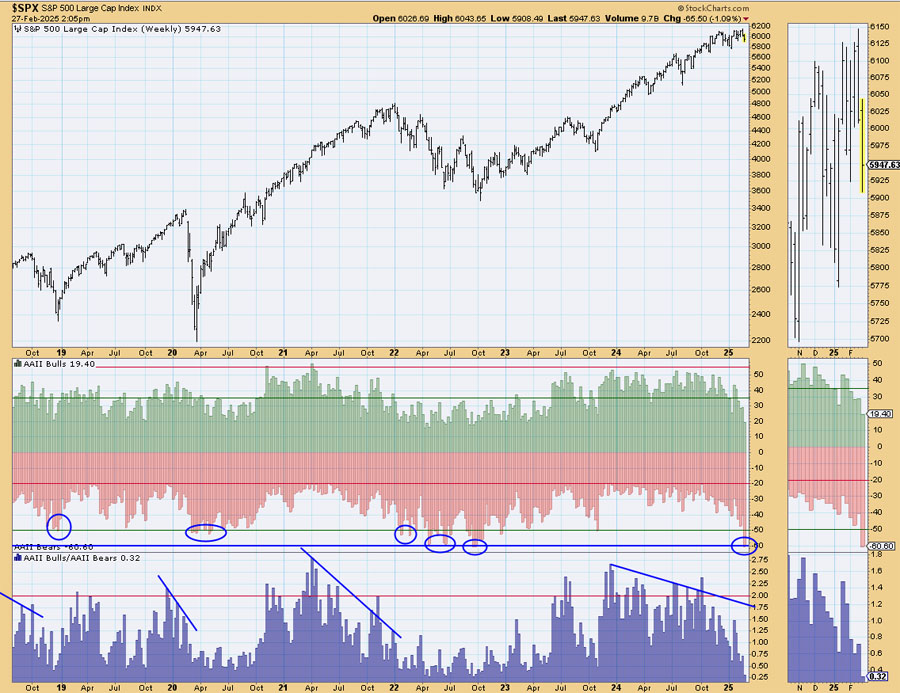

19% BULLS 61% BEARS wawwwwww?????

AAII

#2

Posted 27 February 2025 - 03:26 PM

A reading of over 60% Bears is quite rare--there have only been 5 times we've seen that in the last almost 16 years. Before the last Bear market, one has to look back to the low of the Financial Crisis. In other words, things in the market are typically quite ugly when we get more than 60% bears. Yet the S&P is just 6 days and a couple hundred points off the highs. This quick shift to extreme Bearishness is indicative of a lack of complacency, and I view that as generally Bullish.

Mark S Young

Wall Street Sentiment

Get a free trial here:

https://book.stripe....1aut29V5edgrS03

You can now follow me on X

#3

Posted 27 February 2025 - 04:32 PM

PCE should help for tomorrow. JMHO

#4

Posted 27 February 2025 - 04:38 PM

SPX is now back to the October top. With extreme sentiment as now... will a bounce here it last.

BUFFET has huge cash reserves because there have been no buys in his book!.

Posted 18 October 2024 - 02:33 PM

October 17th 2024 Bankrate.com:

In the aftermath of hot inflation and high interest rates, many Americans have been stretched so financially thin that they’ve borrowed up to the limit on a credit card, new data from Bankrate reveals.

20 percent have maxed out a card and another 17 percent who came close.

- Here are some other details about credit card debt in the United States:

-

DelinquencyDelinquency rates are increasing, with 7.18% of cardholders falling behind on their payments in the second quarter of 2024.INCOMEThe lowest income groups are most affected by credit card debt. For example, 61% of households in the seventh decile have credit card debt, compared with 26% in the first decile.Cost of livingAmericans are struggling to keep up with the cost of living, which includes high prices for food, housing, and auto rates.Credit useAmericans are increasingly using credit cards to make ends meet. For example, 60% of adults used credit cards to buy groceries in 2024

-

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#5

Posted 27 February 2025 - 05:25 PM

SPX is now back to the October top. With extreme sentiment as now... will a bounce here it last.

BUFFET has huge cash reserves because there have been no buys in his book!.

Posted 18 October 2024 - 02:33 PM

October 17th 2024 Bankrate.com:

In the aftermath of hot inflation and high interest rates, many Americans have been stretched so financially thin that they’ve borrowed up to the limit on a credit card, new data from Bankrate reveals.

20 percent have maxed out a card and another 17 percent who came close.

- Here are some other details about credit card debt in the United States:

He could buy China like everyone else or send pallets of cash to Iran. ![]()

#6

Posted 27 February 2025 - 07:50 PM

A reading of over 60% Bears is quite rare--there have only been 5 times we've seen that in the last almost 16 years. Before the last Bear market, one has to look back to the low of the Financial Crisis. In other words, things in the market are typically quite ugly when we get more than 60% bears. Yet the S&P is just 6 days and a couple hundred points off the highs. This quick shift to extreme Bearishness is indicative of a lack of complacency, and I view that as generally Bullish.

I'll be bullish at SPX 5400.

#7

Posted 04 March 2025 - 12:17 PM