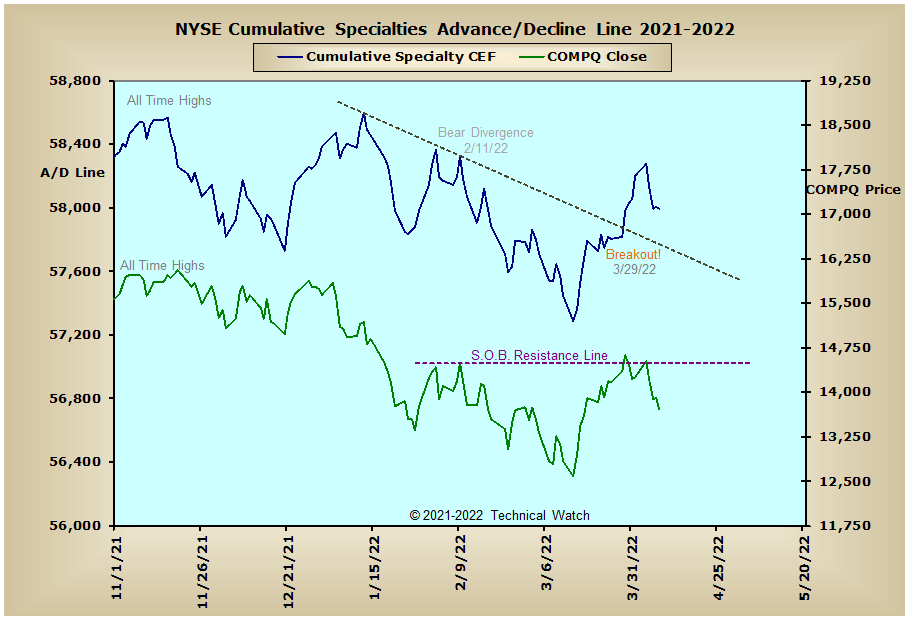

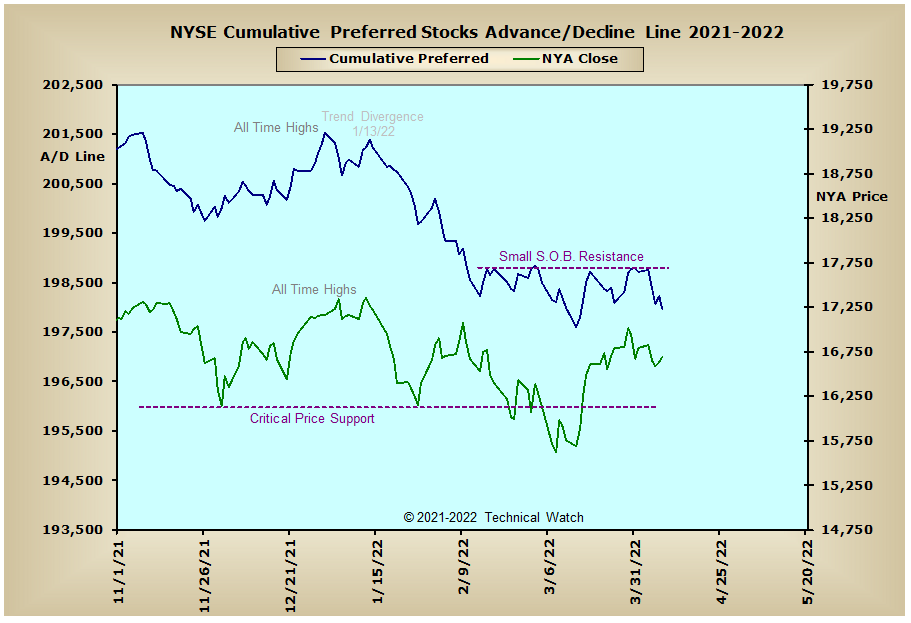

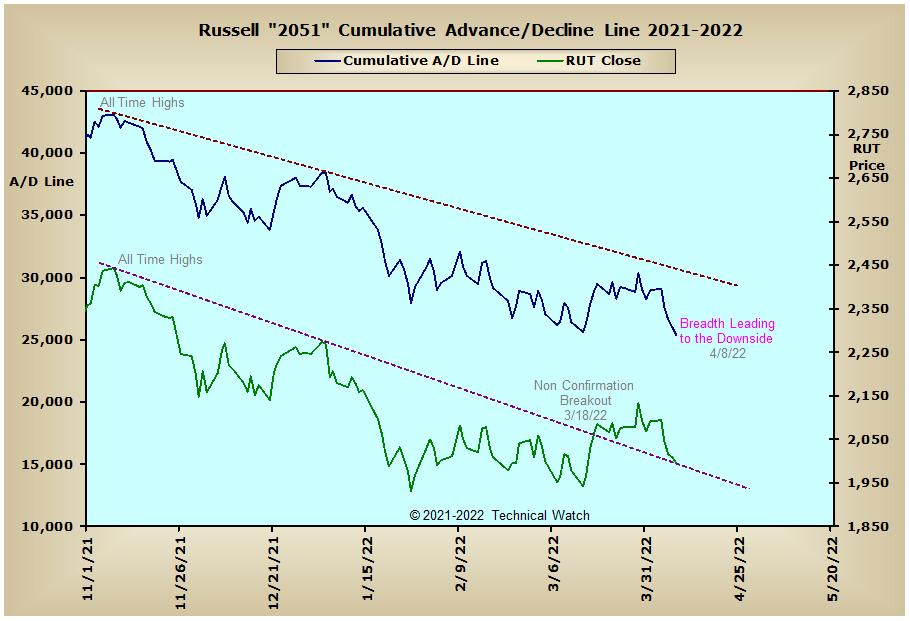

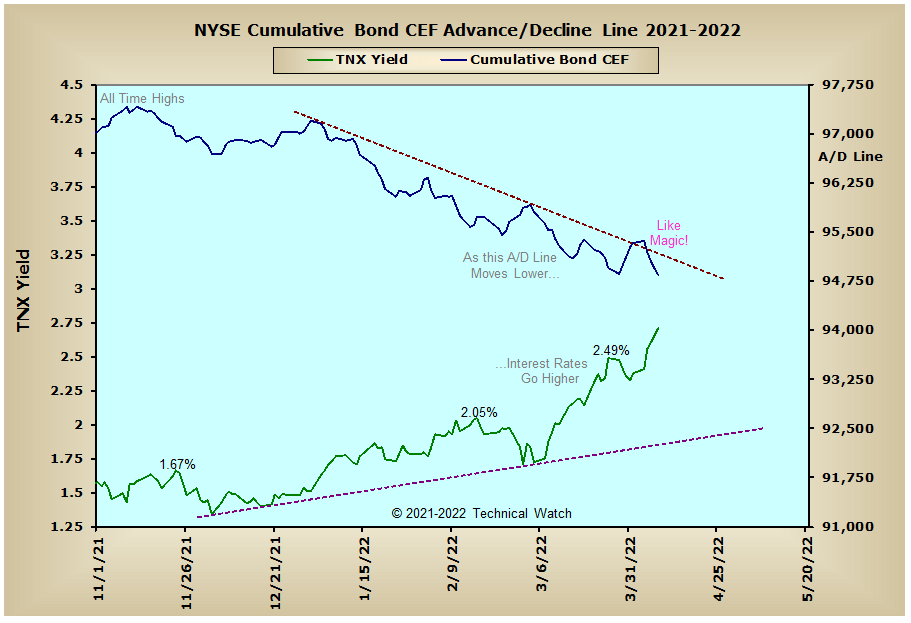

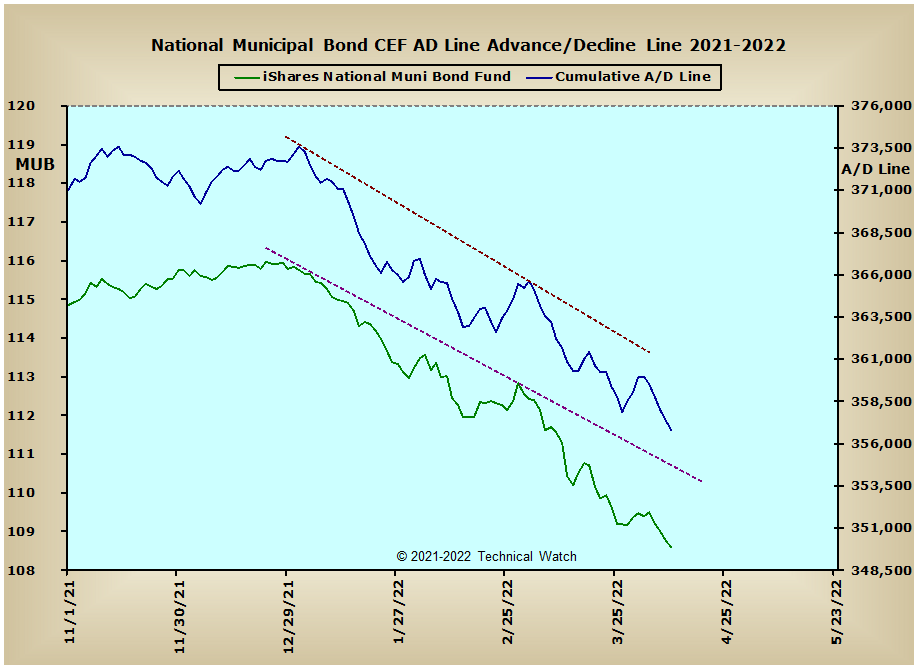

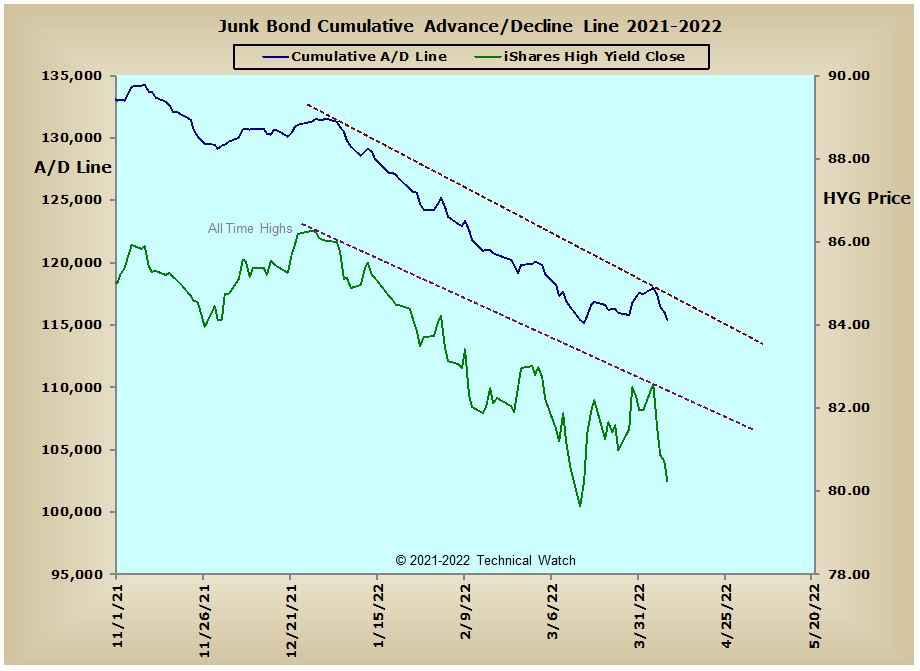

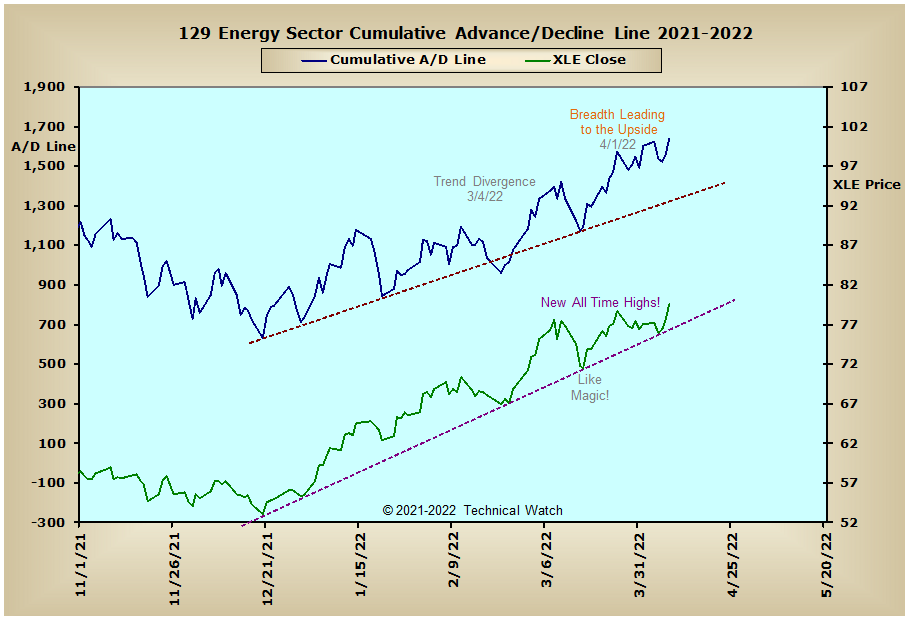

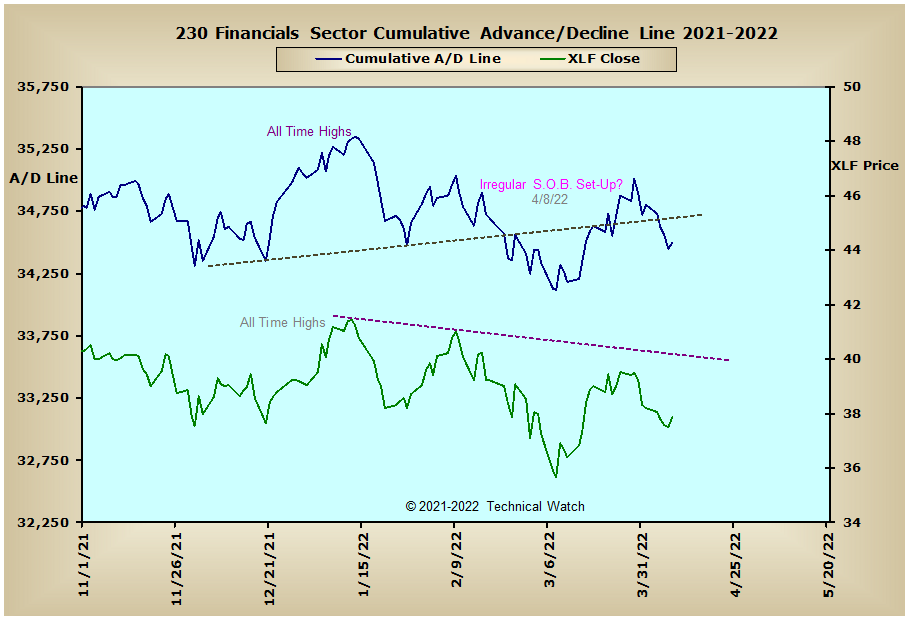

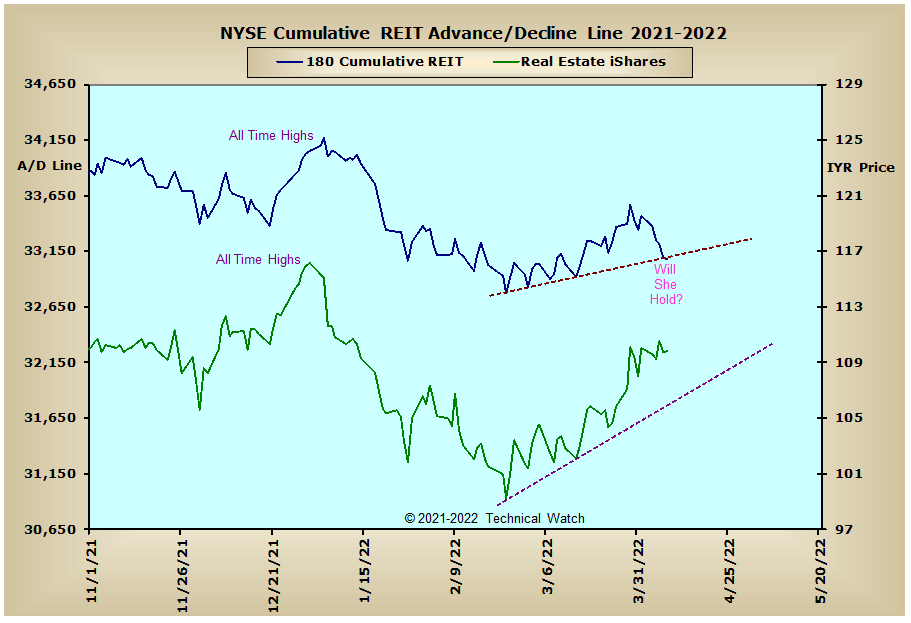

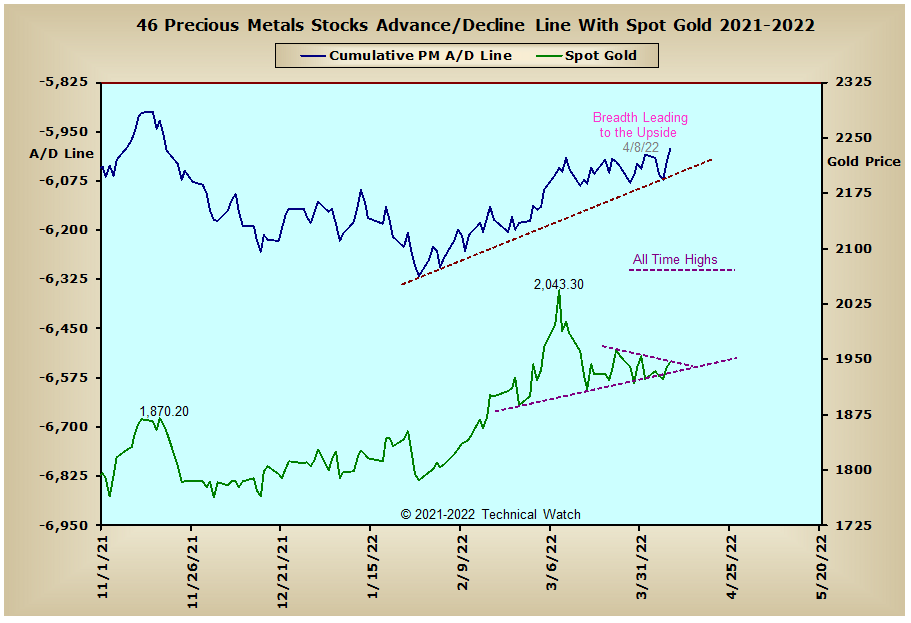

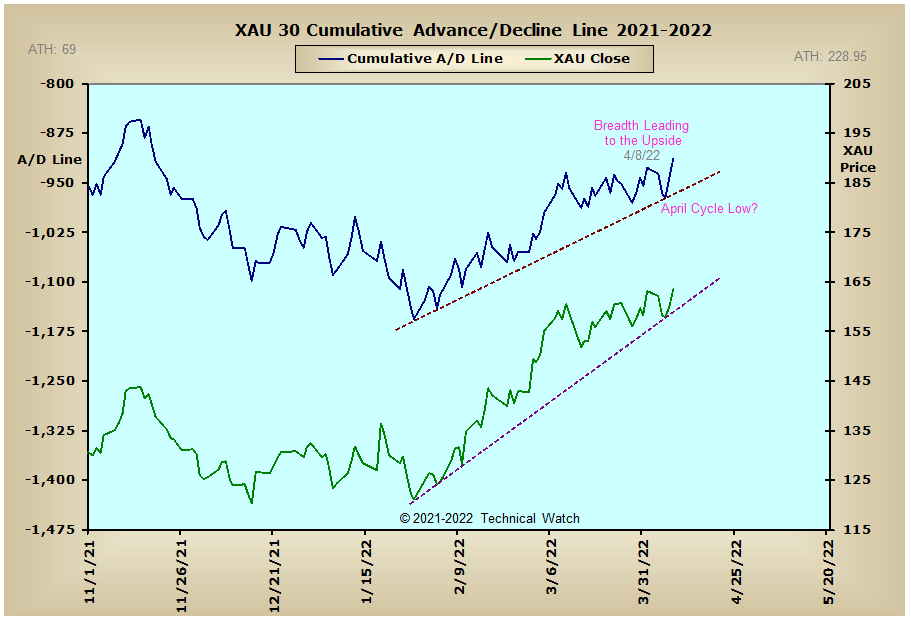

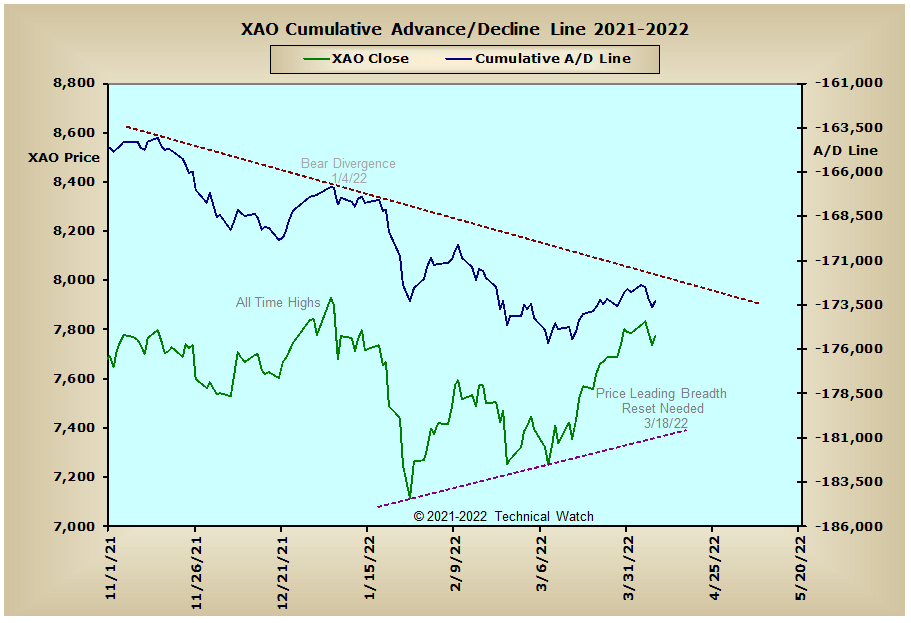

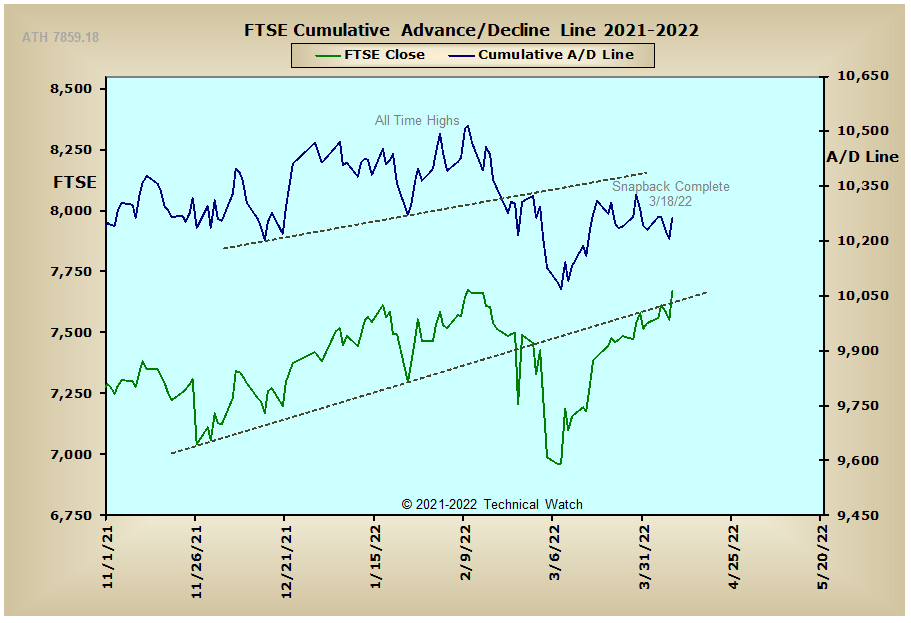

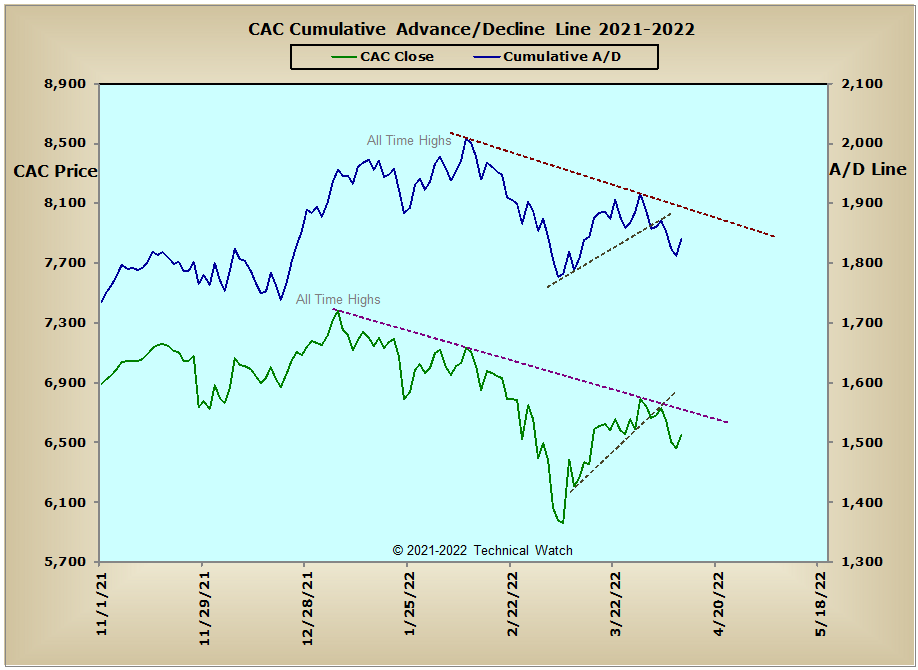

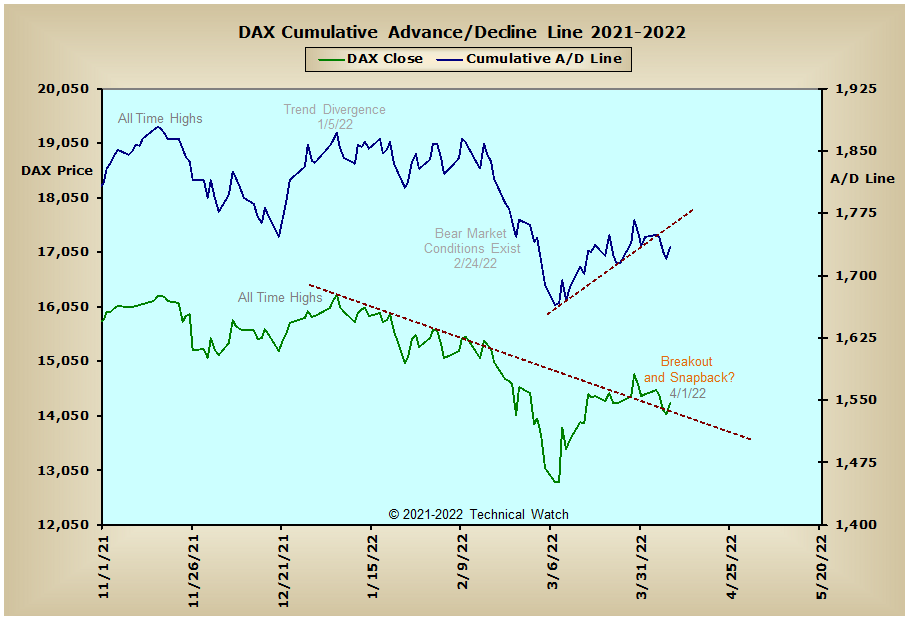

Looking over this week's array of cumulative breadth charts shows that equities continue to struggle as the yield on the 10 year note has now moved up one full point in the last five weeks to 2.71%. With the interest rate sensitive advance/decline lines continuing to show a strong preponderance to the downside, it would seem that our upside target of a 3% yield has become a foregone conclusion, with the likelihood of now reaching 3.25% before this round of interest rate increases takes a pause. Meanwhile, the Energy Sector advance/decline line continues to trend nicely to the upside, while the Precious Metals and XAU advance/decline lines may have seen an April cyclical bottom on Thursday where prices move up and away from as opposed to nesting down and into this low. Of course, both of these areas of investment have been largely driven this year by the war effort in Eurasia, so let's look for something to pop up there in the not too distant future. Internationally, European and Australian issues continue to be more defensive than constructive, while money flow in the subcontinent of India finished at new all time highs on Friday as maybe the likely winner of any future threats of aggression between Russia and Western Europe and/or rising tensions between China and Taiwan, Indonesia and Australia.

So with the BETS getting hit hard this past week to a reading of -15, investors continue to keep their powder dry on the sidelines, while traders maintain their highly effective "hit and run" strategies. As we start the week ahead we see that many of the breadth and volume McClellan Oscillators are now in negative territory. The broader based breadth related NYSE and NASDAQ Composite McClellan Summation Indexes still find themselves below their respective zero lines, while still others are either at or finding important resistance at this same balance between buyers and sellers. Both the NYSE and NASDAQ Open 10 TRIN's were either at or just below minimally "oversold" at 1.00 on Friday, while the 10 day trend of put buying picked up a bit as we move into next weeks OPEX period. More on the bearish side of things is that we're now seeing more and more "irregular" Sign Of the Bear pattern structures popping up now on a longer term basis after last month's reflex rally. With the major A/D lines still showing bear market conditions since January, and liquidity levels receding at an accelerated rate, unless the buyers take a strong stand of support this coming week, the 2nd half of April will likely have a bearish bias that could spill over into both May and June. With all this to chew on then, let's now go back to a more defensive posture for the week ahead, and then we'll reexamine things next weekend as to how the rest of the 2nd quarter is likely to go.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: