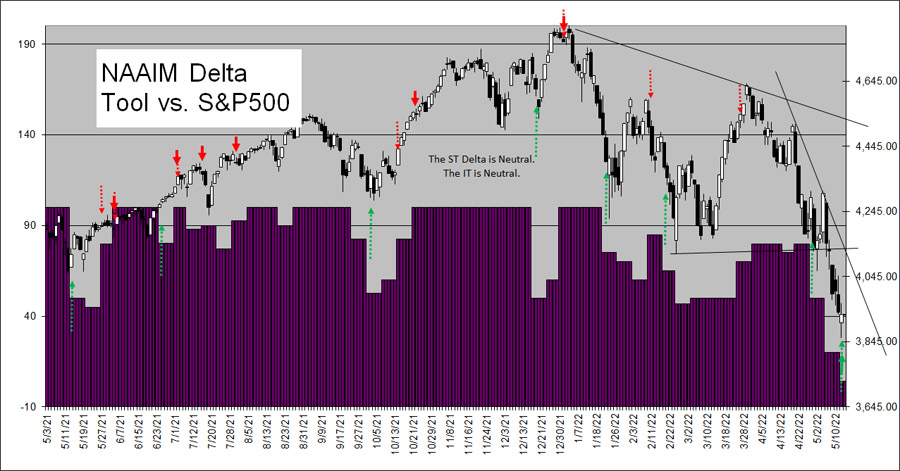

NAAIM is very Bullish for the market. Just 4% median exposure. That's less than at the 2020 low.

Whoa! NAAIM

#1

Posted 13 May 2022 - 11:04 AM

Mark S Young

Wall Street Sentiment

Get a free trial here:

https://book.stripe....1aut29V5edgrS03

You can now follow me on X

#2

Posted 13 May 2022 - 11:05 AM

There was a data correction from last week. They had originally reported 65% median exposure last week. This was corrected to 20%. That means that the buy would have been last week, but in a Bear market, those signals are often a week or so early, soooo, this is more timely.

Mark S Young

Wall Street Sentiment

Get a free trial here:

https://book.stripe....1aut29V5edgrS03

You can now follow me on X

#3

Posted 13 May 2022 - 02:41 PM

but if we are in a bear market, this should be just a bounce......am I wrong ?

forever and only a V-E-N-E-T-K-E-N - langbard

#4

Posted 13 May 2022 - 03:17 PM

Yes, if we are in a bear market this should be a 2 - 4 week bounce which is tradable. There is a chance that it is a just a 3 day bounce, but not likely.

#5

Posted 13 May 2022 - 04:11 PM

This bounce has very simple explanation. It was not NAAIM.

FED chair Powell said today, that there is NO 0.75% rate increase under consideration.

Only 0.5% increase will be considered next month.

Beware of face ripping rallies. That is classic bear market symptom.

#6

Posted 13 May 2022 - 05:01 PM

This bounce has very simple explanation. It was not NAAIM.

FED chair Powell said today, that there is NO 0.75% rate increase under consideration.

Only 0.5% increase will be considered next month.

Beware of face ripping rallies. That is classic bear market symptom.

when do they meet next month to decide the rate increase ?

forever and only a V-E-N-E-T-K-E-N - langbard

#7

Posted 13 May 2022 - 05:48 PM

Two images come to mind...

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#8

Posted 13 May 2022 - 06:30 PM

I'm afraid they may have forgotten to ring the bell at the bottom --- again.

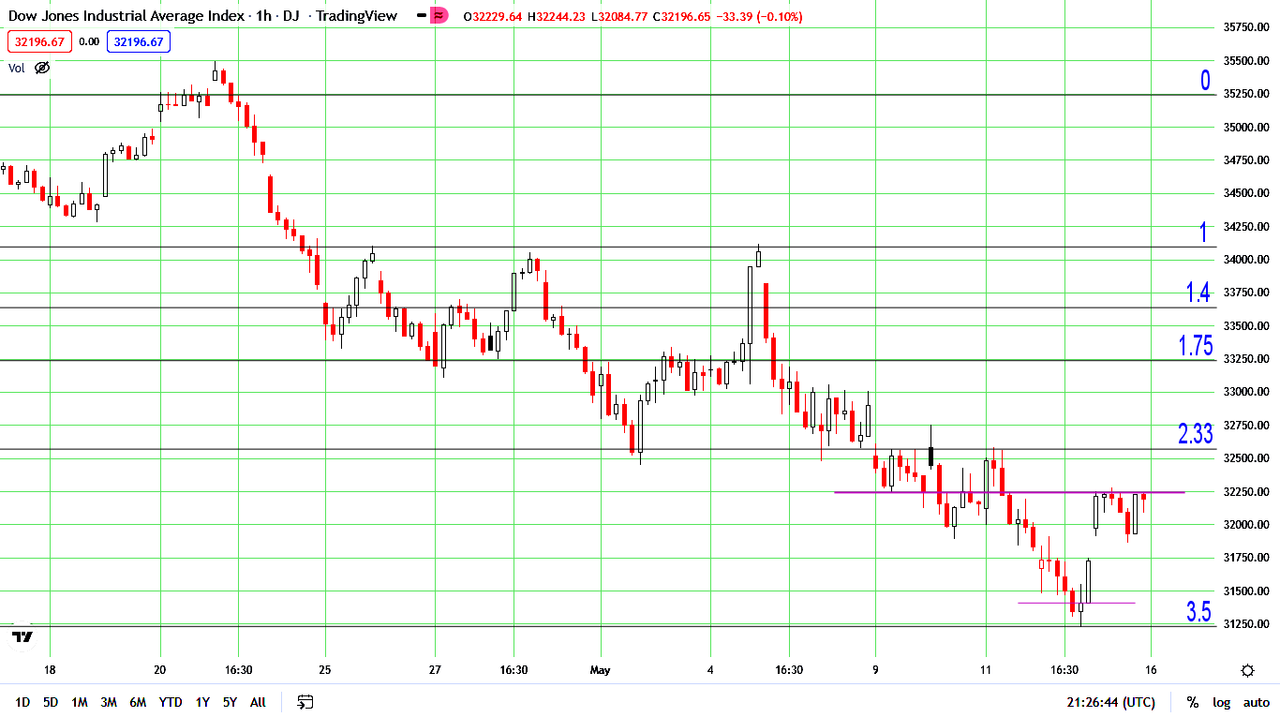

Here is a possible completed hourly down count from April for the dow - though it is full of retraces. Does the purple line mark the first step up off a new floor, or is it the ceiling for another downward move? If the former, the size of the first step points to a potential ATH. The 1 minute chart contains a retrace between 3.5 and 2.33, suggesting the count might represent only a minor leg up. The SPX chart, however, does not contain a retrace (yet).

Avi Gilburt posted some open updates today calling 4010 as the line in the sand. SPX closed comfortably above that level at 4024.

https://www.elliottw...t/market-update

Pretzel Logic is calling for a strong rally into June if SPX sustains above 4015.

https://www.pretzelcharts.com/

#9

Posted 14 May 2022 - 08:31 AM