6 MO

1 YR

2 YR

Posted 11 June 2022 - 01:05 PM

I just do not see how BOJ is going to hold that peg much longer....

extreme dislocation could be imminent...

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 11 June 2022 - 02:35 PM

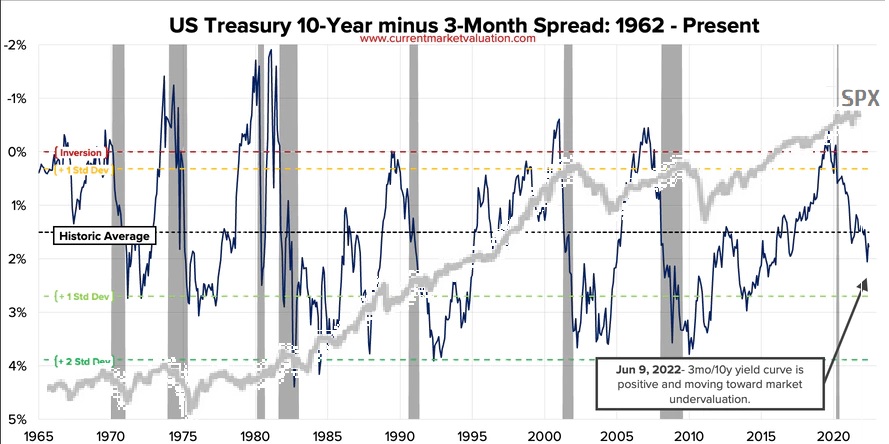

I need an interpreter for this one:

I see examples of "market moving toward undervaluation" but continuing on down for some time.

With SPX Overlay:

Edited by Rogerdodger, 11 June 2022 - 04:12 PM.

Posted 11 June 2022 - 04:11 PM

.

.Former Treasury Secretary Lawrence Summers said the Federal Reserve has failed to account for its mistakes and to realize the damage to its credibility after the latest inflation data dashed hopes that a peak had been reached.

Posted 12 June 2022 - 03:56 PM

‘The numbers are catastrophically bad.’ Top economists are sounding the alarm on inflation Hopes that elevated prices were beginning to settle were dashed Friday morning when the Bureau of Labor Statistics (BLS) released data showing that the CPI, its broad measure for prices of goods and services, reached 8.6% for the month of May.

The number represents the highest level of inflation in the U.S. since 1981, and it has top economists starting to get worried—like, really worried.

“The overall reality for the Fed is that inflation is not under control,” Charlie Ripley, a senior investment strategist for Allianz Investment Management, told Fortune. He said he sees Friday’s CPI release as proof that the central bank needs to be more aggressive in its approach to inflation and institute greater interest rate hikes throughout this year.

Edited by Rogerdodger, 12 June 2022 - 03:58 PM.