When do parabolics terminate?

#1

Posted 03 November 2007 - 03:04 PM

#2

Posted 03 November 2007 - 03:18 PM

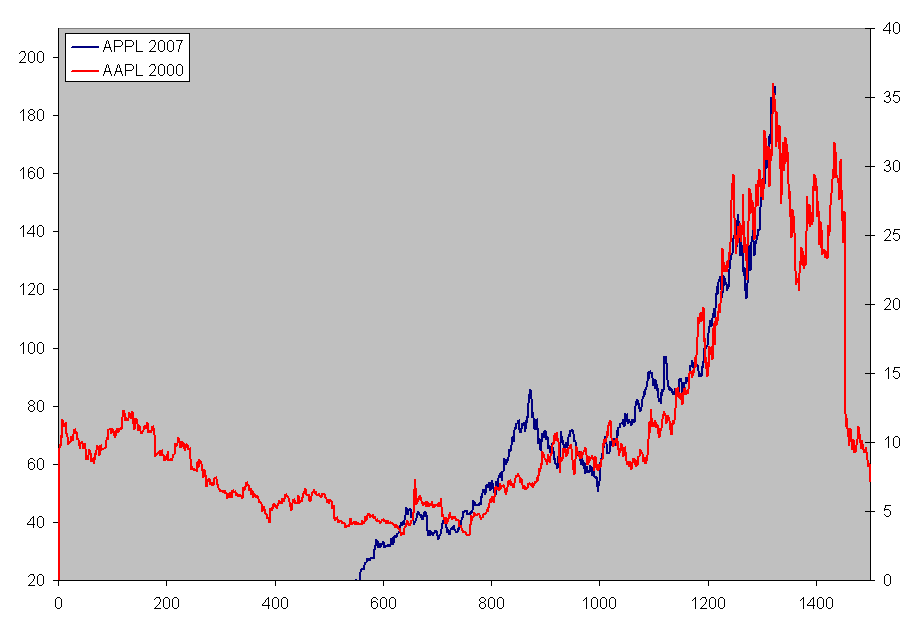

What are the similarities and differences? How can we tell where the end is?

#3

Posted 03 November 2007 - 03:26 PM

#4

Posted 03 November 2007 - 03:31 PM

#5

Posted 03 November 2007 - 03:47 PM

#6

Posted 03 November 2007 - 03:51 PM

Well, you posted a chart comparing 2000 and 2007 AAPL chart... so, market top usually terminates parabolic moves, is it not?

Only if that stock was the leader of the pack.. I can show you some other NDX parabolics that died a while back and it did nothing to NDX price..

If the index itself is going parabolic, then perhaps.. but NDX only slightly looks parabolic right now, not even close to 2000 era.

The parabolic price pattern in AAPL is real, however. It could be that when AAPL dies, NDX goes with it. But its not a given. And theres no telling when AAPL will stop, which is why I opened this discussion.

It could also be that parabolics are all naturally different and they do not share a characteristic that one can use to tell when each of them will die.

#7

Posted 03 November 2007 - 03:55 PM

#8

Posted 03 November 2007 - 04:13 PM

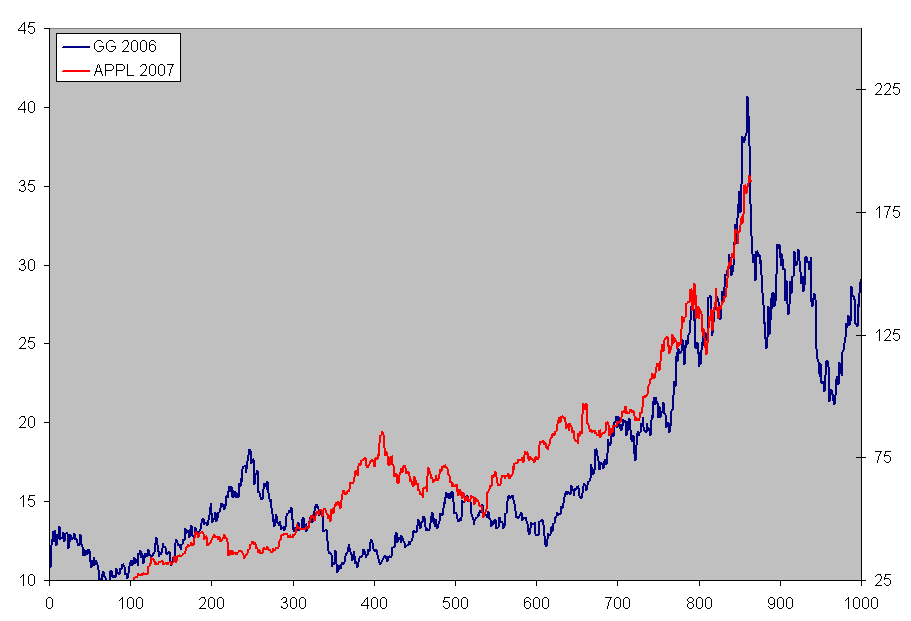

1. Note the long base formed before the initial take off.

2. Then it forms a peak and consolidates

3. Then its first primary peak and decline

4. It rises near this primary peak and decline, and begins consolidating

5. Then after consolidation, it begins moving higher

6. Then after some rise, it consolidates again

7. Finally it gaps and runs and runs until it exhausts itself and reverses. Note the increasing volume near the peak

So far the characteristics are the same, but if this was the last run, I do not know where the final run will end. Now compare this chart with a chart of FXI and you will note similarities... I need to find me some more parabolic stocks and do some comparisons.

#9

Posted 03 November 2007 - 04:20 PM

Heard someone targeted 600

Date: 10/22/2007 7:45:16 PM

Post #

AAPL LT 300 R based on the fib and TL as shown on the chart that it has broken out of 20yr TL during Sep05. Then it retested the breakout in Jul06. It also has broken out of fib R in May 2007, not it is heading near to 300.

Fundamentally, it looks to be supporting the price actions as it is continuing to grow. The current PE shows 33.

#10

Posted 03 November 2007 - 04:22 PM

Newton's Second Law of Motion states:It could also be that parabolics are all naturally different and they do not share a characteristic that one can use to tell when each of them will die.

"The rate of change of momentum of an object (or a price pattern's price) is directly proportional to the resultant force (or money flow) acting on it."

Don't forget to include inverted parabola patterns as well...it's not just a one way street.I need to find me some more parabolic stocks and do some comparisons.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions