From: https://ttheorygroup...uity-condition/

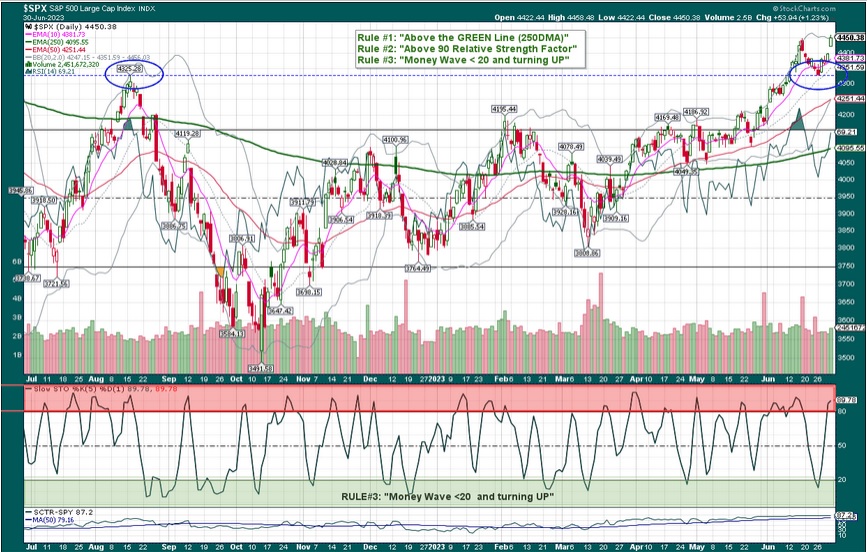

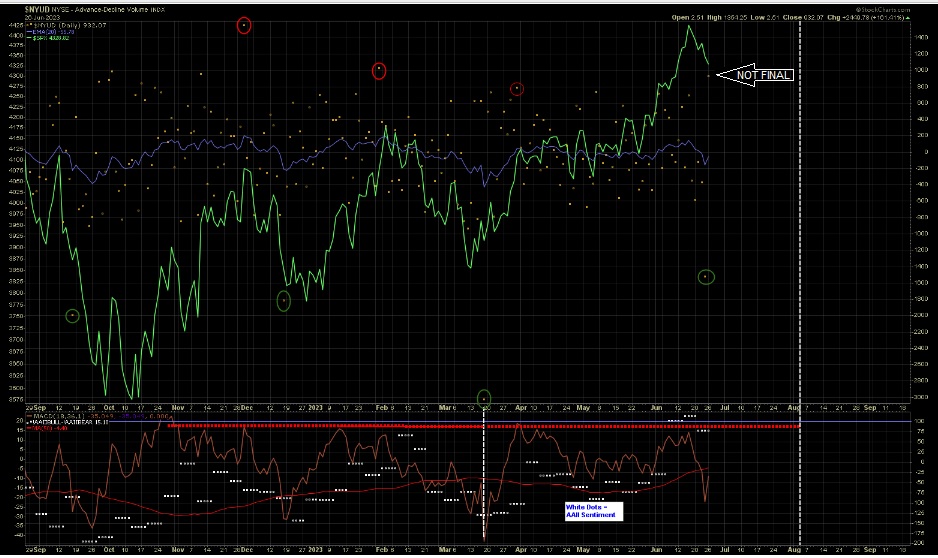

If there is a T now, (should the VO and McOsci form a lower low now than their March lows), it is very possible that this new T (lasting through the end of July) may soon become a Bear T. We are close to getting readings from the Volume Oscillator and McOscillator of lower lows than that March low. (The VO will be adjusted Monday morning.) We have already broken the ascending lows in the McOsci.

Rogerdodger's observation here:

NOTE: Monday morning's adjustment (Yellow Dots) showed a very low reading but not as low as the March bottom.

My chart below shows Friday's close. Ignore today's close because it's not the final number.

I eagerly await an opinion from a T expert.

Looks to me like price might try to stabilize as it did last December. But then I look at that September low... hmmm...

Then there is the high bullish numbers in the AAII Bull/Bear (White dots on bottom panel)

More from T Theory:

What would Terry say about the present state of the market–does the “AI” craze parallel this comment Terry made regarding “fad” stocks?:

“As a Magic T approaches its right end point, it is not uncommon to see investor’s interest turn away from “blue chip” stocks that have been picked over during the years of “superior performance” and begin speculating on relatively unknown “fad” stocks. During the late 1960’s such a speculation manifested itself in the creation of so-called “Go-Go funds”. These funds jumped from fad to fad until the exhaustion of the T in 1968 left the fad stocks vulnerable to the severe downside reaction for the next 6 years.“

1997 Introduction to T Theory Copyright 1997 by Terry Laundry

Edited by Rogerdodger, 26 June 2023 - 10:52 PM.