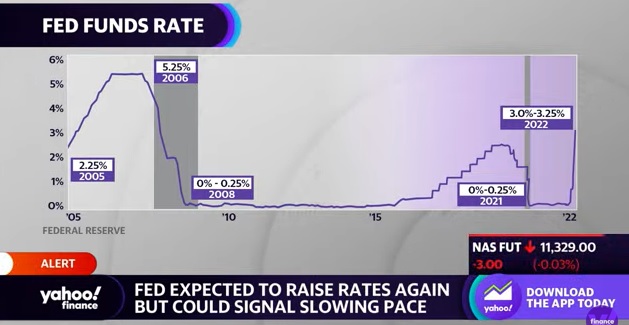

In a widely anticipated move, the Federal Reserve raised its Fed Funds rate by 75 basis points. This is the fourth consecutive supersized rate hike this year. While the central bank remains focused on bringing inflation down, it does appear to be adjusting its stance.

The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

Edited by Rogerdodger, 02 November 2022 - 01:35 PM.