maybe uze guys dint notice wats goin on in aht......snort

Now I see it!

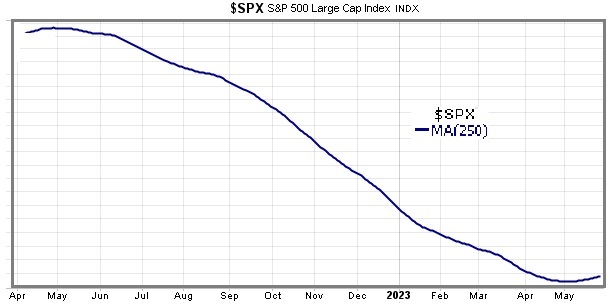

Feb 1st SPX 4119

May 24th SPX 4115

Please don't bring facts into it Roger, we live in 'pick ur own truth' times.

Nov 31/1st Dec - 4100'ish

Today - 4100'ish

That's 5.5 month of sideways being call a 'bull market' by most here... just sayin'. ..some of us (not many, humility prevents me saying who :-) ) called for a long range ..but no glory being right about that of course.

https://mark_davidson1-yahoo.tinytake.com/msc/ODI2Mjg5MV8yMTQ5NzI5Mw

side ways?? where u been lolol last 7 months up 6000 dow pts....make any money???>

Side ways for those with eyes - 4100 then, 4100 now ..5.5months .. them the facts chief ..unless u can show a different chart of SPX? ..DOw .. why not pick NVDA? :-)

B ut FYI - DOw was HIGHER at Dec 1st than NOW - by several 1000' pts .. so down for last 5 months or am I wrong?

https://mark_davidson1-yahoo.tinytake.com/msc/ODI2Mjk3NV8yMTQ5NzQzOQ

Money was made playing the range doh duh!

Edited by EntropyModel, 24 May 2023 - 07:28 PM.