The Elusive BOTTOM - bulls floundering as QT begins

#11

Posted 05 June 2022 - 07:05 PM

#12

Posted 05 June 2022 - 07:18 PM

Agree, that's why I have been trading TLT CALLS since February.

Will add more if TLT drops; if it trades below 107 I will buy at least 80 CALLS

Sentiment Speaks: Big Bond Rally Is Coming Despite The Fed

But, now that the market has seen a sizeable decline, I am seeing the bond market bottoming out and setting up a major rally over the coming year or so. While I do not yet believe we have struck "the bottom" to this decline, and that there is still potential that we drop down to the 106-109 region on the TLT, I believe that any further weakness will likely set up our final bottom in 2022 in the bond market. (But, please do consider that my primary view is that the next rally is likely going to be a corrective rally and will not likely exceed the highs struck in 2020.)

Of course, many will be viewing this analysis in light of the fact that the Fed is still continuing to raise rates. But, consider I put out a similar expectation back in November of 2018 when the Fed was also still intending on raising rates at that time. Yet, amazingly, after the market bottomed within pennies of our bottoming target back in November 2018 and then started its larger rally towards 180, the Fed changed its intentions several months later. So, you see, the bond market led the Fed, and not the other way around. And, if you look closely at history, you will see this is exactly how the bond market and Fed work. The bond market leads the Fed.

https://www.elliottw...6037843383.html

#13

Posted 05 June 2022 - 07:21 PM

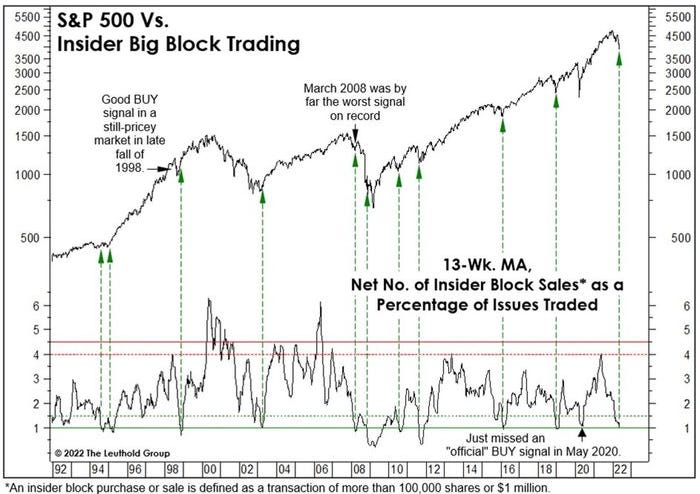

Insider Timing: This “Insider Big Block Trading indicator” looks to be at or close to a buy signal... as always, note the exceptions (beware of early buy signals).

Giving up on Calls: Small trader buying of call options has near evaporated -- stark contrast to the frenzy of 2020/21.

Edited by dTraderB, 05 June 2022 - 07:23 PM.

#14

Posted 05 June 2022 - 07:25 PM

Much more BEARISH than I expected:

-

Bullish (Fundamentals)17.9%

-

Bullish (Technicals)17%

-

Bearish (Fundamentals)52.7%

-

Bearish (Technicals)12.5%

#15

Posted 05 June 2022 - 07:30 PM

As discussed last week, a rally finally took hold as investors found reasons to be bullish. That rally pushed the market above the 20-dma and triggered a reasonably strong “buy” signal. However, despite the optimism of the bulls, we noted an essential headwind to the rally. To wit:

“Concerning how long it will last, I suspect the rally could be powerful but short-lived as a tremendous number of investors swept up during the decline and are looking for a sellable rally. Such is a continuation of investor actions so far this year. For the most part, the 20-dma has consistently acted as the “exit” for ‘trapped longs.’”

While the market did clear the 20-dma, the “trapped longs” headed to the exits at the initial 38.2% Fibonacci retracement level from the March highs. That level was also where previous important support for the February and April lows got broken.

We technically review this chart again in a moment, but the critical point is that if the market doesn’t advance early next week, we will likely retest the recent lows.

As I discussed with Charles Payne on Friday, the problem I have is that we are trapped between a market that, from a sentiment view, is “so bearish, it’s bullish.” However, we are also facing an aggressive rate hiking campaign and the start of “QT” by the Fed.

https://realinvestme...-where-to-next/

#16

Posted 05 June 2022 - 07:30 PM

There are currently several bullish arguments to support a rally. While price action remains weak, the S&P 500 holds short-term support. At the same time, sentiment remains extremely “bearish,” which, from a contrarian perspective, is actually “bullish.”

Such was a point made on Thursday via Yahoo Finance:

“Michael Hartnett’s team over at Bank of America Global Research noted their proprietary Bull & Bear indicator swung into contrarian buy mode a few weeks ago. But Hartnett still leans bearish, arguing that U.S. stocks are ‘vulnerable’ to a bear market rally and that traders should ‘sell any rips.'”

Concurrently, Hedge Fund leverage has gotten sharply reduced. As Morgan Stanley noted, last week ended with one of the most significant gross reductions. That happened on both the long and the short sides of their books.

With June wrapping up the second quarter of 2022, it is very likely that between the selloff in both stocks and bonds this year, many fund managers are “out of balance” regarding their allocations. Such could provide decent buying pressure to align allocations by quarter-end.

Lastly, as noted by Sentiment Trader previously:

“In late March 2020, thrusts in buying interest were wildly impressive. But almost all technicians mocked them as ‘unofficial’ because they didn’t meet some arbitrary, cherry-picked, overly optimized rules. It’s happening again, and there is even more skepticism that this rally is real. The number of articles dismissing the gains as just another “bear market rally” is nearly double the prior record from early April 2020.

In the three days leading up to the exchange holiday, more than 80% of volume on the NYSE flowed into advancing stocks. We typically do not see this kind of behavior during bear markets, usually at the end of them.“

Market Fails At First Resistance

As discussed last week, a rally finally took hold as investors found reasons to be bullish. That rally pushed the market above the 20-dma and triggered a reasonably strong “buy” signal. However, despite the optimism of the bulls, we noted an essential headwind to the rally. To wit:

“Concerning how long it will last, I suspect the rally could be powerful but short-lived as a tremendous number of investors swept up during the decline and are looking for a sellable rally. Such is a continuation of investor actions so far this year. For the most part, the 20-dma has consistently acted as the “exit” for ‘trapped longs.’”

While the market did clear the 20-dma, the “trapped longs” headed to the exits at the initial 38.2% Fibonacci retracement level from the March highs. That level was also where previous important support for the February and April lows got broken.

We technically review this chart again in a moment, but the critical point is that if the market doesn’t advance early next week, we will likely retest the recent lows.

As I discussed with Charles Payne on Friday, the problem I have is that we are trapped between a market that, from a sentiment view, is “so bearish, it’s bullish.” However, we are also facing an aggressive rate hiking campaign and the start of “QT” by the Fed.

https://realinvestme...-where-to-next/

#17

Posted 05 June 2022 - 07:38 PM

Every time when combined sentiment got nearly this low in the past, both stocks and bonds rebounded. All those 60/40 investors who got sucked in by steady gains over the past few decades are hoping history repeats. What the research tells us

- General U.S. consumer sentiment toward stocks is the worst in over a decade.

- It's also historically pessimistic toward the bond market

- Combined stock and bond sentiment is the worst in history.

- After other bouts of pessimism, both stocks and bonds showed positive total returns in the months ahead.

#18

Posted 06 June 2022 - 07:55 AM

Technical Review – The Bullish View

There are currently several bullish arguments to support a rally. While price action remains weak, the S&P 500 holds short-term support. At the same time, sentiment remains extremely “bearish,” which, from a contrarian perspective, is actually “bullish.”

Such was a point made on Thursday via Yahoo Finance:

“Michael Hartnett’s team over at Bank of America Global Research noted their proprietary Bull & Bear indicator swung into contrarian buy mode a few weeks ago. But Hartnett still leans bearish, arguing that U.S. stocks are ‘vulnerable’ to a bear market rally and that traders should ‘sell any rips.'”

Concurrently, Hedge Fund leverage has gotten sharply reduced. As Morgan Stanley noted, last week ended with one of the most significant gross reductions. That happened on both the long and the short sides of their books.

With June wrapping up the second quarter of 2022, it is very likely that between the selloff in both stocks and bonds this year, many fund managers are “out of balance” regarding their allocations. Such could provide decent buying pressure to align allocations by quarter-end.

Lastly, as noted by Sentiment Trader previously:

“In late March 2020, thrusts in buying interest were wildly impressive. But almost all technicians mocked them as ‘unofficial’ because they didn’t meet some arbitrary, cherry-picked, overly optimized rules. It’s happening again, and there is even more skepticism that this rally is real. The number of articles dismissing the gains as just another “bear market rally” is nearly double the prior record from early April 2020.

In the three days leading up to the exchange holiday, more than 80% of volume on the NYSE flowed into advancing stocks. We typically do not see this kind of behavior during bear markets, usually at the end of them.“

Market Fails At First Resistance

As discussed last week, a rally finally took hold as investors found reasons to be bullish. That rally pushed the market above the 20-dma and triggered a reasonably strong “buy” signal. However, despite the optimism of the bulls, we noted an essential headwind to the rally. To wit:

“Concerning how long it will last, I suspect the rally could be powerful but short-lived as a tremendous number of investors swept up during the decline and are looking for a sellable rally. Such is a continuation of investor actions so far this year. For the most part, the 20-dma has consistently acted as the “exit” for ‘trapped longs.’”

While the market did clear the 20-dma, the “trapped longs” headed to the exits at the initial 38.2% Fibonacci retracement level from the March highs. That level was also where previous important support for the February and April lows got broken.

We technically review this chart again in a moment, but the critical point is that if the market doesn’t advance early next week, we will likely retest the recent lows.

As I discussed with Charles Payne on Friday, the problem I have is that we are trapped between a market that, from a sentiment view, is “so bearish, it’s bullish.” However, we are also facing an aggressive rate hiking campaign and the start of “QT” by the Fed.

https://realinvestme...-where-to-next/

With the Fibonacci retracement I'd use the 2022 Jan. high instead of the March high, and expect a 50% retracement, that's SPX 4315 .....................................

Edited by redfoliage2, 06 June 2022 - 08:00 AM.

#19

Posted 06 June 2022 - 08:34 AM

However, a 61.8% retracement also should be expected, that's at SPX 4432..........................

Edited by redfoliage2, 06 June 2022 - 08:35 AM.

#20

Posted 06 June 2022 - 08:43 AM

Very slow start, well on putting trades up here but was active lol!! In the end went into the weekend long at 4115 and took profits when I woke up at 4155 for a nice 40 point profit. Then at the open went long at 4145 for a 3 point profit gain and currently back in long at 4145 profit stop 4148. On the option selling point for June as you know I took put profits already and my 4300, 4400 calls look great with profits but are a hold. Just sold the June 4250 calls for $25 and will add if we rally a bit more.