August 21, 2022 (From SevenSentinels.com)

============================================

Producing consequential trading profits does not have to be rocket science. It is as simple as listening to the hoofbeats, recognizing them for what they are, and aligning with the TREND.

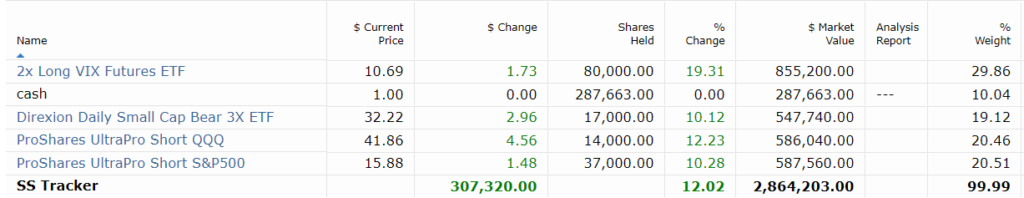

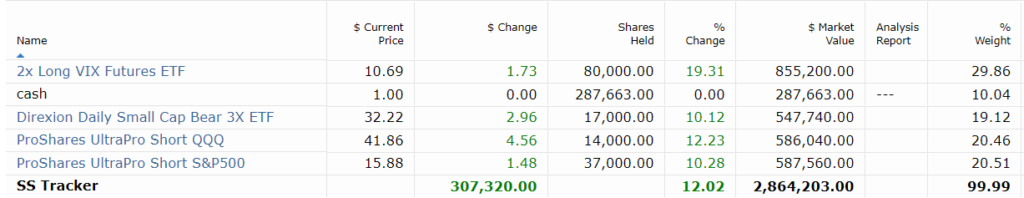

Our Tracking account for 2022 exemplifies the importance of this concept:

Tracking Account Value: 2,864,203, +127% YTD (updated 8-26-22)

This focus requires, however, that we discard the "this time it's different" drumbeat from the crowd of pundits who wrap themselves into pretzels explaining why the Bear Market Signature is not what it appears to be.

We must see the "This Time Its

Different" calls are a convenient attempt to explain away the bear market." And amazingly, these pundits usually manage to convince themselves of this nonsense.

When we see this signature, the explanations of pundits ask us to believe fiction stranger than that hoofbeats outside our door are coming from a herd of wild donkeys, American bison, zebras, or even unicorns.

Occam's Razor* suggests otherwise. This time is NOT different.

So it is with the market. Jesse Livermore made over $100 million in 1930 dollars (about $1.2 Billion in 2022 dollars) in the Bear Market that began in 1929 and ran into 1932. He did so by (in his own words) “being right and sitting tight.”

He aligned with the price direction and let the market do the rest. Of course, it immensely helped his bottom line that the trend with which he aligned was powerful.

Let’s start there. Livermore said, “what happens today has happened before and will happen again.”

We are listening to the hoofbeats and recognizing them for what they are.

This particular primary trend has occurred again and again throughout market history.

It is a Bear Market.

But it is no “ordinary” Bear Market. The trend underway is indeed powerful. Think 1929, or even a downtrend of a higher cycle degree:

These three simple observations confirm the current primary trend as a Bear Market:

-

The monthly MACD is in downtrend mode

-

The 6.572-month (200-day) moving average of $NYA Price is falling

-

The current $NYA price is BELOW that decline moving average

We are in a quintessential Bear Market. Full stop.

No matter how many times the pundits and the media

try to explain away this simple truth, we need to remember that THIS TIME IS NOT DIFFERENT. Those hoofbeats you hear really are horses, not zebras!

This Bear Market is just getting started.

=============================

In this section, we’ll tackle the following important truth:

Markets have been in a Bear Market Rally since June 17, 2022.

That rally is pau, done, finished. A new downtrend has just begun.

The hoofbeats are loud, and they are clear. Yet these distortions persist: that this rally from June 17, 2022, has "proved" that the bear market is over. Many suggest that markets will finish the year over 4800, and some suggest much higher.

Remember William of Ockham! Recognize those hoofbeats as horses, NOT zebras!

Let’s look at just a couple of dozens of examples that show the current Bear Market tracking exactly like past multi-year Primary Bear Markets.

The 1929 Market, for example, peaked on September 3, 1929, crashed, then produced a secondary high seven months and 14 days later on April 17, 1930.

But April 1930 was just the beginning of the Primary Bear Market:

The 2007 market peaked on October 11, 2007, crashed, then produced a secondary high seven months and eight days later on May 19, 2008.

But that was only the beginning of the Primary Bear Market, yet again:

This 2022 market peaked on January 3, 2020, crashed, then produced a secondary high seven months and 13 days later on August 6, 2008.

SPX is just beginning a Primary Bear Market, yet again:

Also, for the record and documented below:

-

The rally into the second high on May 21, 2001, lasted 42 sessions

-

The rally into the second high on May 19, 2008, lasted 44 sessions

-

The rally into the second high on August 6, 2022, lasted 40 sessions

This time is NOT different. There is nothing new under the sun. This year’s 40-session rally did not evidence that the Bear Market has bottomed as the pundits suggest daily!

Each such Bear Market Rally turned down, and the real work of the Bear cycle followed in 2001 and 2008, as it will in 2022 and 2023 and perhaps beyond.

The good news is that a new powerful trend is just beginning. SPX turned down this week as 10-year rates broke their downtrend:

Daily VIX has entered an Uptrend via MACD just as markets entered declines in January, April, and June.

VIX produced clear MACD buy signals over these last several days:

Likewise, Daily UVXY has entered an Uptrend via MACD just as it did as markets entered declines in January, April, and June.

Below are clear UVXY BUY Signals at the beginning of each of the above-cited SPX downtrends, including the signal this week:

The setup for VIX, UVXY, VXX, and UVIX are producing BUY Signals this last week in every time frame, including hourly, daily, and even weekly.

The SPX/UVXY RATIO produced essential

weekly SELL-Signals for SPX and Buy-Signals for UVXY this last week:

At the same time, Key SPX Downtrend Signals were produced again this week, just like in January, April, and early June as the SPX downtrend began.

This powerful signal is the crossing of the 13-day NYMO (McClellan Oscillator) below the 34-day NYMO:

Another downtrend signal displays the crossing of the 3-Day $BPNYA below the 13-Day moving average NOW, signaling a downtrend in SPX just like it did five prior times in 2022:

The following image (shown on SevenSentinels.com nearly every day) displays the essential VIX bottoms and Buy Signals coinciding with SPX top and downtrend signals combining several of the above indicators:

Summary:

-

US Equities Markets are in a transparent, well-defined Primary Bear Market.

-

The flood of pundits and media calls for a “bottom in place” is as wrongheaded as calling the hoofbeat of horses “the sound of a herd of zebras.”

-

This Time Is NOT different- and those are NOT zebras. William of Ockham was right.

-

Perhaps the most timely point today is that a new downtrend for SPX and uptrend for VIX and UVXY just began this last week.

-

But the most critical point today is this: Consistent long-term trading gains come from being correct with the TREND and sitting tight.” Livermore said, “once I learned this, millions came easier than hundreds had before.”

(updated 8.26-22)

We will review the overnight futures at 9:15 AM Monday.

*Occam’s Razor states: “

the simplest solution is almost always the best.” It’s a problem-solving principle arguing that simplicity is better than complexity. Named after 14th-century logician and theologian William of Ockham, this theory has been helping many great thinkers for centuries.

Special August Offer: One Week of Seven Sentinels for One Dollar

(updated 8.26-22)

We will review the overnight futures at 9:15 AM Monday.

*Occam’s Razor states: “the simplest solution is almost always the best.” It’s a problem-solving principle arguing that simplicity is better than complexity. Named after 14th-century logician and theologian William of Ockham, this theory has been helping many great thinkers for centuries.

Special August Offer: One Week of Seven Sentinels for One Dollar

(updated 8.26-22)

We will review the overnight futures at 9:15 AM Monday.

*Occam’s Razor states: “the simplest solution is almost always the best.” It’s a problem-solving principle arguing that simplicity is better than complexity. Named after 14th-century logician and theologian William of Ockham, this theory has been helping many great thinkers for centuries.

Special August Offer: One Week of Seven Sentinels for One Dollar