From

spielchekr's post below:

I think we need to call in an expert here (ahem, Mark?). The author implies that rather than launching us higher, this discrepancy is rather supporting the dip buying, if I'm rephrasing his interpretation correctly.

Thanks Mark!

It seems to me:

Different sentiment sources have different sample sources and sizes, sampled at different time intervals.

Thus, one reading may be reflecting the most current news or market condition at the time it was taken, whereas another, taken a day later and from another sample source may reflect something else.

Each can add a thread to the overall sentiment tapestry.

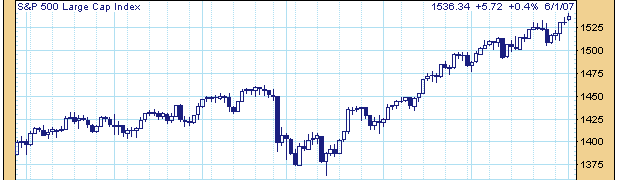

As the markets make new highs, you would expect sentiment to become more bullish.

That in itself might not be a "sell" signal since it is really a confirming signal.

But just the opposite has happened during the past year!

As the markets have rallied, sentiment has remained muted.

That to me,

this has been a very bullish divergence.

Therefore, while short term jumps in bullishness usually pull back price, they may be offering opportunities to buy the dip rather than sell. (Depending of course on one's trading style.)

This might be true, at least until we see the longerterm measures at higher levels.

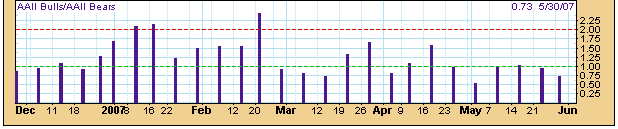

I've mentioned this one before. Notice that sentiment has only touched 70 one time in over a year.

It even got below 30 to begin a 200+ point S&P rally!

VERY UNUSUAL! It did nearly the same in 2002 but while the market was at multi year lows.

Now we have the same readings near all time highs?

Note that after weeks of neutral readings, sentimentrader is showing more bullishness.

Note the extreme bullishness going into Thursday. It gave us a doji day.

For the reasons mentioned above, I suspected it would not be a big selloff but rather:

Wednesday's Post:

I have only a guess:

Labored gains, pause, hesitation, nominal new highs

(Also the jump in pessimism going into Friday before Memorial day was the beginning of a 30 point S&P rally.)

Edited by Rogerdodger, 02 June 2007 - 02:14 PM.

My read is that this is supportive of a continuation of the Bull market. It's Bullish, but as a short-term indicator, it's not so good. With the right type of set up from the other sentiment, we can go down with these types of readings. It's just not likely that we go down for too long.

I'll be writing more about this in the letter and probably in my much-neglected Blog this weekend.

My read is that this is supportive of a continuation of the Bull market. It's Bullish, but as a short-term indicator, it's not so good. With the right type of set up from the other sentiment, we can go down with these types of readings. It's just not likely that we go down for too long.

I'll be writing more about this in the letter and probably in my much-neglected Blog this weekend.