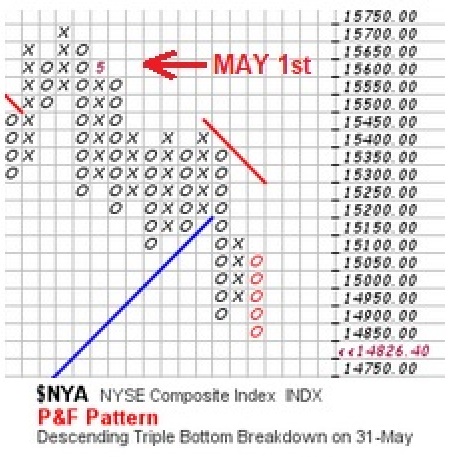

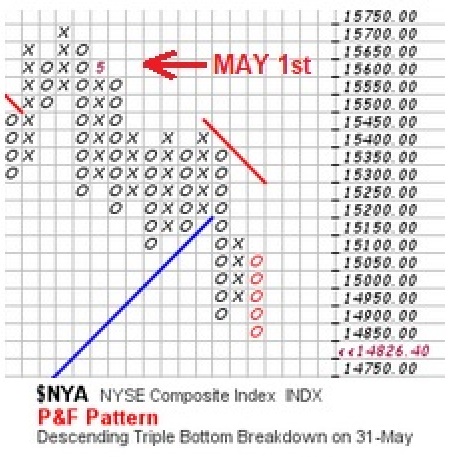

A good year to go away in May in spite of the ongoing "BULL MARKET" ![]()

.

Posted 31 May 2023 - 09:46 AM

A good year to go away in May in spite of the ongoing "BULL MARKET" ![]()

.

Posted 31 May 2023 - 08:01 PM

Still playing tic-tac-toe I see Roger.

well, here is a pattern I've commented on many times - for last 8 months except Dec &Feb ..saw ramp into the end of month, then sell off at beginning ...I see this as high odds this time based on my signals/model/setups/juju etc

..at least on SPX .... we are getting split market now ..so need to be specific about indexes...but SPX is 'broadest' market... we shd see a 'right translation' drop at some point soon back into the ground-hog range (never left it on SPX)...

then 'we will see'

https://mark_davidson1-yahoo.tinytake.com/msc/ODI4NzA5OF8yMTUzMTI2MA

https://mark_davidson1-yahoo.tinytake.com/msc/ODI4NzExNF8yMTUzMTI5MQ

Edited by EntropyModel, 31 May 2023 - 08:15 PM.

Posted 31 May 2023 - 08:28 PM

FYI - i've been alot of work last few months on building RISK Models ..these are not 'buy/sel'' but telling me the risk/reward- i've got about 5 of them now, all work differently ...this one I think is quite interesting.

I've managed to test these model back to 1970 to incude inflationary period ...harder back to 1930 ..but I have data now to 1900 to test some of them and they hold up.

This shows me currently RISK is rising extremely high on long side - so, whilst more upside is 'possible' into the summer based on these..it would push risk into extreme that historically

was 'mean or extreme' reverse literally 100% of time ... I guess 'this time could be different' but I don't see why it would be.

https://mark_davidson1-yahoo.tinytake.com/msc/ODI4NzEyMV8yMTUzMTI5OQ

Edited by EntropyModel, 31 May 2023 - 08:29 PM.

Posted 31 May 2023 - 09:42 PM

Here's a 2nd RISK model based on Liquidity - above one is based on volatility

https://mark_davidson1-yahoo.tinytake.com/msc/ODI4NzIwNV8yMTUzMTQ0Mw

I've got a few others based on interest rates and other stuff ...on back test, the Volatility and LQ worked much better interesting than interest rates, which for example, failed in 1994-1995 and somewhat

in 1987-1988 - but LQ has never failed, YET at least LOL ...there are no holy grails.

https://mark_davidson1-yahoo.tinytake.com/msc/ODI4NzIxMV8yMTUzMTQ0OQ

Posted 31 May 2023 - 10:19 PM

Thanks!

Thanks!

Edited by Rogerdodger, 31 May 2023 - 10:20 PM.

Posted 01 June 2023 - 11:32 AM

this is the least risky market ive seen ever

Posted 01 June 2023 - 12:00 PM

this is the least risky market ive seen ever

What calculation are u using ? ..i would need to see come convincing charts/data to counter what I've shown.

Posted 01 June 2023 - 02:47 PM

Haha, never gonna happen he only makes comments. I've been around for 40 years to and know that when only about 10 stocks are holding up your index that's not a good thing long term. if you took them out of the S&P it would be down on the year right now,,,, yep really healthy "least risky" market lol!! Calls have just gone back to insane pricing within a matter of hours also not healthy longer term.