Looking at some TA, I think it probably does. And we could pick up steam to the upside, especially next week.

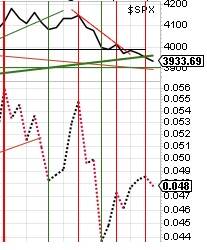

Also, my fundamental model, pricing in the 10 year around 4% is finally at Fair Value for SPX.

This model is closely tied to interest rates and looked a lot better for the bulls when the 10 year yield was 50BPS lower.

The market did not like the higher PPI last week and CPI in the Eurozone and the prices paid by manufacturers yesterday.

So, really the question here is on interest rates and inflation and that will point us the right direction on the stock markets.

If interest rates continue to rise, we will probably make new lows.

If interest rates stabilize and come down, the bull is still on.

I am in the latter camp due to a variety of reasons that I written about including population trends, economies of scale etc.

Also, looking at interest rate cycles, the last 3 cycles when the Fed pauses, 10 year yields either come down or at least finish the year the same. 2000, 2007 and 2019.

So, is it different this time?

Unless the Fed has to keep going and raise rates all the way through 2024, history would tell us that rates should come down as they are currently 30 BPS higher on the 10 year yield on the year.

Looking at the inflation of the 1950s through early 1980's and while I was not trading or alive the majority of this period. I just see the eras as apples and oranges.

Not only was our population growth much higher that contributes to inflation, but the labor participation rate was also much higher which contributes to inflation. Also, we did not subsidize a lot of manufacturing to Mexico, China etc.

Also, looking at from 1950-1980 home prices increased by 20%. So the markets could absorb those higher rates while the 30 year increased from 2% to 12% in those decades.

If 30 year interest rates went to 12% today, home price would be cut in half, at least.

Every action in the market can have an opposite reaction, so we got too far on the downside in regard to rates, now we swung above and should revert back to our norms of this era of 2-3% on the 10 year.

If the Fed goes too far, we have potential for more downside, so it is important to be nimble here.

All IMHO.

Edited by MikeyG, 02 March 2023 - 06:35 AM.