You guys seem to be arguing economics! That's a "dismal" endeavor.

Relax, have "half a glass" and enjoy some good news...While it lasts.

Shhhh! Don't tell anyone.

#11

Posted 08 March 2007 - 11:26 PM

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#12

Posted 08 March 2007 - 11:34 PM

#13

Posted 08 March 2007 - 11:37 PM

(but that's because I'm short

#14

Posted 08 March 2007 - 11:41 PM

#15

Posted 08 March 2007 - 11:51 PM

One of the outfits I worked for and was receiving pension from upon reaching 55

went bankrupt. (Mainly because I had left the outfit, hahaha). But PBGC took over

and I am still getting 100% of my previous pension from PBGC.

I take everything back, the system is undoubtedly working just fine. Now, if I could just find the key to that Social Security lockbox.

#16

Posted 08 March 2007 - 11:57 PM

Could not find article I had but found one even better and more up to date. That is good news.

Bad news is that the numbers are even worse. This is from a Federal Reserve publication just last summer. Scholarly treatment, but worth the read if you really want to understand this issue..

http://research.stlo...7/Kotlikoff.pdf

Best

TM

#17

Posted 09 March 2007 - 07:11 AM

I'm not typical, by any means, but I'm thinking my net worth increased that much or more last year. Decrease the debt, make a little more, save a little more, have a decent year in the IRA...it all adds up.

But note, my assets aren't yet my government's to confiscate. They only get to mess with income. Further, the "unfunded liabilities" will for some and at the margins remain unfunded--forever and for a variety of reasons.

M

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#18

Posted 09 March 2007 - 07:30 AM

Net worth of U.S. households skyrockets

By JEANNINE AVERSA, AP Economics Writer Thu Mar 8, 5:27 PM ET

WASHINGTON - The net worth of U.S. households climbed to a record high in the final quarter of last year, boosted mostly by gains on stocks, the

Federal Reserve reported Thursday.

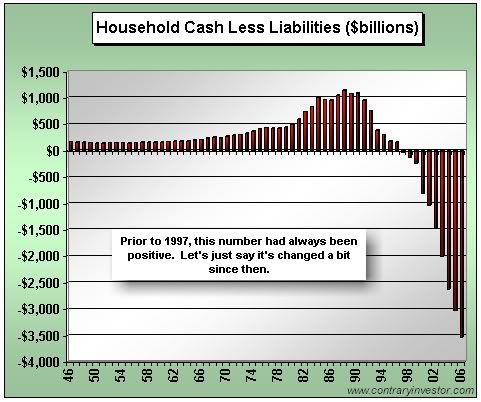

Net worth — the difference between households' total assets, such as houses and bank accounts, and their total liabilities, such as mortgages and credit card debt, totaled $55.6 trillion in the October-to-December quarter.

That marked a 2.5 percent growth rate from the third quarter, the previous quarterly record high. Stocks gains helped fuel the increase in net worth, although real-estate gains played a role, too.

For all of last year, households' net worth rose by 7.4 percent, a slower pace than the 7.9 percent increase registered in 2005.

Household debt, meanwhile, grew by 8.6 percent in 2006, down from a 11.7 percent increase in the prior year. The Fed said this deceleration "was accounted for by much slower growth of home mortgage debt."

Home mortgage debt growth slowed to a 8.9 percent last year, compared with a 13.8 percent increase in 2005. This year's growth in home mortgage debt was the smallest increase in six years.

After a five-year boom, the housing market fell into a deep slump last year. Sales cooled. So did home prices, which had been galloping ahead, making consumers feel more wealthy and more inclined to spend.

Economists said Thursday's report suggest households' finances are holding up fairly well to any strains caused by the troubled housing market and well as some sluggishness in overall economic growth. Analysts said that's because the jobs climate remains in good shape and income growth has picked up.

"Slower growth in some of the nation's high-flying housing markets was not enough to send net worth south in the fourth quarter," said Gina Martin, economist at Wachovia. "Instead, household balance sheets continued to improve, as growth in liabilities continued to slow, while growth in assets held steady."

One risk facing the economy is that the housing slump will take an unexpected turn for the worse, a development that likely would cause consumers to clamp down. That could spell trouble for overall economic activity.

The question you must ask is what % of Americans have a large enough stock portfolio to have produced that type of gain. I'm no liberal by any means, but it's a factor of the wealthiest 5-10% of American's portfolio 'carrying the load' for everyone.

#19

Posted 09 March 2007 - 09:46 AM

have a decent year in the IRA

+40%

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#20

Posted 09 March 2007 - 10:09 AM